From now until November, the New York State vegetable crop hits top gear. And although some crops are available year-round, peak vegetable shipping volumes usually peak in October each year according to the USDA.

The New York vegetable crop is best characterized as having a shorter growing season and a long harvest of cool-weather crops (compared to the rest of the country). In terms of the main crops grown, cabbage tops the list with 42% of the annual tonnage produced. Onions follow at 42%.

According to Turek Farms located in the Finger Lakes Region (DAT Elmira freight market): “After fewer plantings and shipments a year ago due to the pandemic, it appears New York state vegetable shippers are back on track with more normal volume this season.”

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Reefer volumes out of the Elmira market have been climbing steadily since the season started in early July. Volumes are currently up 35% since June.

Reefer spot rates out of Elmira have also been climbing and have now doubled in just four weeks increasing from $1.51/mile on July 24 to $3.10/mile this week.

Loads to Hunts Point in New York City from King Ferry, NY are averaging $5.31/mile this week. Loads east to Boston are higher still at $5.76/mile. Both lanes reflect roundtrip rates averaging $2.82/mile.

Loads west to Chicago are much lower this week, paying $2.44/mile for the 684-mile one-way haul.

Rates continue to plummet outbound from Miami now that produce season is over and capacity shifts to other produce markets further north. Northbound spot rates to most markets, including Miami to Atlanta, bottomed out at $1.23/mile last week. This comes after rates as high as $2.79/mile just three months ago during peak produce season — a drop of $1.59/mile.

Loads to Los Angeles are paying even less and averaged $0.96/mile last week for the 2,732-mile run. As expected, inbound Miami rates are climbing to offset declining northbound rates. On the Philadelphia to Miami run, spots rates have increased by $0.83/mile since May to an average of $2.85/mile this week.

Further north in Green Bay, WI, capacity continues to tighten with average outbound spot rates climbing $0.21/mile in the last four weeks to $3.39/mile. For loads to Des Moines, IA, the average rate is $0.24/mile higher at $3.63/mile.

Spot rates

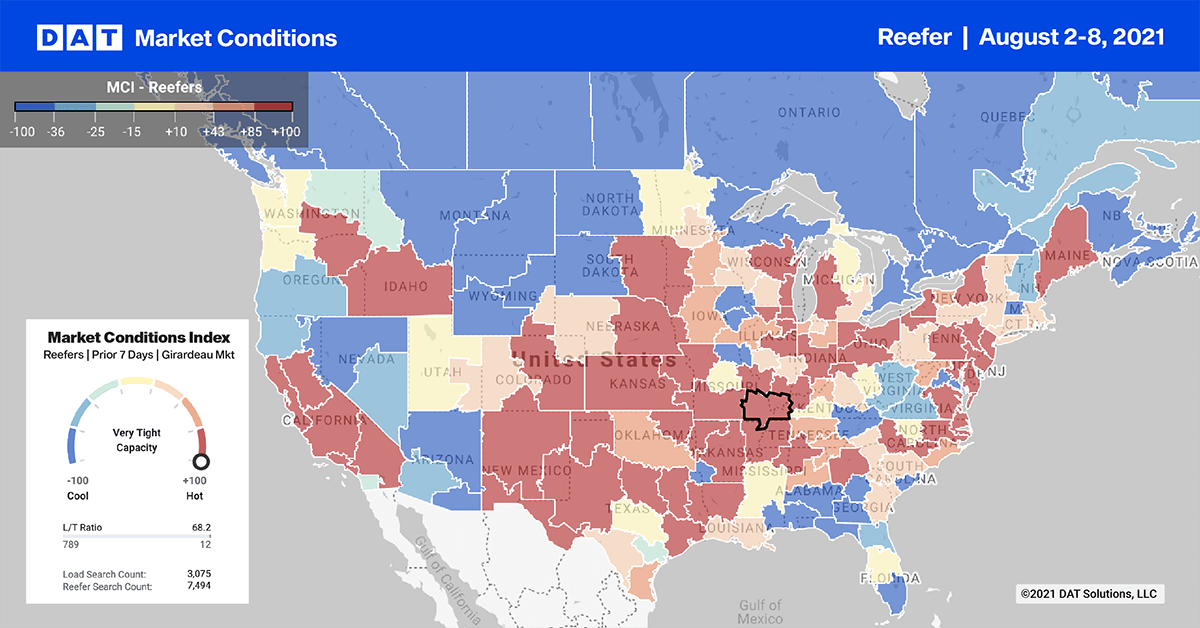

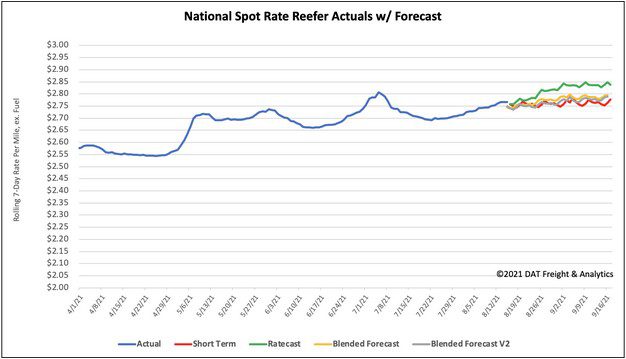

Reefer spot rates decreased by just over $0.01/mile last week to an average of$2.77/mile following two weeks of gains. Spot rates are still $0.58/mile higher than this time last year with rate movement across our top 70 reefer lanes evenly split: a third were up, a third were down and third remained unchanged.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models