“March went out like a lion, a whippin’ up the water in the bay.” I’m a big fan of Rodgers and Hammerstein musicals — well, any musicals, but theirs are classics. That song is from “Carousel” and I started humming it under my breath as I sat down to write about last week’s freight market.

Looks like we won’t have to wait until June for freight and rates to be “bustin’ out all over” though, because rates are already heading in that direction.

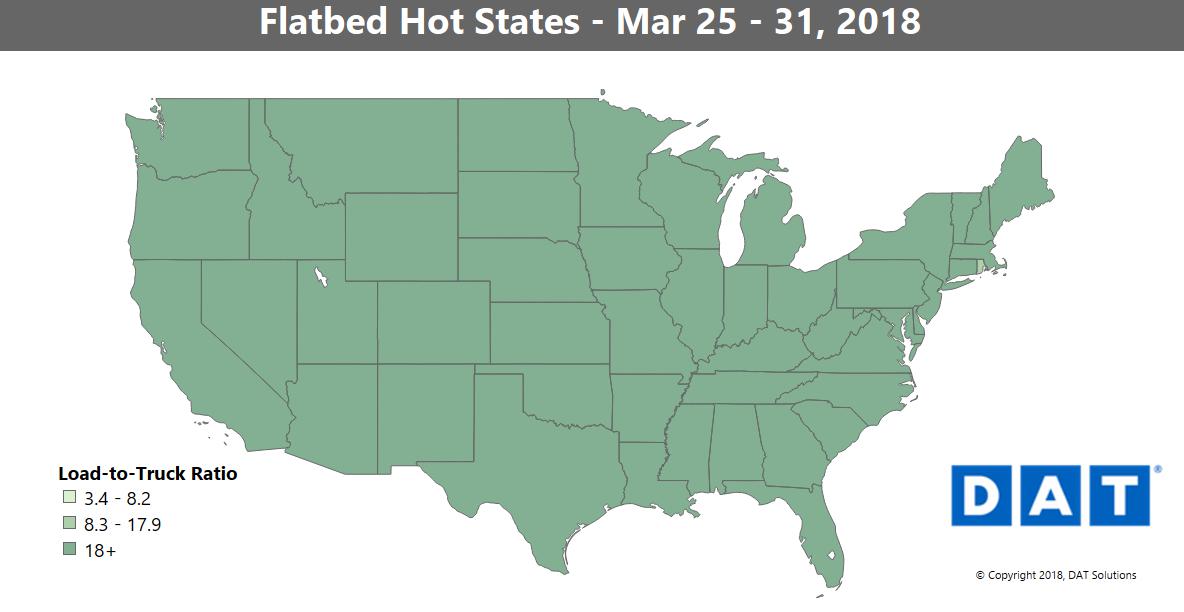

First, a look at the Hot States map for flatbeds. Yup, all states are Hot States now. The load-to-truck ratio for flatbeds blew past 100 last week, which tells me that it’s time to adjust the map legend. Also, if you have an available flatbed, you’re gonna be very, very popular with freight brokers. Flatbeds closed the month at $2.53/mile as a national average, the highest since 2014. Then, a day or two into April, rates went up some more.

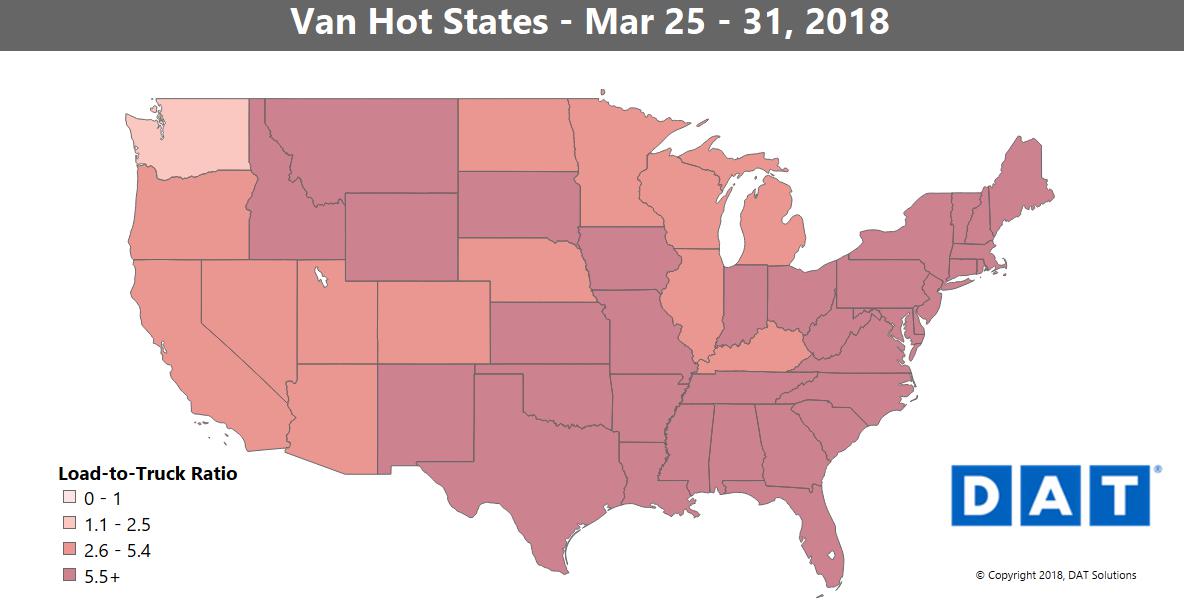

The picture for vans looks a little bit more mixed on the map, but rates and ratios are up solidly in all but a few key markets. Nationwide, the load-to-truck ratio hit 7.2 for the week, and the average van rate gained 2¢ to close the month at $2.15/mile.

Then Monday happened. Van rates rose another 4¢, to $2.19. That could balance out over time, but it’s more common to see rates drop in the first week of the new month, especially after a quarter close and a major holiday. Looks like ELDs are having a renewed impact, on top of growing demand for freight transportation.

More specifically, if you’re looking for a load out of Houston, Dallas, or Memphis, you’ll see higher rates. A few lanes had big gains last week:

- Charlotte to Buffalo, up 31¢ to $3.04/mile

- Memphis to Indianapolis gained 22¢ to $2.58/mile

- Houston to New Orleans got a 14¢ boost, to $2.93/mile

Freight volume dropped on major lanes out of Chicago last week, but you can still find a load.

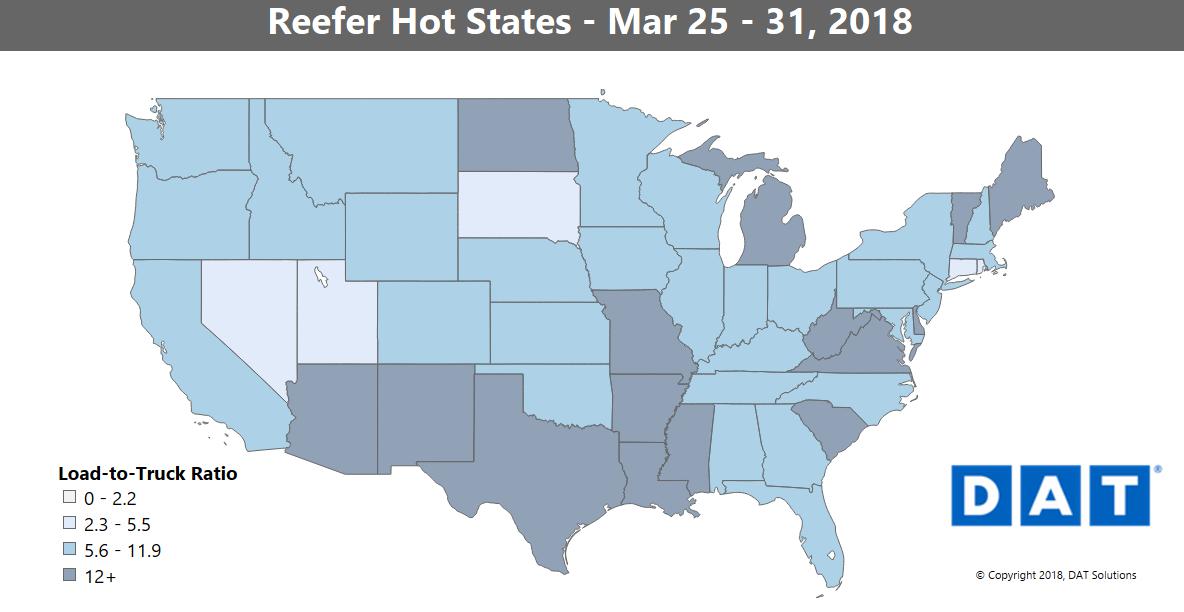

Strong reefer volumes and pricing from the Southeast and West signal the start of spring produce season. Those are typically spot market moves, so rates are rising in key markets:

- Ontario, CA, where volumes dipped slightly out of the Imperial Valley, but rates increased 2.9% on the major outbound lanes. Ontario to Chicago lane rates jumped 29¢ to $2.14/mile.

- Miami outbound rates were up an average of 7.6%, on higher volume. One key lane, Miami to Baltimore, bounced up 24¢ to $2.28/mile.

- Lakeland, FL, pricing rose an average of 4.0% compared to the previous week.

Those hot markets in Florida and California offset weaker rates in Midwest dairy hubs like Grand Rapids, MI and Green Bay, WI. Expect the big action to be focused on California and the Sun Belt for the next couple of months.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.