When disaster strikes, trucks are needed to get emergency supplies where they’re needed most. But as has been the case with Hurricane Florence – which is anticipated to make landfall on the mid-Atlantic coast later this week – we’re seeing how trucks are a big part of the preparation process before the storm, too.

Big weather events like this usually affect the spot freight market in three stages.

1. Before the storm, there’s urgency to move freight into the area or out of the way of the storm’s path. We saw that last week and early this week. Load board activity on DAT Load Boards last week wasn’t down nearly as much as you’d expect when accounting for Labor Day. Part of that was FEMA loads adding to demand on the spot market.

2. When the hurricane hits, there won’t be much going in or out until the storm passes, so volumes decline in the storm zone. FEMA and other emergency responders will move freight to temporary warehouses just outside the storm zone, waiting until road conditions are stable. Some of those loads are already being tendered to freight brokers and 3PLs, who post them on DAT load boards. Many of the destinations are in inland North Carolina markets, including Charlotte, and those lane rates are rising now.

3. After the storm passes, we’ll see more emergency freight brought in, which usually brings a temporary increase to inbound rates. There likely won’t be much freight moving out of the areas hit by the storm, so truckers will probably have to deadhead out. Van and reefer loads usually move in first, and flatbed demand picks up later if there’s construction equipment needed for rebuilding and cleanup.

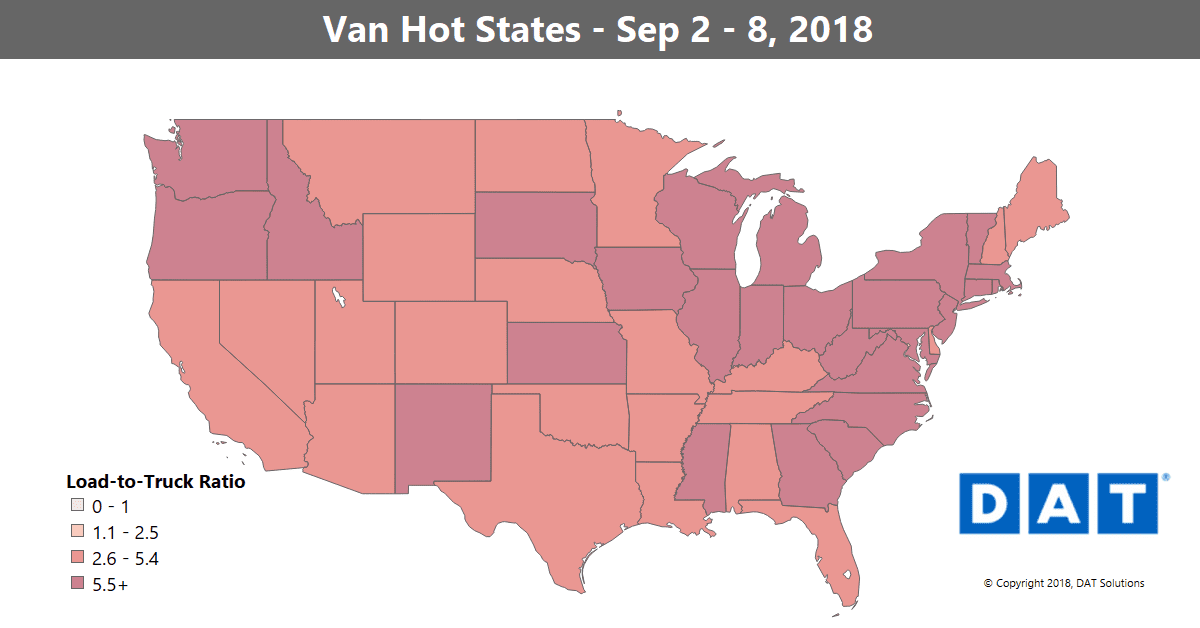

The Hot States Map above shows high load-to-truck ratios along the East Coast, as shipments moved in and out of the region ahead of Hurricane Florence.

Rising prices

Urgency to get freight from the Northeast into Charlotte ahead of the storm pushed rates higher:

• The average rate from Buffalo to Charlotte was up 21¢ to $2.54/mile

• Philadelphia to Charlotte also climbed 15¢ to $1.90/mile

The two biggest increases were on lanes out of Denver, where outbound rates are typically low:

• Denver to Oklahoma City was up 24¢ at $1.47/mile – low, but still higher than that lane has paid in more than a month

• Denver to Albuquerque was up 25¢ to $2.24/mile

Falling prices

• Rates out of Memphis continued to lag, and the lane to Atlanta was down 12¢ to $2.68/mile

• Seattle to Spokane was the biggest drop, down 19¢ to $3.52/mile, but rates out of Seattle otherwise continued to trend upward

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.