Less than ten days after Hurricane Harvey, trucks were already moving freight out of Houston, with almost the same volume as before the storm. That doesn’t mean nothing has changed.

Harvey hit Houston on Friday evening, August 25, and hung over the metro area for days, dumping more than 50 inches of rain on Southeastern Texas and Southwestern Louisiana. Floods in the Gulf Coast region tragically cost the lives of at least 60 people. Economically, Harvey inflicted enormous damage on homes and businesses.

Houston is home to a number critical industries, including energy exploration, oil and gas refineries, and related manufacturing of petrochemicals and plastic resins, among others. Houston is also a major freight hub for rail and sea traffic, as well as trucking, including trade with Mexico by land and with South America and other regions by sea. The port has since re-opened, as have some portions of the railroads, but some capacity has yet to be restored. It could take months.

Houston Rates Remain Elevated, Due to Disruption and Pent-Up Demand

Immediately after the rain subsided, trucks began hauling in emergency relief supplies for residents of the storm-affected zone. Inbound rates skyrocketed, as trucks were likely to leave empty, and so were paid the equivalent of roundtrip rates, with additional compensation for detention and layovers.

Outbound freight has picked up by now, and rates have declined in both directions after the initial, post-storm peak. But rates remain elevated in the region due to supply chain disruptions and pent-up demand. Ripple effects from Harvey, and now Irma, extend across the country, and will be felt for months to come.

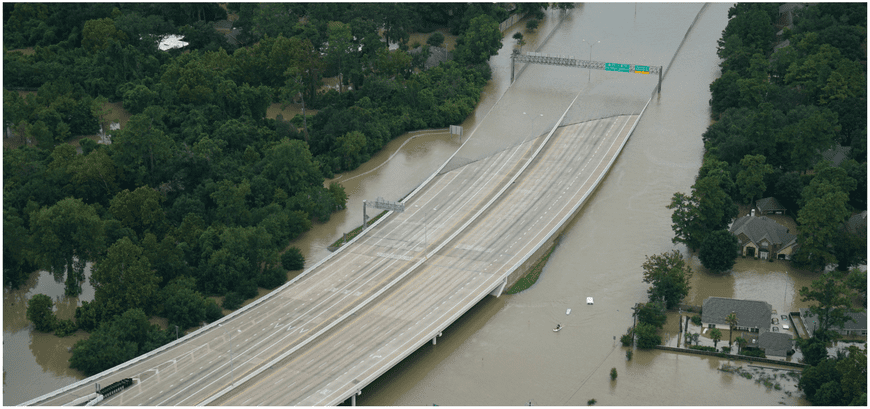

Flood waters cover a Houston highway during Hurricane Harvey.

Irma’s Impact on Truck Freight is Different from Harvey’s

Hurricane Irma’s impact on freight appears to be following the patterns that are more typical of a big weather event, while Harvey was exceptional in many ways.

Big weather events, like Super Storm Sandy in 2012 and Hurricane Katrina in 2005, usually affect freight movements in three stages:

- Before the storm, if it is predicted in advance, shippers hustle to move freight out of the way of the impending onslaught. Outbound rates rise sharply in the zone that will soon be battered by wind and rain.

- During the storm itself, nothing moves in or out of the area. It’s just not safe. FEMA and other organizations may move emergency relief supplies to a location on the outskirts of the storm zone, so they are ready to act as soon as roads are clear.

- After the storm is over, those emergency supplies are brought in, and the inbound rates shoot way up. This is usually a temporary increase, because conditions are still iffy. Plus, very few loads are available so soon after the storm, so truckers will probably have to deadhead back out. They are glad to help, but they want to be compensated for their time and effort. Van and reefer freight moves in first, and flatbed demand follows when it’s time to bring in construction equipment and materials for cleanup and rebuilding.

As of now, Irma is almost finished assaulting the Southeast. It is sunny today in Tampa and Atlanta, with a light breeze. But Irma caused the deaths of at least 11 people in the U.S., and dozens more in the Caribbean. Homes and businesses were destroyed. Millions are still without power in Florida. On a more positive note, relief supplies are being delivered by FEMA and other groups, and cleanup will get underway as conditions allow.

It will take a very long time for freight transportation and logistics to return to normal, after two such monstrous storms in the same month. After Harvey smacked into Houston, some shippers started supplying the South Central region from distribution centers in the Southeast. So Atlanta, Charlotte, Memphis and other regional hubs were moving freight to Arkansas, Louisiana, Texas, and Oklahoma, because Houston couldn’t do it.

Then Irma headed toward Florida, and those same Southeast hubs re-focused and moved freight south instead of west. Meanwhile, the Midwest had to supply the Northeast, to compensate for all the freight that would ordinarily arrive from Atlanta. And the Midwestern warehouses were also called on to supply Colorado, which is often served by Houston. So it’s not so surprising that rates went a little crazy last week, in between the two megastorms. The pressure intensified even more because it was a short work week following Labor Day.

We’ll see how this plays out, and you can score the accuracy of my predictions. Keep checking the DAT blog and DAT Trendlines for updates, as well as Facebook and Twitter, and let us know how the hurricanes have affected your business.

Stay safe out there!

DAT employees are donating to American Red Cross to help support those affected by Hurricanes Harvey and Irma, and DAT Solutions is matching those contributions. To learn more about how you can help, visit the Red Cross website. Transportation and logistics professionals are urged to contact the American Logistics Aid Network, if you can help provide trucks, trailers, or warehouse space.