While new home construction and low mortgage rates fueled a lot of flatbed demand in 2020, spending on private nonresidential construction in November was 9.5% below 2019 levels, according to the U.S. Census Bureau.

Hotel and motel construction fared worse and is down 26.5% y/y, while office construction is down 6.6%. As we start 2021 with the pandemic far from being under control, it’s realistic to think many consumers will continue to work from home well into 2021, which will translate into lower demand for commercial building projects and in turn lower flatbed freight volumes.

Last week’s Fannie Mae Home Purchase Sentiment Index (HPSI) also added weight to slowing demand in the residential housing market. According to Doug Duncan, Fannie Mae Senior Vice President and Chief Economist, “the HPSI declined for the second consecutive month and fell to its lowest level since May 2020, as consumers adjusted to the worsening COVID-19 conditions of the first few weeks of December – the survey collection period.”

Five of the six HPSI components decreased m/m and consumers reported a substantially more pessimistic view of homebuying and home-selling conditions, which drove down the index by 17.7 points y/y.

Find flatbed loads and trucks with the largest on-demand freight marketplace in North America.

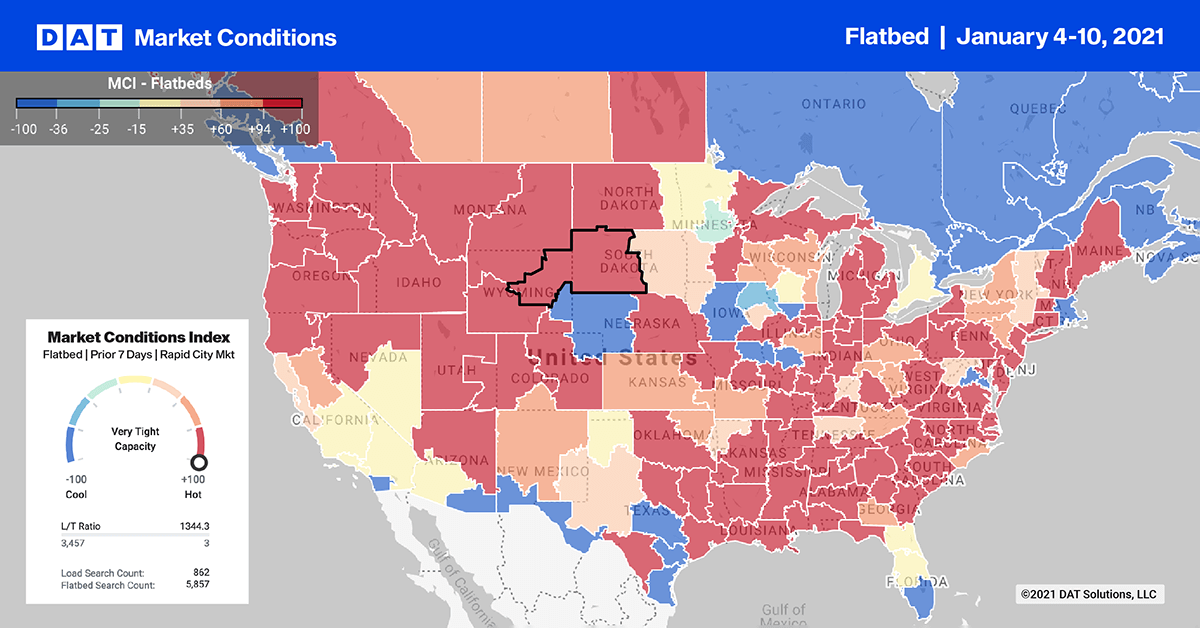

Load post volumes in the vast majority of flatbed markets were higher compared to the prior week. Memphis and Little Rock, AR, maintained their number one and two positions, although tighter capacity in Little Rock drove up rates $0.22/mile to $2.74/mile (excluding fuel) following a 78% w/w surge in volumes.

Lakeland, FL, was the number one destination for loads out of Little Rock. Rates on the lane increased by $0.13/mile to $2.68/mile.

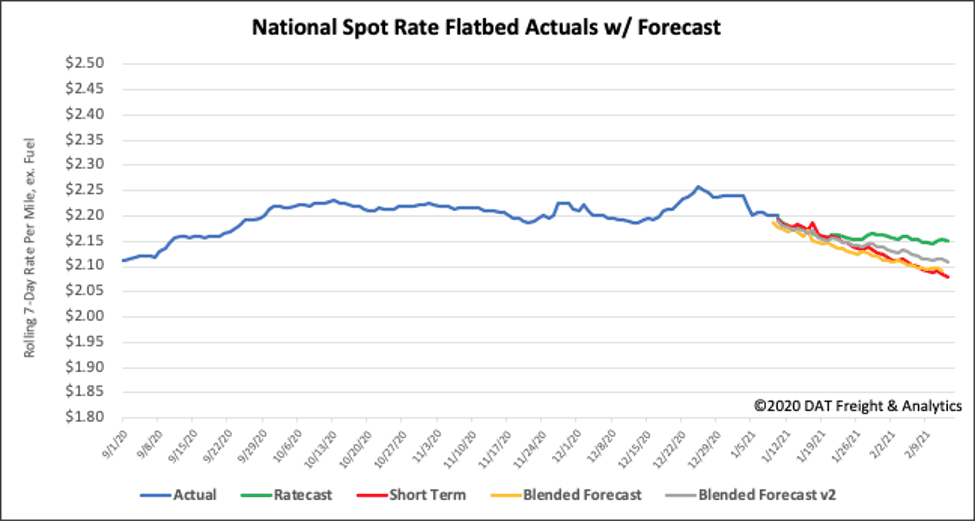

Spot rates

Flatbed spot rates dropped slightly by $0.01/mile to $2.20/mile, excluding FSC last week. Compared to the same week in 2019 when flatbed rates were $1.84/mile, rates are currently $0.37/mile higher.

How to interpret the rate forecast

- Ratecast Prediction: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.