New rules will make 1.3 million Americans newly eligible for overtime pay, says the U.S. Department of Labor, and that will affect transportation companies nationwide. The new rules begin Jan. 1, 2020.

While the new rules likely won’t be an issue for most truck drivers, who are paid by the mile, they may affect both carriers and brokerages with back-office staff. The new rules increase the salary threshold for employees to be exempt from overtime, rising from the current $23,660 to $35,568.

Streamline your back-office operations with DAT BrokerTMS

The level proposed by the Department of Labor under the Obama administration had set a threshold of $47,476, but two weeks before those rules were to take effect on Dec. 1, 2016, a court injunction put the rules on hold. Two months later, the Trump administration came into office with a vow to reduce governmental regulations.

Because the Obama-era regulations were so close to being implemented, some businesses may have already made changes to their employees’ hours or pay levels. Below is a chart that includes the current requirements, the previously-proposed rules, and the final rules.

| Current Requirement | Obama-era proposal | Final rule Begins Jan. 1, 2020 |

|

|---|---|---|---|

| Exempt Salary Threshold | $23,660 | $47,476 | $35,568 |

| Can include commission/bonus? | No | Up to 10%, if paid quarterly | Up to 10%, if paid annually |

| Adjusted every 3 years | No | Yes | No |

| Changes duties test? | No | No | No |

Bonus pay and commissions

The final rules allows companies to include commissions and bonuses as part of an employee’s salary, but only up to 10%, and it must be payed at least annually. For example, if an employee currently earns $20,000 in salary and $20,000 in commissions, the employer would only be able to count $22,000 as the employee’s salary and would therefore be required to pay overtime.

Employees must meet “duty test”

In addition to the amount of money an employee makes, the employee must meet a “duty test” to determine if he or she is in performing what the Department of Labor calls “executive, administrative, or professional” tasks.

“Just because someone is on salary does not necessarily mean they’re exempt from overtime,” said employment law attorney Jessica Summers in a recent webinar hosted by the Small Business Legislative Council. She said employers should refer to the Duty Tests published by the Department of Labor to determine which employees can be exempt from overtime. She noted that this would be a good time for all employers to conduct an audit of their employees’ salaries and duties so they can make adjustments if necessary before the deadline.

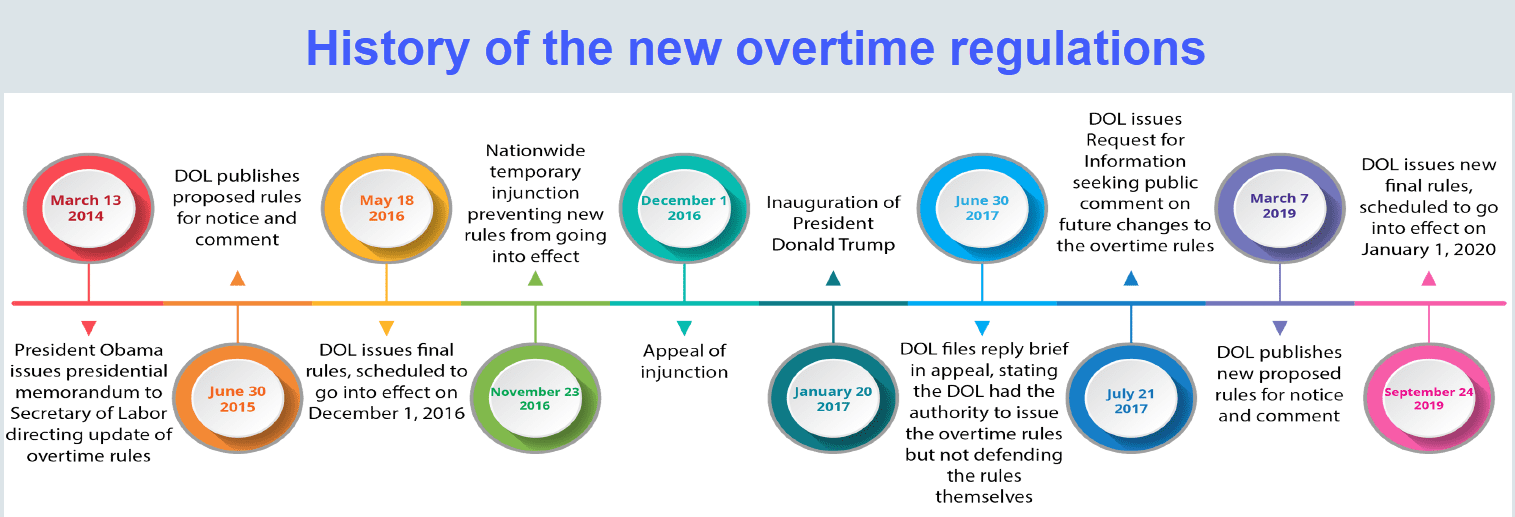

The process of changing current overtime rules began in 2014, as seen in this timeline from the Small Business Legislative Council.

For a summary of the final rule, a fact sheet, and frequently asked questions, see the Department of Labor’s Final Rule: Overtime Update webpage.