There is an emerging consensus that the retail party is starting to run its course as retail tonnage begins to converge to last year’s levels. According to Michigan State University (MSU) Associate Professor Jason Miller:

“My impression is many folks thought e-commerce sales were going to not only have the COVID-19 ‘jump,’ but they would then keep going at the same ~14% year-over-year upward trajectory we were seeing pre-COVID. That almost certainly isn’t going to happen, especially once Delta gets contained.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

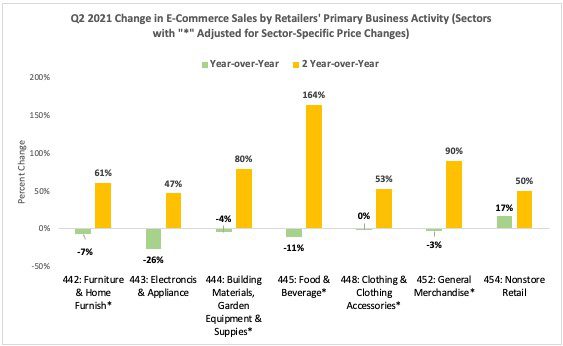

The fact e-commerce sales in Q2 2021 were below Q2 2020 levels for most brick-and-mortar retailers (see chart below) has huge implications for the carriers wanting to grow middle-mile e-commerce freight.

Jason Miller and Yemisi Bolumole, PhD at MSU created the Retail Truck Tonnage Index, which converts retail sales for all sectors — excluding gasoline stations and motor vehicle and parts dealers — to sector-specific tonnage. July’s Index showed that tonnage decreased by 0.15% last month. Compared to July 2020, retail tonnage is still up 2.5% this year. Compared to July 2019, tonnage is up 14.5%.

On last week’s DAT iQ Weekly Market Update, Professor Miller offered some insight into why we’re seeing the retail spending spree of the last 18-months start to slow.

“A lot of us expected that once the consumer started to run out of stimulus money, we’d start seeing a transition away from physical goods to services, which in turn would reduce overall demand for truckload carriers,” said Miller. “And while we’ve seen signs of that happening, the key challenge right now is manufacturing supply chains, be it automotive, furniture, or wood products to some extent, are so snarled at the moment. I don’t know if the manufacturing side is in a position to really pick up some of the slack.”

To support this view, Miller noted that data from the Bureau of Economic Analysis on personal savings (personal saving as a percentage of disposable personal income) was at 9.4% in June, which is by far the lowest level it has been since the pandemic began. The long-term average for personal savings pre-COVID was 8% but peaked to the 30% range during the worst of the lockdowns last year.

“As we’ve seen, personal savings rates are basically heading towards their long-term trend and personal income is going down now that stimulus has been exhausted,” said Miller.

For carriers and brokers looking to where truckload demand is headed, ongoing supply disruptions in the manufacturing sector should be the most concerning. According to the latest Commodity Flow Survey and analysis by MSU, manufacturing accounts for 58.6% of ton-mileage in the for-hire truck transportation sector.

The retail e-commerce sector will continue to grab all the headlines. But what’s important to remember is that the majority of small carriers who make up the bulk of the industry are still heavily dependent on manufacturing activity.