Reefer markets continued to sizzle during the last week of June, as the end of Q2 and the upcoming 4th of July holiday added to pressure on freight rates. As a result, spot market rates hit the highest point ever recorded for reefers in DAT Trendlines. At $2.69/mile, the national average spot rate for reefers was also 11¢ higher than the average shipper contract rate.

Several major reefer markets saw large increases last week, though activity out of Southern California was lackluster. Truck load demand continued to outpace capacity in the Southeast, leading to higher prices out of Atlanta.

June is the traditional peak for reefer rates, so we expect prices to begin to retreat in July, though that might happen at a much slower pace than usual.

RISING

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

- Atlanta reefer rates shot up 7% last week – the lane to Philadelphia soared 57¢ to a whopping $4.08/mile

- California demand shifted northward to Sacramento, with rates up 9% – the lane to Denver jumped up 52¢ to $3.46/mile

- Miami to Baltimore had an unexpected rebound, up 55¢ to $2.70

- Rates also rose out of Chicago and Philadelphia, ahead of the Fourth of July

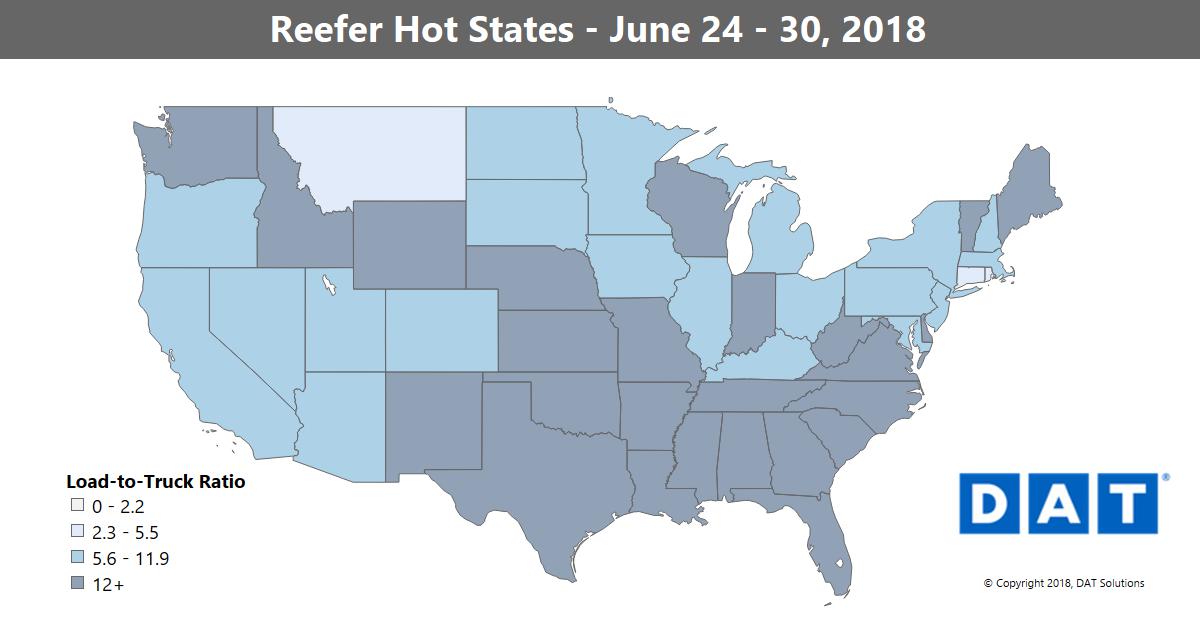

The load-to-truck ratio represents the number of loads posted for every truck posted on DAT load boards. Changes in the ratio typically signal impending changes in freight rates.

FALLING

Rates were down along the border markets of Nogales, AZ, and McAllen, TX. Grand Rapids, MI, also slipped despite an uptick in volumes.

- Grand Rapids to Cleveland has been a volatile lane, and last week it lost 52¢ to $3.41/mile

- Chicago to Philly fell from its spike from a week ago, down 24¢ to $3.41

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.