The Washington state harvest got underway a few weeks ago with an upbeat outlook.

“The outlook for the 2021 crop was much better than 2020, when COVID-19 caused an interruption in both fresh and processed potato sales,” says Chris Voigt, Executive Director of the Washington State Potato Commission. “Last year, we were concerned that we might have an extra billion pounds of potatoes in storage that weren’t going to get used. While the number of excess potatoes turned out to be only about 200 million pounds, growers did suffer hardship.”

Harvest can occur anywhere from July to October. Once growers move harvested potatoes into storage — the fifth and final stage of the growing process — volumes will be shipped to market over the course of the year.

In Washington’s Columbia Basin, which accounts for about 90% of the state’s potato production, August volumes are usually the highest. It accounts for 12% of annual production, or the equivalent of just over 2,000 truckloads per month.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

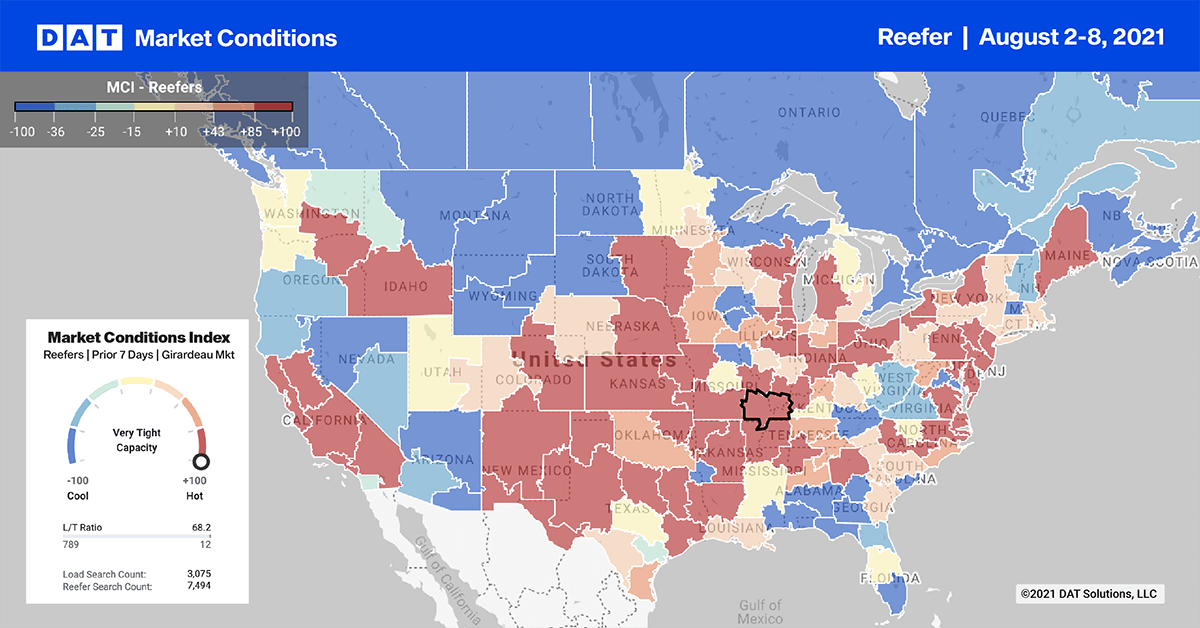

Even though reefer spot volumes were up 4% last week and 27% this month, growers have been finding adequate supply of trucks according to the USDA. The average reefer spot rates are down from $2.41/mile to $2.36/mile last week.

An unprecedented run of triple-digit heat has stressed and diminished Northwest tree fruit crops, but the full extent of damage is not yet known. The resulting impact on truckload apple volumes is also unknown, which is a concern given volumes are usually highest from August through January.

Washington apples typically produce around 11,700 truckloads per month during this timeframe. But with 16 days over 100 degrees Fahrenheit this year, lower truckload volumes are looking more likely this year.

“What the record heat means for 2021 Northwest tree fruit production is not yet known,” says Lee Calcsits, associate professor of fruit physiology with Washington State University. “Some think damage could knock the apple crop down 10% to 15% with sunburn damage evident on both large trees and small trees.”

West Coast truckload carriers rely heavily on fruit production volumes in Washington to reposition assets during late summer and early Fall in particular. But at the moment, truckload volumes have been relatively flat with spot rates down 21% this month. Loads from Yakima to Dallas are paying $2.40/mile. Chicago loads are at $2.37/mile this week with East Coast loads to New York City paying $2.70/mile.

Spot rates

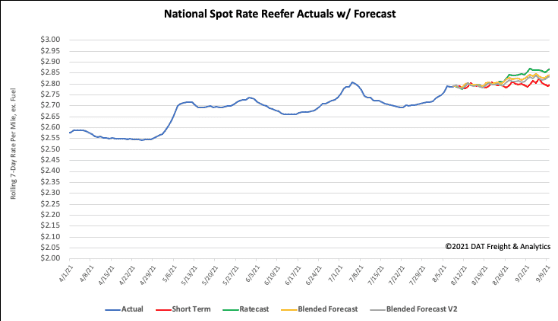

Reefer spot rates increased for the second week in a row, bucking seasonality trends. Rates were up by just under $0.02/mile last week to an average of $2.78/mile. Spot rates are still $0.61/mile higher than this time last year.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models