Last week’s U.S. industrial production report from The Federal Reserve for December increased by 1.6% month over month, as the economy showed glimpses of improving.

Industrial production is a measure of factory, mining and utility output and a reliable indicator of flatbed demand, especially for manufactured goods, which is the largest component of total industrial production. Manufacturing output increased by just 0.9% in December m/m and although manufacturing has regained much of the ground lost early in the pandemic, production ended 2020 down 2.8% y/y.

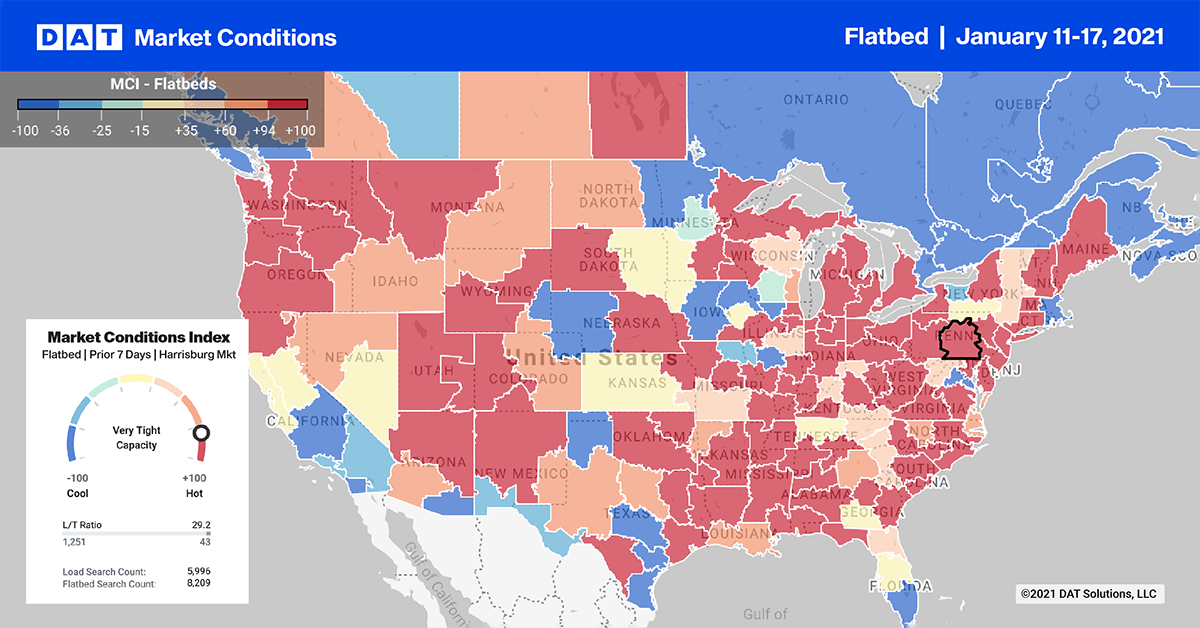

Load post volumes in the vast majority of top 10 flatbed markets increased last week, as shippers took advantage of the above average temperatures across most of the U.S.

Memphis was again the number one market for outbound load posts increasing by just under 1% w/w – capacity was also tight pushing rates up by $0.02/mile. Load volumes in Buffalo (#4) increased by 24% w/w although brokers and shippers found plenty of capacity pushing down rates by $0.23/mile. Little Rock (#6), normally a number one or two market for load post volumes, recorded a 25% w/w decrease in volume with available capacity loosening rapidly and rates dropping by $0.24/mile.

In the Southeast where just over half of all new single-family homes are constructed, available capacity was tight in Birmingham (#2) pushing up spot rates by $0.10/mile to $2.92/mile as load post volumes decreased slightly.

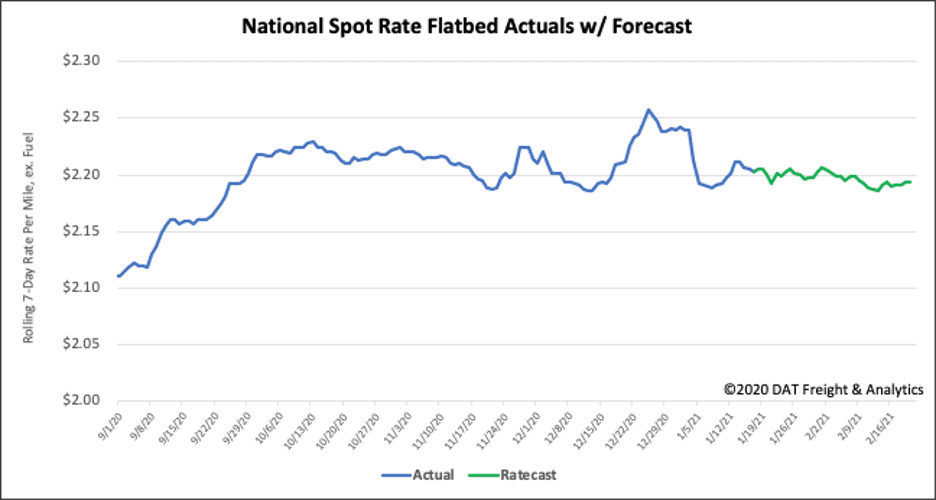

Spot rates

Flatbed spot rates remained flat last week, staying at the $2.20/mile excl. FSC last week. They’ve been at this level for just over three months, and compared to the same week in 2020 when flatbed rates were $1.92/mile, rates are currently $0.46/mile higher. Flatbed rates are however, $0.14/mile higher than the same week in 2018 when the flatbed rate rally was taking shape.