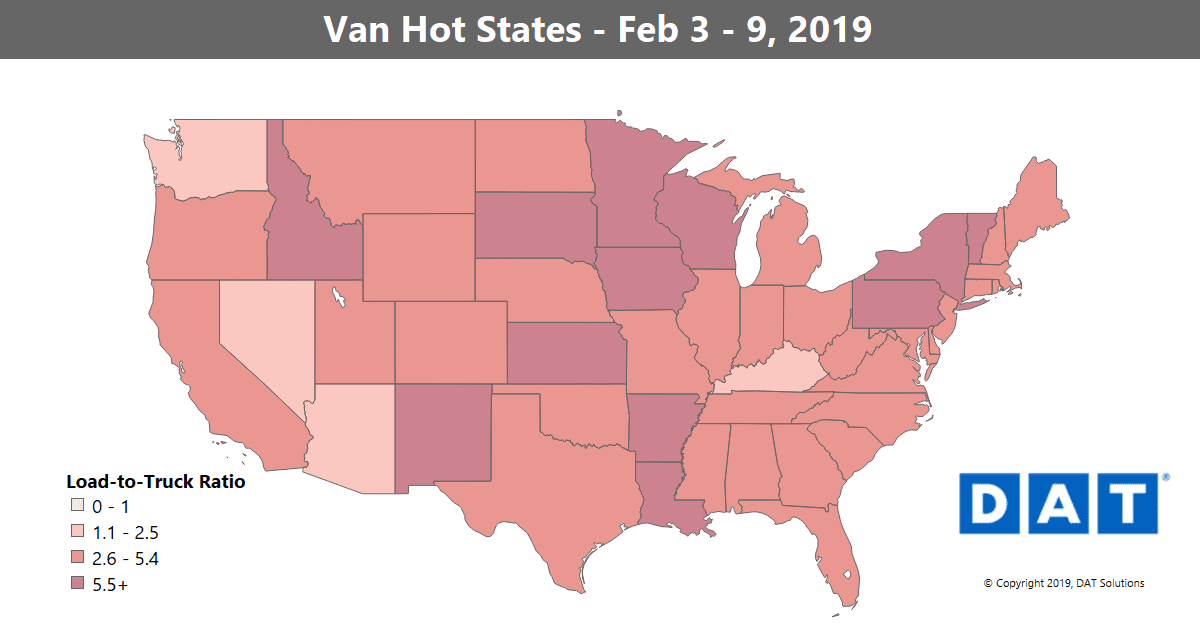

Has money been a little tighter for your business lately? If you’re a small carrier or owner-operator, you’re not alone. Freight rates have been in decline since the calendar flipped to 2019. Prices are typically down during this part of winter, but there are signs that rates could thaw soon.

The good news is that volumes have been firming up this month. On the top 100 van lanes, February volumes so far have outpaced both 2017 and 2018, and the number of lanes with higher rates versus lower rates was fairly balanced last week.

That said, rates out of most of the major markets are well below where they were a month ago. Outbound prices picked up from the Northeast, though. Rates out of both Philadelphia and Allentown, PA, were up 3%.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING

- Philly to Boston jumped up 16¢ to $3.43/mile

- Allentown to Boston was also up 14¢ to $3.62/mile

- Out West, Denver to Oklahoma City added 14¢ at $1.38/mile

- Stockton, CA to Portland, OR, was up 13¢ to $2.63

FALLING

We saw some spikes in prices out of Chicago two weeks ago as a result of that blast of Arctic weather, but those rates started to fall back to earth last week.

- Chicago to Detroit was down 22¢ at $3.13/mile

- Chicago to Columbus lost 12¢ at $2.79/mile

- The lane from Denver to Albuquerque is still one of your best bets for getting out of Colorado, but that lane lost 15¢ last week at $1.88/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.