Last week was the peak shipping week for flowers ahead of Valentine’s Day. Most of the truckload and air cargo activity is centered on Miami, just 3.5 hours flying time from where the majority of Valentine’s Day roses and carnations are grown. According to the USDA, 70% of rose and carnation stems were imported from Colombia and 30% from Ecuador last year with the majority landing at Miami International Airport (MIA) before being trucked all over the U.S. and Canada.

Behind the scenes there are dozens of 747 jumbo jet air freighters loaded with flowers arriving from South America at MIA every day. Global floral supply chains follow a south-north pattern – fresh cut flowers in Europe arrive from North Africa, mainly from Kenya (the largest producer of roses in the world), while in North America, flowers mostly come from South America. All are close to the equator where growers have natural light all year round, reducing the need for artificial illumination.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Why Miami when you can fly direct to most major capital cities?

Miami has a large perishables-handling infrastructure in place and ideally located to handle both the domestic air-to-truck logistics and the international air-to-air transfers. MIA also has an efficient consolidation center for both the US and Europe/Asia for southbound traffic of all kinds.

“The air freighters that provide the big lift in the market need high volumes of good two-way traffic to be profitable so it is safer and more efficient for them to schedule MIA schedules vs other airports,” according to international air freight expert Jesse Cohen. “There are a lot of other traffic opportunities in MIA for non-flower traffic in MIA as well (to/from Central America) and many of the freighters fly multi-stop schedules so they can maximize their loads across all seasons. Bottom line — economies of scale and overall efficiency”

It’s also not the favorite time of the year for reefer drivers

“Floral loads are all driver unload as some places don’t even have docks,” according to one trucker DAT spoke. “They’re very unpopular loads as they’re all time sensitive so you have to haul butt because it takes so long to unload box by box. My last load had 2,230 boxes spread over four stops.”

To compensate, some large flora carriers have already imposed a temporary 20% holiday surcharge to all products shipped outbound from Florida with a ship date of January 19, 2022, through February 6, 2022.

Will shippers pay more to ship flowers this Valentine’s Day?

In the seven weeks leading up to February 14th, an average of 500 truckloads per day will head north out of Miami where 80% of all flora volume is handled by just three carriers. They typically rely on a large number of company-owned trucks as well as independent contractors to handle the surging volume of roses in particular.

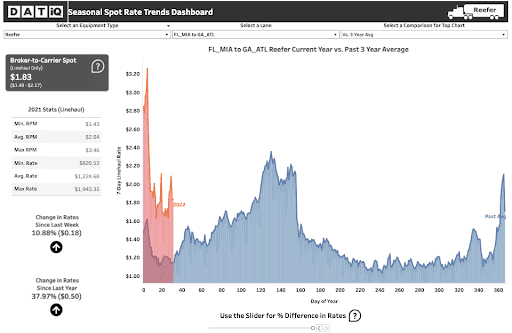

Miami outbound load post volumes on the spot market were already up 15% w/w with reefer spot rates averaging $1.89/mile excl. FSC to all destinations. On heavy volume lanes including New York City, spot rates averaged $2.76/mile incl. FSC, which was already $0.50/mile higher than the December average. Chicago loads are currently averaging $1.64/mile on average ($0.34/mile higher y/y) and $2.35/mile excl. FSC to Atlanta and as shown in the chart below, loads this week from Miami to Atlanta are currently just over $0.68/mile higher than the 3-year average spot rate.