Truckload capacity remained tight during the first week of 2019, and national average rates increased 3¢ for vans, reefers and flatbeds. However, rates declined on many of the highest volume lanes, so increases in the national averages could be temporary. Lower diesel prices and declining fuel surcharges may also counteract future rate increases.

Load posts on the DAT Load Board were were up 18% last week compared to the week before, though, and truck posts were up 11%. That pushed the load-to-truck ratio up 6%, signaling that demand outpaced truckload capacity.

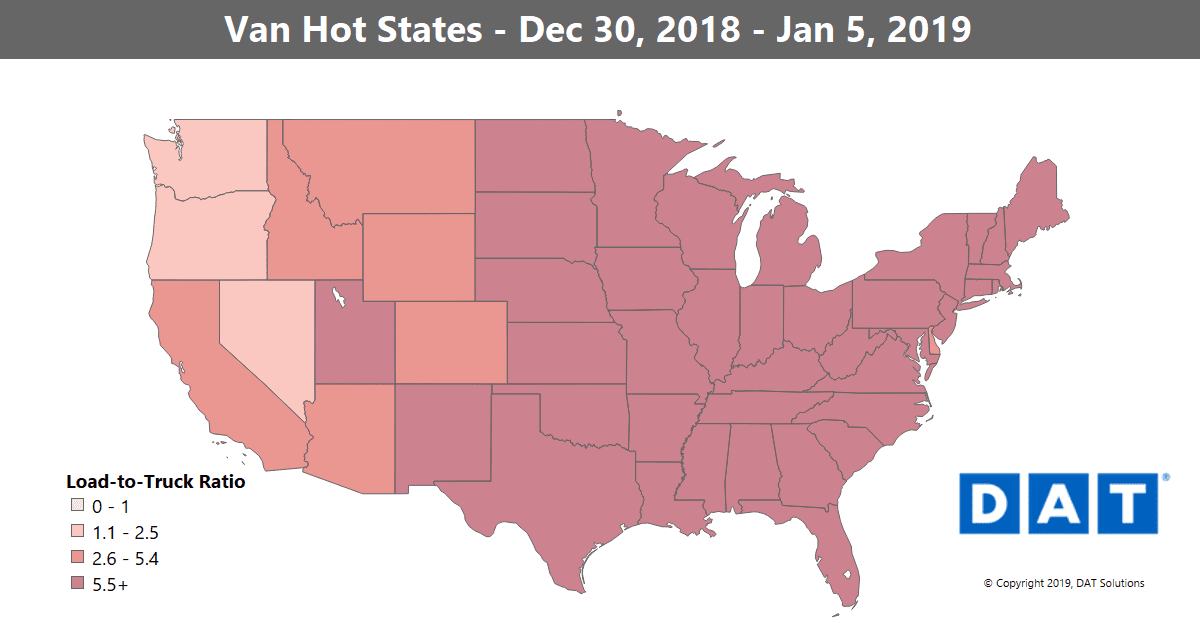

VAN TRENDS

In the top 100 van lanes last week, rates moved higher on 41, while prices fell on 53 lanes. The other six held steady.

Rising

The three largest price increases last week came out of Denver. Denver is a big beer producing market, with both large production breweries and smaller craft brewers shipping beer in vans and reefers. It’s possible that the NFL playoff games and college bowl games increased demand from bars, restaurants and grocery stores.

- Denver to Albuquerque jumped 28¢ to $2.35/mile

- Denver to Oklahoma City gained 21¢ to $1.41/mile

- Denver to Chicago added 20¢ to $1.52/mile

Elsewhere, the sharpest increase in freight activity were in Texas, where both Dallas and Houston look strong. In fact, van trends from Houston are much stronger than flatbed trends. There may be shipments of support supplies needed prior to construction materials for the oilfields and pipelines.

Falling

Seattle rates continue to fall seasonally, slipping another 4% lower last week. Also, Allentown, PA, and Philadelphia declined, as e-commerce season has mostly subsided for now.

- Seattle to Eugene, OR dropped 40¢ to $2.61/mile

- Columbus to Buffalo was down 39¢ to $3.28/mile – still a decent rate

- Atlanta to Philadelphia declined 20¢ to $2.31/mile.

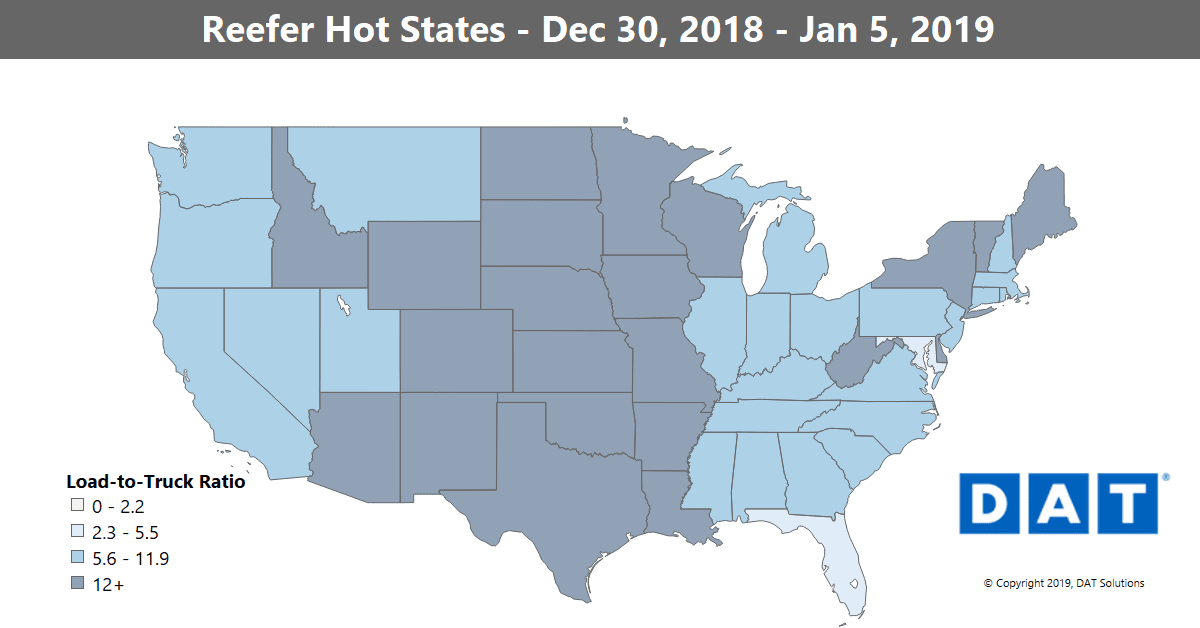

REEFER TRENDS

The national average reefer rate increased to $2.47/mile. On the top reefer lanes, 24 moved higher and 46 were lower — mainly because of the spike in rates from the previous week, which included Christmas. Football also seems to be impacting reefer demand. The Super Bowl is in Atlanta this year, on the first weekend in February, and lanes to Dallas (Cowboys) and Philadelphia (Eagles) were among the leaders in rate increases.

Rising

Nogales, AZ has been hot for freight, as well as Lakeland in central Florida.

- The lane from Nogales to Dallas surged 61¢ to $3.38/mile

- Nogales to Brooklyn NY jumped 44¢ to $3.08/mile

- Last week the lane from Atlanta to Philadelphia rose 50¢ to $3.19/mile

Falling

- Green Bay to Des Moines plunged 73¢ lower to $2.22/mile

- Miami to Baltimore slipped 75¢ to a more-normal $2.13/mile

- McAllen to Atlanta slid 36¢ to $3.00/mile, but expect that lane to hold up as the Super Bowl approaches in Atlanta

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.