Industry analysts seem to agree that spot and contract rates will keep rising due to the stronger economy and the ELD mandate. However, that shared belief doesn’t address how much markets will change, and when.

Five industry experts tackled those key questions.

Rates Will Continue to Rise

“Spot rates could stay above contract prices for a few months or even two or three quarters in one or more truckload freight segments,” said Donald Broughton, who heads Broughton Capital. He noted that for the first time ever, spot rates in January were above contract in all three freight segments — dry van, reefer, and flatbed.

“Both the industrial and the consumer economy are really accelerating at the same time,” creating upward rate pressure, he said.

“There is more to come” on the pricing front, Broughton said, because it takes time to add capacity, and because rates have to be increased to cover driver pay hikes.

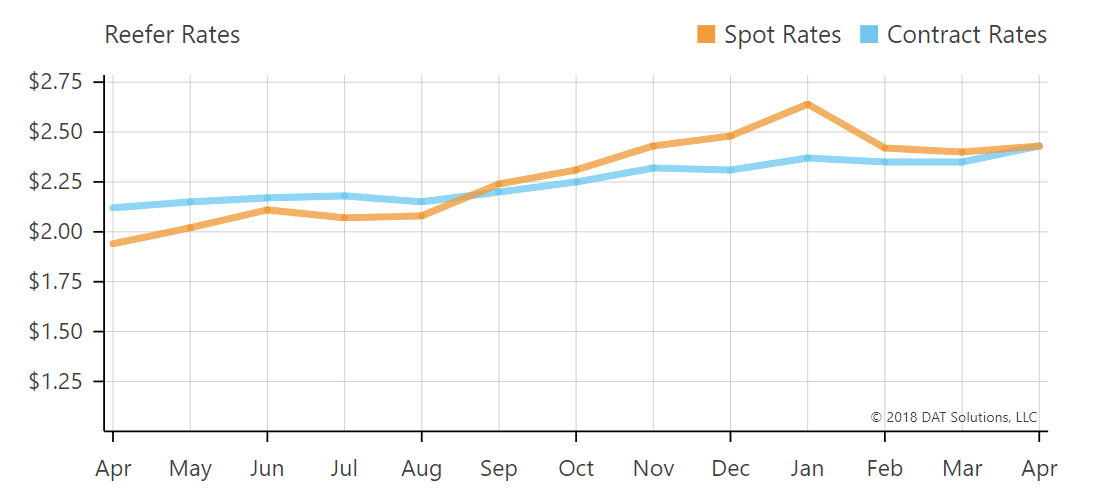

In the reefer category, spot market rates have exceeded contract rates for the past 8 months. Source: DAT RateView.

Expect Rates to Peak in June

DAT pricing analyst Mark Montague sees a spot market rate peak in June before that market settles down.

“As we go deeper into the year, the normal spread will be restored between spot and contract rates,” Montague believes.

Dave Broering, president, Non-Asset at NFI Industries, anticipates spot market rates will rise slightly in June and July, cool off in August, and then take off again in September and October if consumer spending remains solid and cataclysmic events like hurricanes are avoided.

“There is still slightly more demand than capacity,” Broering said, “which will magnify the effect of any disruption.” The next disruption is the June 5-7 Roadcheck, which has prompted some drivers to stay off the road and cut capacity over the past three years.

“If we keep roaring after July 4, the third quarter could be a real challenge,” Broering said.

Price Increases Force Change in Shipper Behavior

Broering said shipper resistance to rate increases has softened after the tightest first quarter capacity in two decades.

Montague noted contract rate increases in the high single-digit ranges have been enough to prompt shippers’ behavioral changes, such as reducing dock delays, paying bills faster and relaxing strict appointment times.

Paul Newbourne, Executive Vice President of Covenant Transportation Solutions, expects increases in the 8% to 12% range. Rate hikes will be smaller “where shippers and receivers work in earnest to be driver-friendly and turn trucks quickly,” and higher for shippers who don’t, he said.

Newbourne noted that in early 2018, many customers were surprised by the carrier-friendly market.

“We are talking to customers about how they can lock in a certain amount of capacity on a year-round basis as well as for surge coverage during peak periods,” he said. “Shippers are smart. We expect them to continue to look for innovative ways to protect their capacity needs while stabilizing the associated rate environment to the extent possible.”

Contract Terms Are Changing Too

Russell Leo, CEO of RLS Logistics Group, emphasized that market volatility is pushing carriers to not lock in rates beyond 90 days, instead of annual pricing.

“It’s just not realistic to quote for a longer period,” he said. “The hot topic out there still is capacity. Where that capacity is going to come from is the million dollar question.”

Leo believes that eventually annual rates will come back into contracts later in 2018, and possibly next year.

DAT Data Analytics provides customizable reports on truckload capacity and pricing.

ELDs Hit 400-750 Mile Runs Hardest

Other key patterns are emerging. Rates jumped 35% for 400-mile to 750-mile runs, Broering said, after the ELD mandate influenced driver assignments in that mileage band, far above increases for shorter or longer runs.

“We have to help people understand what we are seeing, and help them recognize the effects on the freight network,” Broering said. “The hiring situation isn’t going to change anytime soon. Our focus is to figure out how to add value, outside of the rate picture.”

According to Donald Broughton, the early 2018 experience isn’t a fundamental shift in the spot and contract rate relationship, with basic economic principles prevailing over the longer term as higher rates and profits attract capacity. “There will be times when spot exceeds contract rates and others when the spot market price lags contract by double digit percentages,” he predicts.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.