Last week’s release of January housing and permit data from the U.S. Census Bureau reported a 4% month over month increase in new single-family building permits. That puts this leading indicator of flatbed demand up 30% year over year.

Building permits typically lead new home starts by one to two months, so it’s a valuable data point for flatbed carriers. The number of privately owned single-family housing starts cooled off though, dropping 12% m/m but are still up 13% y/y.

In the Southeast, where 55% of January’s single-family homes are constructed, volumes are still up 24% y/y after dropping 9% m/m. Volumes in the Midwest (14% of total volume) dropped the most, recording a 24% m/m decrease.

For flatbed carriers, the housing market has been one of the strong performers during the economic recovery, fueled by lower mortgage rates and demand for technology-enabled homes suitable for working, exercising and schooling at home.

Find flatbed loads and trucks on North America’s largest on-demand freight marketplace.

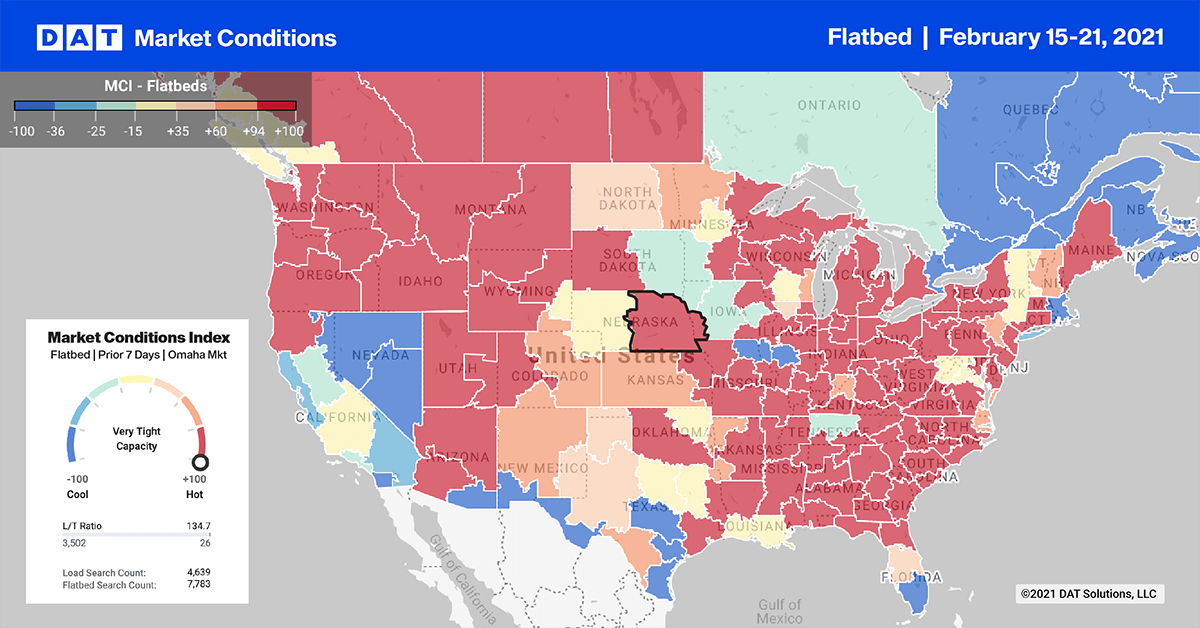

Load posts in the top 10 flatbed markets increased by 5% w/w, but capacity was tight due to the massive delays caused by last week’s two storms. As a result, available capacity tightened, with rates jumping by $0.20/mile to an average of $3.12/mile for outbound loads in the top 10 markets.

Unlike the dry van and reefer sectors, capacity was not uniformly tight in all markets. Rates dropped $0.23/mile in Memphis following a 4% drop in load posts. In nearby Montgomery, AL, load posts plummeted by 20% w/w, with rates dropping by $0.48/mile to $2.76/mile. In St Louis, where temperatures dropped to zero last week, outbound volumes dropped by 1%, but capacity tightened rapidly, driving up spot rates by $0.59/mile to $3.52/mile.