The major components of President Biden’s $1.2 trillion infrastructure package includes $110 billion allocated for fixing and building roads, bridges, and other major highway projects. For flatbed and dry bulk carriers, this is great news given the amount of steel, asphalt and ready-mix concrete that will be required to upgrade the nation’s highways and bridges.

Find loads and trucks on the largest load board network in North America.

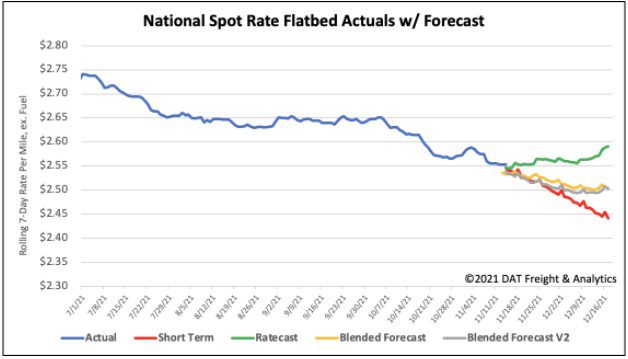

Note: All rates exclude fuel unless otherwise noted.

According to Associate Professor Jason Miller from Michigan State University:

“Truck transportation is set to see a nice bump in that it is the eighth most indirectly impacted sector. Gains will be primarily directed towards specialized carriers hauling steel, sand and gravel, and chemicals. Petroleum refining and fracking are the sectors expected to see the greatest gains because it takes a lot of petroleum products to build asphalt roads and all the chemicals necessary to produce steel and fabricated metal products.”

According to the American Iron and Steel Institute (AISI), steel production is quickly recouping lost production during the 2020 pandemic with raw steel production up 20.1% since the start of the year. Production capacity is at 81.5% (67.3% this time last year).

For steel carriers this is equivalent to an additional 541,000 truckloads of steel hauled this year compared to the first 10 months of 2020. Hot markets to watch include:

- Gary, IN — the largest freight market for steel products

- Flagstaff, AZ — home to some large steel mills and where flatbed spot rates have increased by $0.57/mile in the last three weeks to an outbound average of $2.64/mile

Capacity is tight this week on the 620-mile haul from Flagstaff to El Paso, TX. Spot rates are $0.25/mile higher than the October average to $2.11/mile this week.

The state of Florida found flatbeds in high demand last week as spot rates jumped $0.12/mile to an average of $2.58/mile. Capacity was the tightest in Miami where outbound load post volumes jumped 32% since the previous week while inbound volumes only increased by 3%, creating a capacity imbalance for brokers and shippers.

In Miami, spot rates were up $0.09/mile last week to an average of $2.39/mile. Loads west on the 864-mile haul to New Orleans jumped to $1.91/mile last week. It’s now up $0.52/mile compared to last year and $0.23/mile above the average for October.

Further west in Houston load post volumes remained flat this week. But like most large flatbed markets, capacity was tight pushing up spot rates by $0.03/mile to an average of $2.81/mile.

Spot rates

Flatbed capacity cooled off last week following a $0.04/mile drop in spot rates to a national average of $2.55/mile. Compared to the same week last year, flatbed spot rates are still 13% or $0.33/mile higher and $0.42/mile higher than 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models