Allentown, PA, was once a major manufacturing town, but it has emerged more recently as a popular location for warehouses and distribution centers, especially at this time of year. It’s the fastest-growing city in Pennsylvania, with over 120,000 residents and a one-day roundtrip to major population centers on the East Coast. From Allentown, it’s only 60 miles to Philadelphia, the 5th-largest city in the U.S., and less than 100 miles to New York City, or to Newark, NJ, and the largest sea port on the East Coast. Those short hauls can be navigated by LTL and parcel carriers, or by drayage carriers for port traffic.

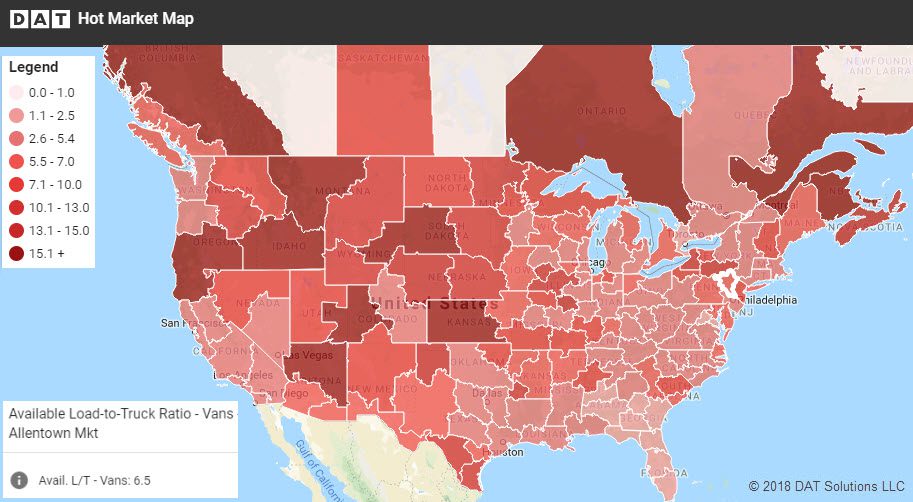

DAT Hot Market Map showed an outbound load-to-truck ratio of 6.5 for dry vans out of Allentown on November 28, and there were more van loads posted there than for either Philly or Baltimore.

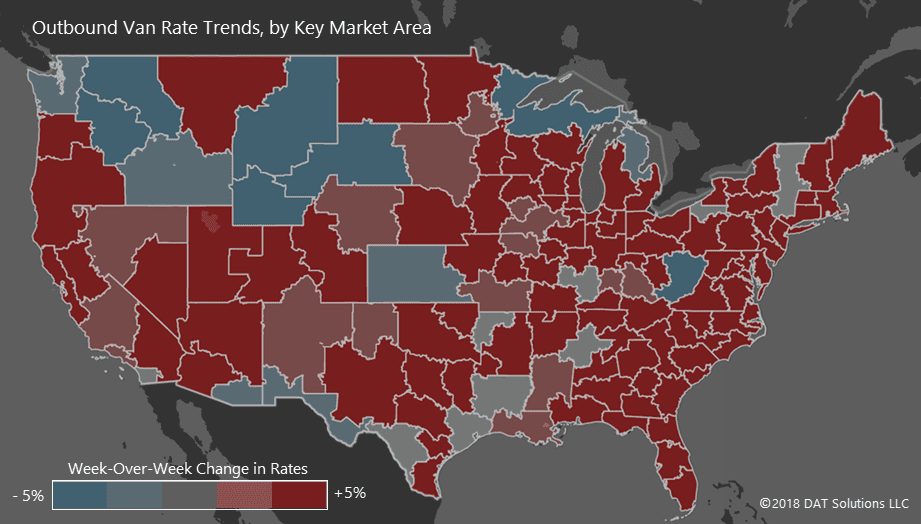

During Thanksgiving week, rates rose on lanes in and out of Allentown. That was consistent with an overall trend during Thanksgiving week, as rates rose on lanes heading towards regional distribution centers near the largest cities.

Outbound rates rose or held steady in all but 13 key market areas during Thanksgiving week.

With its distribution centers and access to multiple freight corridors, Allentown was exceptionally busy for a short holiday week. For example, rates rose steeply on the eastbound and northbound directions on two high-volume lane pairs that begin or end in Allentown:

308-mile length of haul, heading northeast

Allentown to Boston: $3.96/mile, up 19 cents

Boston to Allentown: $2.14/miles, up 1 cent

400-mile length of haul, heading west

Allentown to Cleveland: $1.82/mile, down 1 cent

Cleveland to Allentown: $3.59/mile, up 10 cents