Flatbed load and equipment posts on the DAT network each increased 2% last week, leaving the national average flatbed load-to-truck ratio virtually unchanged at 52.8.

Load post volumes in DAT’s top 10 flatbed markets increased by just under 1% compared to the previous week. However, the number of loads moved on the top 78 flatbed lanes was up 13.2% week over week, and the average spot rate was higher or neutral on 59 of those lanes.

Construction helps demand

The U.S. Census Bureau reported a 1% increase in construction spending during the month of December compared to November, but that doesn’t tell the whole story. Residential activity was up 3% month over month while nonresidential construction spending declined 1.7%.

In this era of extraordinarily low interest rates, new home construction should continue to be a star performer as the economy improves. For flatbed carriers looking for indicators of future demand, building permits were up 30% in December compared to December 2019.

Find flatbed loads and trucks on the largest on-demand freight exchange in North America.

Recovery in Birmingham

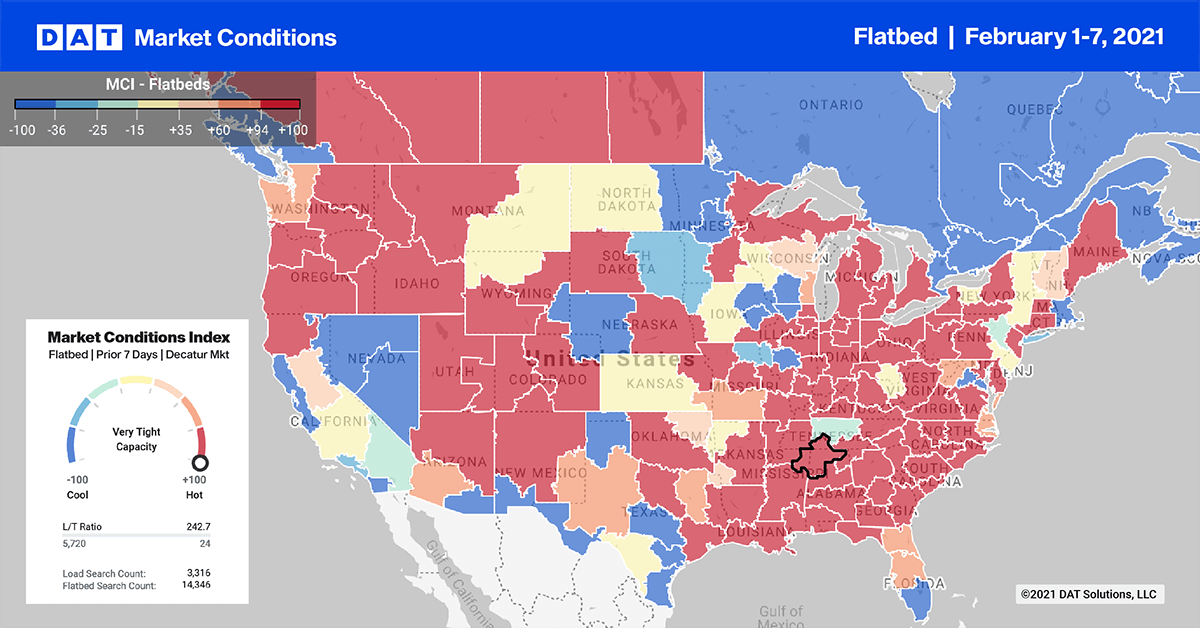

Load volumes into Birmingham, Ala., settled down 23% compared the previous week, when inbound volumes surged 18% following a Jan. 25 tornado that affected parts of Alabama and Georgia. The average outbound flatbed rate from Birmingham increased 9 cents to $2.86/mile on a 9% increase in volume. Nearby Decatur reported a 7% increase in volume although loose capacity led to a 7-cent decline at $3.30/mile. Although outbound volumes from Little Rock slipped 6% week over week, the average rate was up 30 cents to $2.86/mile.

Spot rates

With little movement in the number of available loads and trucks, the national average spot flatbed rate was unchanged at $2.19/mile. After peaking above $2.50/mile at the start of January, spot flatbed rates have settled into the $2.17/mile to $2.22/mile band.

However, compared to the same week in 2020, the national average flatbed rate is up 38 cents.

How to interpret the rate forecast

1. Ratecast Prediction: DAT’s core forecasting model estimate showing continued optimism and rate growth.

2. Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

3. Blended Scenario: More heavily weighted towards the longer-term models.

4. Blended Scenario v2: More heavily weighted towards the shorter-term models.

> Learn more about Ratecast predictions available in RateView.