February’s new residential construction numbers produced by the U.S. Census Bureau reported what many had expected. There was a drop in both building permits and new home starts, which will affect flatbed demand.

As severe weather gripped much of the South in late February, homebuilding activity in the single-family sector dropped by 8% month over month, the lowest number of new homes since last August. Building permits, which lead new home construction by 1-2 months, dropped by 10% m/m but remain up 15% y/y. In the Southeast where 51% of single-family homes were constructed in February, volumes dropped 16% m/m and are now down 11% y/y.

For flatbed carriers looking to building permits and new home starts as an indicator of future demand, we should be careful not to read too much into February’s numbers given the impact weather had on building activity. March data should most likely show a strong rebound based on an improving economy, strong housing demand and warmer weather.

Find flatbed loads and trucks on the largest load board in North America.

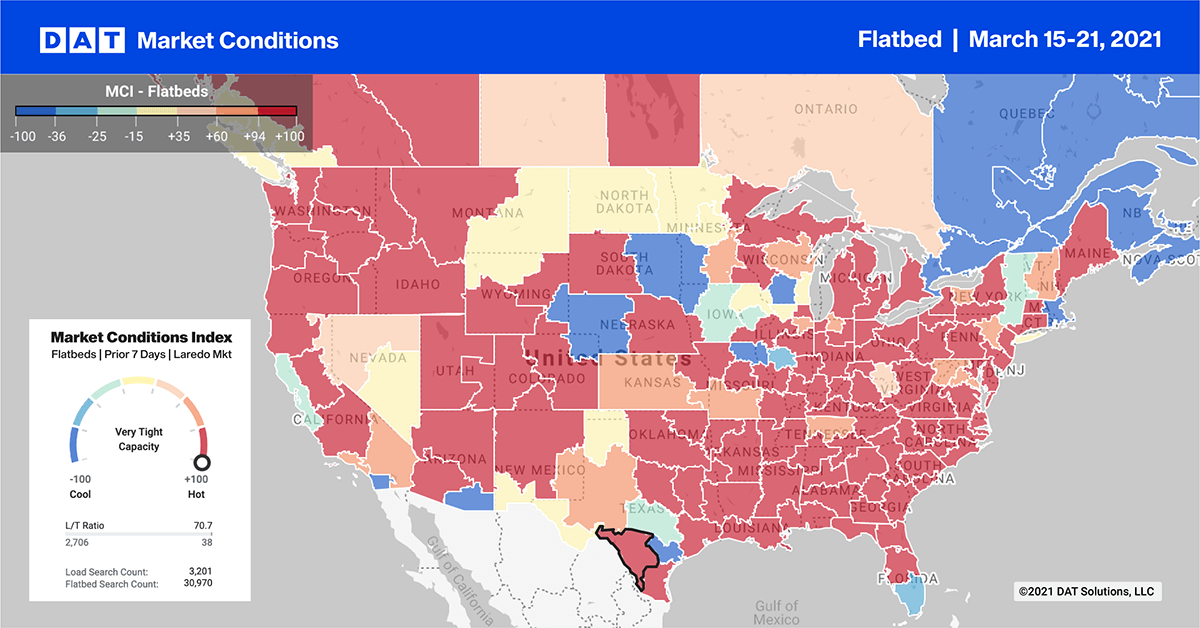

Load posts in the top 10 flatbed markets increased by 5% last week, with spot rates dropping by $0.14/mile on average. Capacity was especially tight again in southern markets, including Memphis, Decatur, AL; Charlotte and Birmingham, AL.

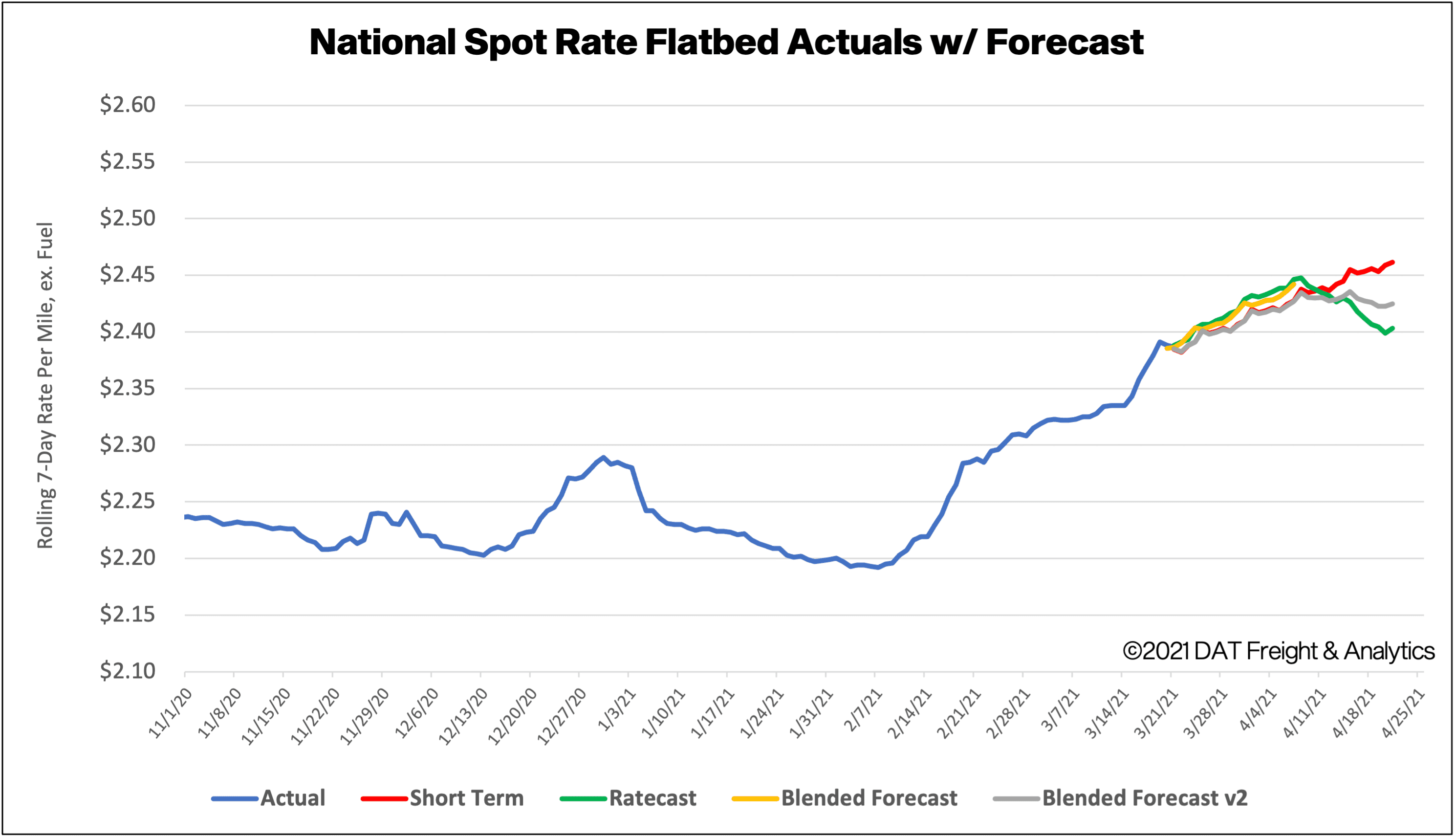

Spot rates forecast

The national average flatbed rate increasing by $0.07/mile last week to $2.40/mile, excluding fuel. Compared to the same week in 2020, flatbed rates were $0.45/mile higher.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.