Photo by Tom Saunders, Virginia Department of Transportation, February 2014

Winter has started early, with snowstorms in Denver and Minneapolis last week, and sub-freezing temperatures from the Rockies down to Texas reminding us of last year’s Polar Vortex. That’s not a good sign, and there are other supply chain issues as well:

Port congestion creates backlog, as freight that should be on its way to distribution centers is stuck waiting to be unloaded, or it’s on the dock waiting for scarce drayage or intermodal resources, especially in the twin ports of Los Angeles and Long Beach. Shippers continue to re-route cargo to other ports on the West, Gulf and East Coasts, but this bottleneck is rippling through the supply chain. Delays may add to the pressure on trucking company schedules in the last two weeks before Black Friday. Rates may rise briefly, and more freight will likely find its way to the spot market. If the weather gets bad again and trucks are unable to move easily, that could prevent small fleets from taking advantage of the short-term rate spike. Meanwhile, large fleets are adding trailers to their pools at a record pace in order to preload and cut down time.

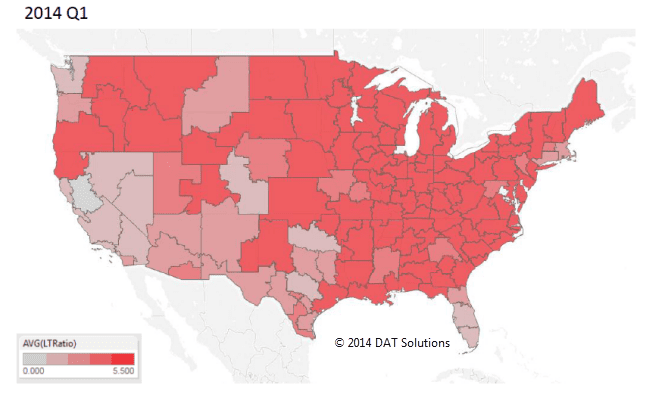

Even spot market capacity is tight. Looking at the two Hot Market maps below, it’s easy to see a big difference in the balance between demand and capacity on the spot market in the more typical winter that we had in the first quarter of 2013, compared to Q1 2014 below it. In the darker red areas, there were five or more loads posted for every truck posted on DAT Load Boards during each quarter. In a typical winter season like Q1 2013, freight availability is soft, there is no big seasonal competition for capacity, and the load-to-truck ratio in most of the 149 key market areas on the map will linger at 2.2 or below. In Q1 2014, however, severe, recurring storms turned the map red throughout the Midwest, Northeast and even the Southeast, where municipalities were not prepared to handle the unprecedented levels of snow and ice.

Load-to-truck ratios were below 2.2 in much of the country during the first quarter of 2013. The Hot Market Map above reflects a typical winter lull in truckload freight movements, under ordinary seasonal weather conditions.

The Polar Vortex wreaked havoc on truckload freight transportation in the first quarter of 2014, however, turning the Hot Market Map red throughout most of the U.S. Only the Southwest and Florida were unaffected by the extreme weather that snarled supply chains and hampered fleet productivity.

On the other hand, winter weather is just part of life on this continent, and last year’s transportation fiasco led to some positive changes that bode well for this winter:

Strong demand for freight transportation is a “happy problem” for carriers, but it could cause additional complications if bad weather strains tight capacity even further. The National Retail Federation predicts a 4.1% increase in sales this season, so retail supply chains remain in high gear, compared to the modest gains of the 2013 season.

Road conditions will improve, as state and local governments across the country have repaired highways, purchased snow-removal equipment and established better procedures to help them cope with extreme weather.

Railroads are more ready to handle inclement weather, based on hard lessons learned last winter. BNSF, UNP, NSC and CSX, for example, have added locomotives and other equipment, hired more operational employees, and improved procedures and infrastructure for handling weather-related challenges.

Fuel is more affordable, which is good news for carriers. Fuel is a large component of operating cost for all fleets. When trucks are sidelined by severe storms, revenue is reduced, and all cost savings help the bottom line during a difficult season. (For those of you who watch fuel prices closely, I recognize that the national average price for diesel fuel rose 5¢ per gallon last week. This is a regional issue, primarily affecting the Midwest and Rock Mountain States, and it is due to an annual change in the blend that keeps diesel from gelling in cold climates during the winter.)