According to the USDA, domestic truckloads of produce were down 37% y/y for the week ending 16 January but up 13% y/y for imported truckloads.

The decrease in domestic volumes is significant and is driven mostly by the large number of closures of temporary shutdowns in the foodservices industry. Most restaurants and catering companies are on life support at the moment and absent more financial assistance in the form of PPP loans, it’s hard to see how demand in the refrigerated sector improves before late spring/early summer.

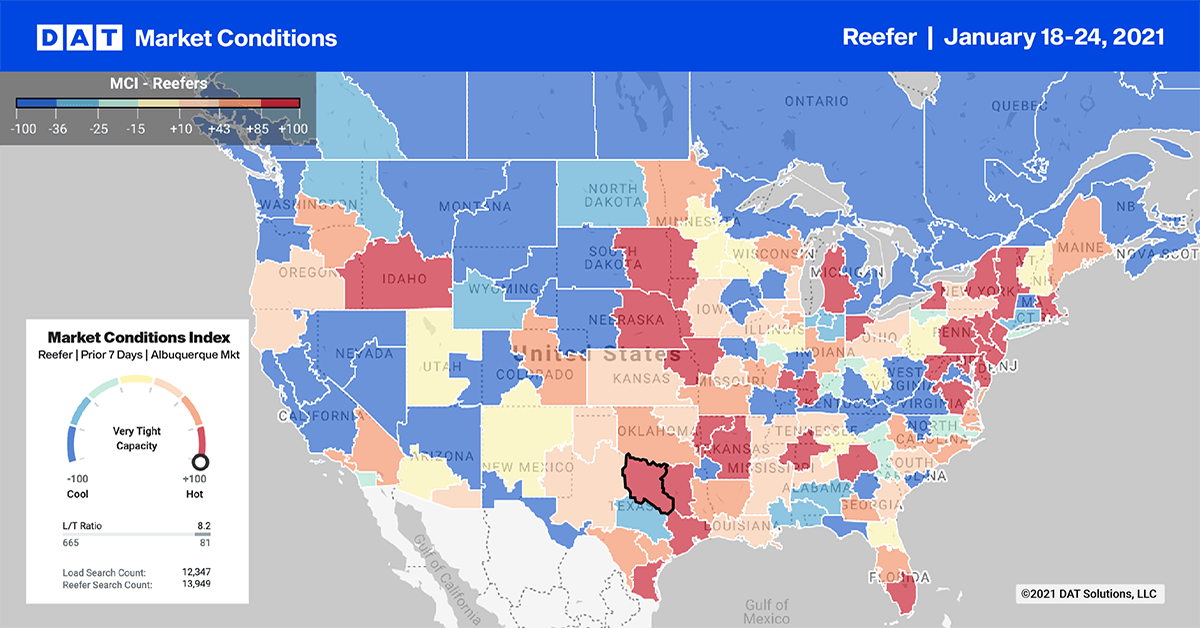

Reefer load posts on the DAT One marketplace dropped in most of the top 10 markets again last week, putting downward pressure on spot rates.

Elizabeth, NJ, was the number one market again last week, but rates continued to fall, ending the week down $0.02/mile on average. In Atlanta (No. 2), outbound volumes increased by 2% week over week, and prices rose slightly, up $0.01/mile to $2.26/mile on average (excluding fuel).

In Florida, winter produce volumes are providing some backhaul opportunities for carriers who ventured deep into the Miami (No. 13) and Lakeland (No. 22) markets, where volumes increased by 19% and 23% w/w respectively. Capacity tightened as a result, pushing up spot rates $0.10/mile to $1.51/mile in Miami and $0.03/mile to $1.35/mile in Lakeland. Higher volumes and outbound rates in Savannah, GA; Jacksonville, FL, and Tifton, GA, will incentivize carriers to stay in southern Georgia, keeping capacity tighter for outbound central and southern Florida loads.

Spot rates

The national average spot rate in the reefer sector continued to drop, decreasing by $0.07/mile to $2.27/mile, which is still $0.40/mile higher than the same week in 2020.

Reefer rates are tracking almost identically with 2018 spot rates and are now just $0.02/mile than the same week in 2018.