If you make your money on the truckload spot market, you had stiffer competition from rail and contract carriers last month. Shippers moved more intermodal and contract freight in August than they did in previous months, and spot market rates fell as a result.

A late-summer slide is normal for freight rates, but August was otherwise a strong month for spot market volumes. At this time last year, spot market demand spiked following Hurricane Harvey, and load counts for last month nearly matched those for August 2017.

And while, yes, the average van rate fell 13¢ in August compared to July, the per-mile national rate of $2.14 was still higher than any monthly average from 2017. Part of that is because of higher fuel costs, but the lost productivity as a result of the ELD mandate has also played a big role. The pace of decline slowed at the end of the month, with late-summer harvests boosting demand. Fall shipping season will also add pressure, so prices may turn the corner soon.

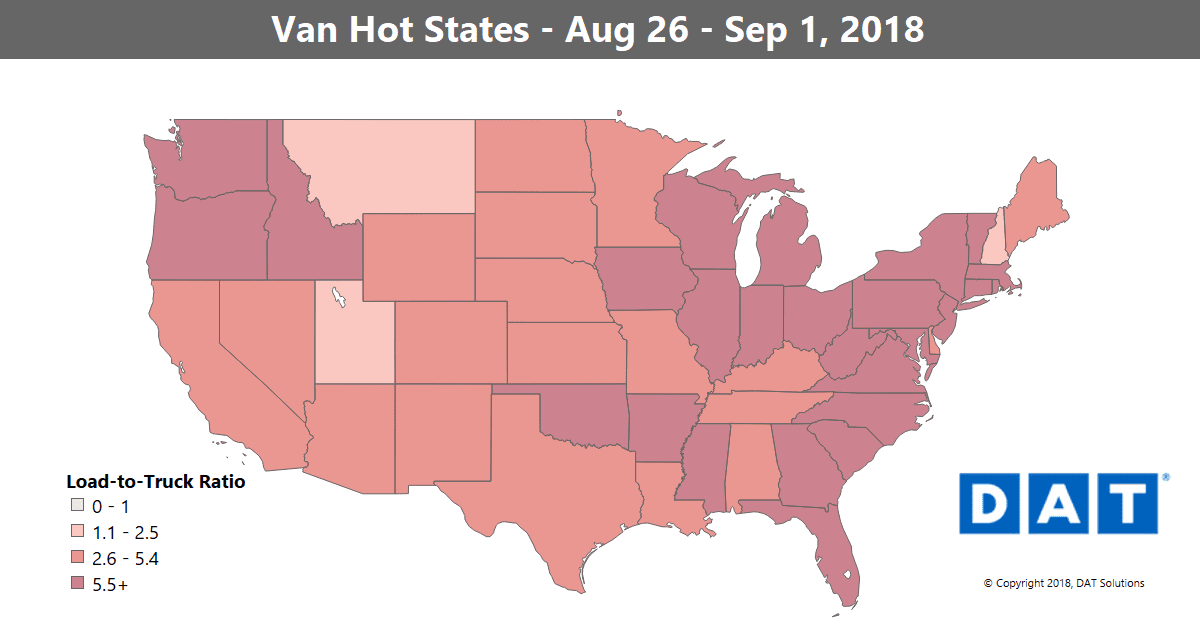

The Pacific Northwest moved counter to the national trend in August, and van rates out of Seattle jumped up 5% last week. Pricing in the Midwest was also more stable than in other parts of the country, with outbound rates from Chicago and Columbus, OH, mostly holding steady for the month.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING

- Buffalo to Allentown, PA rose 24¢ to $3.64/mile

- Memphis to Atlanta increased 14¢ to $2.80/mile

FALLING

The increase in rail activity dragged rates down out of Los Angeles, and the lane to Chicago fell 14¢ to $1.71/mile – that’s a normal rate for that lane, but it should go up in the fall shipping season. Otherwise, most declines were relatively slight last week.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.