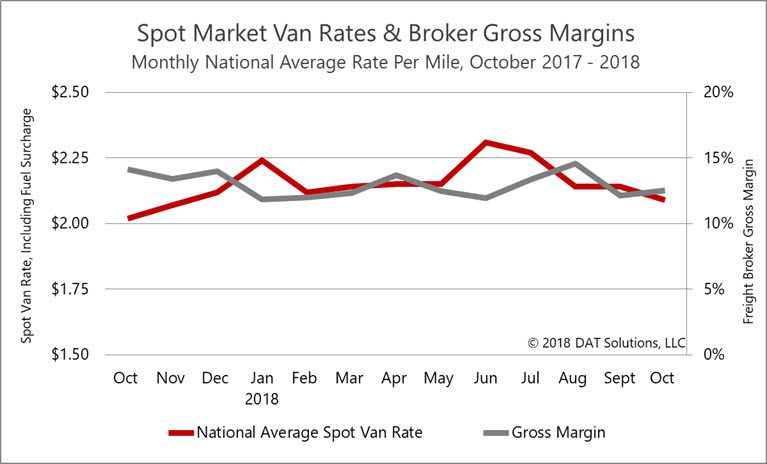

Freight brokers’ revenues and costs rose by about the same amount in October, indicating that high rates paid by shippers were passed along to carriers. As a result, brokers’ gross margins stalled at 12.5%. Brokers moved about the same number loads during the month but they made more money per load, compared to September.

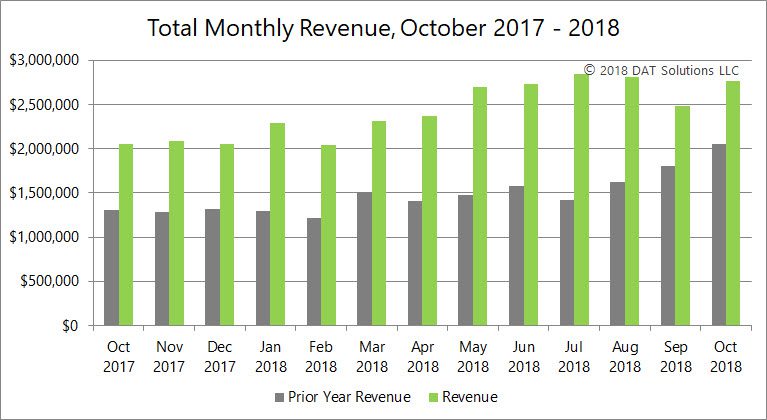

This report is derived from the monthly financial results of more than 100 freight brokerage companies. Their 2017 average annual revenue of $19.5 million has risen 65% in the first 11 months of 2018, year over year, putting them on track to exceed $30 million for the year.

Get the full monthly report delivered to your inbox. Subscribe to the DAT Broker Benchmark Report.

Total revenues averaged almost $2.8 million for the month, up 11% compared to September, and 34% higher than October 2017. For the year-to-date, revenues are up 65% compared to the same period in 2017. High truckload freight rates throughout the year contributed to the revenue increase, as did higher demand for freight brokerage services.

Gross margins averaged 12.5% in October, an improvement over September’s 12.1% but lackluster when compared to 14.1% margins in October 2017. Elevated rates ate away at the margin as a percentage, but yielded strong results in dollar terms. Brokers averaged almost $200,000 in net revenue, which is what’s left after paying carriers.

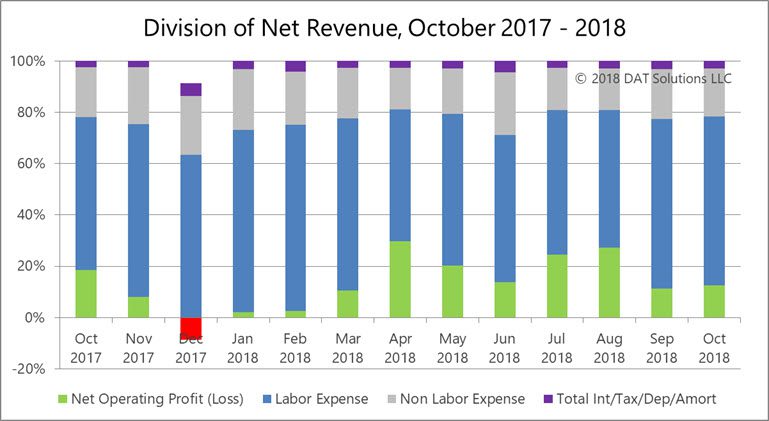

Net operating profit rose 30% month over month because net revenue rose faster than expenses. Compared to October 2017, however, operating profit declined 19%, due mostly to an increase in labor expense. As a percentage of net revenue, labor expense came to 65%, non-labor expense was just under 19%, and 2.8% went to interest, taxes, depreciation and amortization, leaving 12.7% net operating profit.

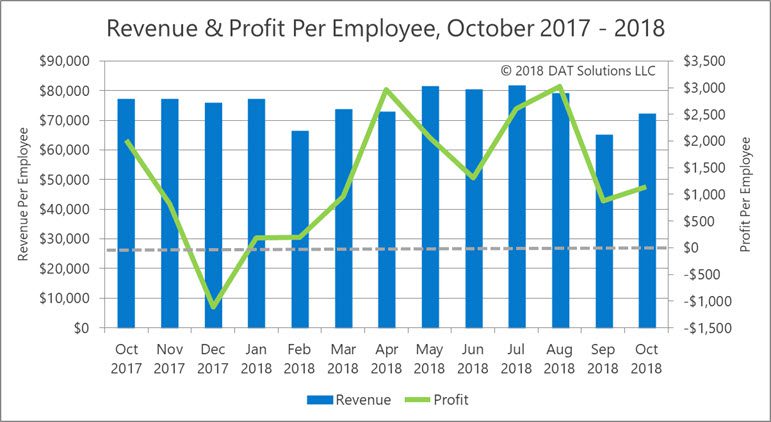

Revenue per employee added 11% in October month over month, with no change in the average headcount. The increased revenue had more to do with rates than productivity, however. Compared to October 2017, revenue per employee dropped 6%, and profit per employee tumbled 43%, due mostly to a 43% increase in headcount, year over year.

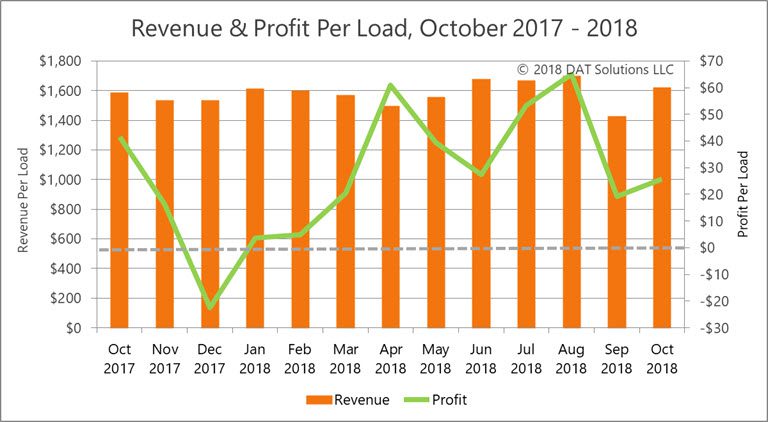

Brokers moved 2% fewer loads in October, compared to September, but revenue per load rose 14% and profit per load added 33%, compared to September. Load counts were 31% higher and revenue per load added only 2% compared to October 2017, while a $26 average profit per load was 38% lower than last year’s result.