The general theme of the 2021 freight market has been one of material and labor shortages hampering production, which was amplified in the latest IHS Markit Manufacturing PMI. All industries are reporting record-long lead times for raw materials and disrupted supply, chains constraining economic activity early in the fourth quarter.

Find loads and trucks on the largest load board network in North America.

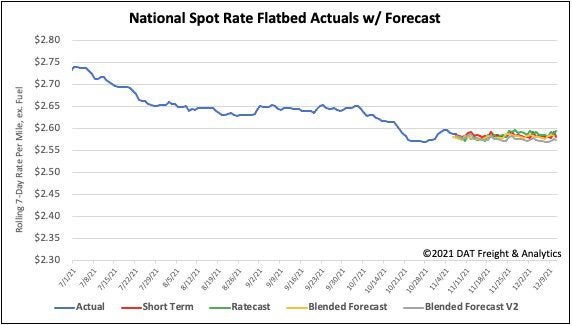

Note: All rates exclude fuel unless otherwise noted.

According to IHS, the seasonally adjusted Manufacturing Index posted 58.4 in October, down from 60.7 in September with output growth in the manufacturing sector the weakest in the last ten months.

According to Chris Williamson, Chief Business Economist at IHS Markit:

“October saw U.S. manufacturers report yet another near-record lengthening of supply chains, with shortages of components constraining production growth to the lowest since July of last year. Around half of all companies reporting lower production in October attributed the decline to a lack of supplies. However, a further one-in-ten cited a lack of labor, and one-in-four reported that demand had fallen, often because customers either lacked other inputs or were pushing back on higher prices.”

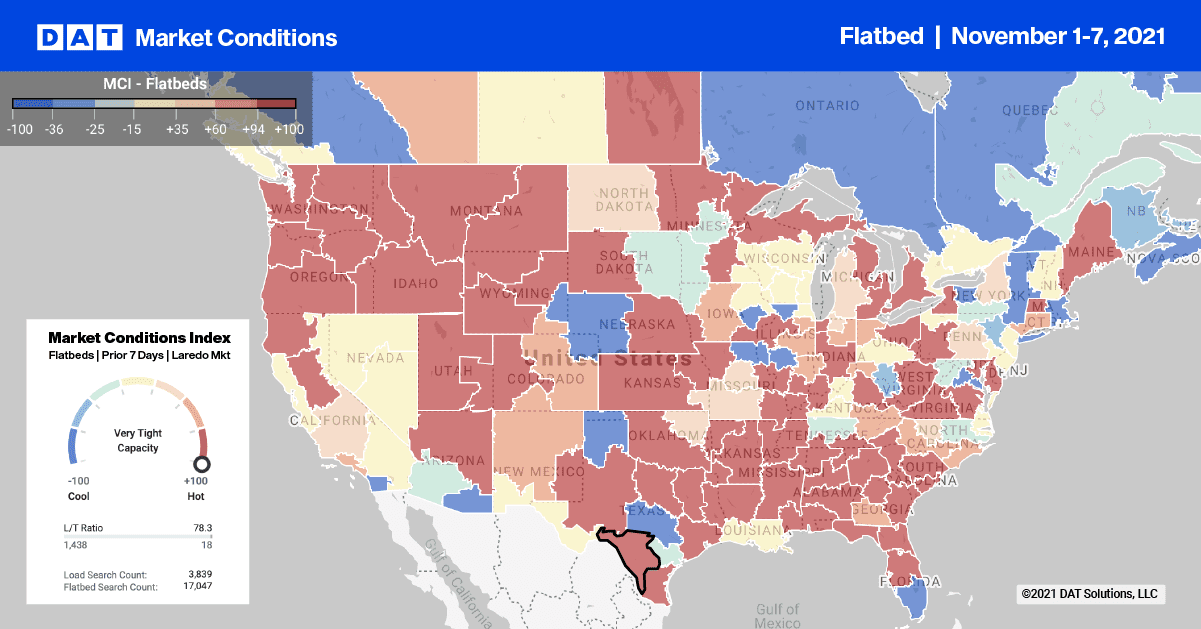

Flatbed capacity tightened last week in Texas where average outbound spot rates increased $0.05/mile to $2.79/mile. Regional loads from Houston to Shreveport hit a new 12-month high at $3.65/mile, which is $1.13/mile higher than this time in 2020.

Loads from Houston to Dallas were also up 11% compared to the previous week to an average of $3.74/mile. Compared to the same week last year, flatbed spot rates are up 60%.

In the Great Lakes region, flatbed capacity eased after being tight for several weeks. Spot rates in Gary, IN dropped $0.17/mile last week to an average outbound rate of $3.28/mile. In nearby Columbus, OH, spot rates jumped $1.04/mile to an average outbound rate of $4.07/mile last week with rates to Philadelphia $0.25/mile above the October average at $4.65/mile last week.

Spot rates

Flatbed capacity remained unchanged last week as spot rates ended the week where they started — at around $2.59/mile. Compared to the same week last year, flatbed spot rates are still 13% or $0.34/mile higher and $0.42/mile higher than 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models