By Christina Ellington

Even with record sales of grills this summer, the volume of goods in cold storage (meats, dairy products, poultry products, fruits, nuts, and vegetables in public, private, and semi-private refrigerated warehouses) is much lower to start the grilling season. According to the USDA, volumes in cold storage are down 13% year-to-date (YTD) compared to pre-pandemic years or around 1,600 fewer reefer truckloads YTD. This freight category usually peaks in October each year, so it’s unlikely that cold storage volumes will make a material difference to reefer spot rates between now and July 4.

According to the USDA, weekly truckloads of fruit and vegetables are down 18% y/y or just over 31,000 fewer weekly truckloads in the last week of May in the lead-up to Memorial Day. Volumes in the week after typically decrease on average by 6% or 10,000 fewer truckloads before ramping up to the seasonal high around Independence Day. This year the volume decrease in the first week of June was 9%, or the equivalent of 15,000 fewer truckloads compared to last year. The seasonal effect of higher produce volumes in the next four weeks is usually enough to push up spot rates, but it’s not looking like that will occur this year. If June truckload volumes are equivalent to the average of the last six Junes, then produce volumes will have only increased by 1% from March 1 to July 4. The long-term average increase over the period is 12%.

All rates cited below exclude fuel surcharges unless otherwise noted.

One of the highlights of the tight capacity the West Coast experienced in late 2021 was the record-high and sustained reefer rates between Los Angeles and Las Vegas. After being flat since March this year, spot rates on this lane have started to increase as we head into the summer holidays. A year ago, rates on this lane were around $5.61/mile, and in the lead-up to Christmas, they peaked at $6.35/mile. At $5.51/mile this week, they’re up around $0.50/mile on the average of the last three months. On the major produce lane from Fresno to Hunts Point, NY, dominated by team carriers, reefer linehaul rates dropped last week to $2.06/mile or around $1.38/mile lower y/y. Loads out of the cherry capital of the world in Lodi, CA, are following the Fresno trend at $2.30/mile, which is around $1.00/mile lower y/y but trending up this week.

Last week the Los Angeles-based Huy Fong company, makers of Sriracha Hot Chili Sauce, announced they were suspending sales over the summer due to a shortage of chili peppers due to climate changes. According to the USDA, 93% of chilies come from Mexico yearly, and those volumes are down 23% y/y, or the equivalent of 685 fewer truckloads per week. Reefer linehaul rates from the hottest commercial crossing for carriers in Nogales to Los Angeles are trending lower this week and at $2.29/mile are $0.86/mile lower than the previous year. Reefer capacity loosened in Houston last week, with linehaul rates down $0.20/mile to an average outbound rate of $2.35/mile. Loads to Omaha were up slightly to $2.37/mile this week after dropping $0.29/mile since February, while capacity loosened in Omaha following last week’s $0.27/mile decrease in outbound linehaul rates to an average of $2.33/mile. On the high-volume lane north to Minneapolis, at $2.79/mile, reefer spot rates are now $0.35/mile lower y/y.

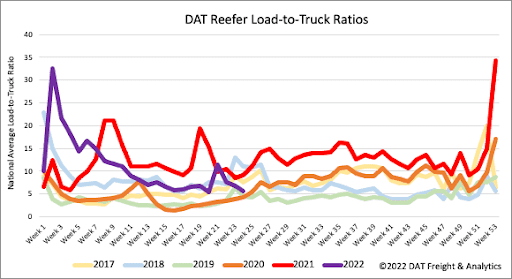

Reefer load post volumes cooled off last week and are almost identical to volumes seen this time in 2017 following last week’s 7% decrease. Produce volumes are still lagging, which is part of why equipment posts are increasing as capacity loosens instead of the opposite occurring in the produce season. Equipment posts increased 12% w/w, resulting in the reefer load-to-truck (LTR) ratio decreasing from 6.77 to 5.63. At these levels, the reefer LTR is very close to the 2019 and 2020 levels.

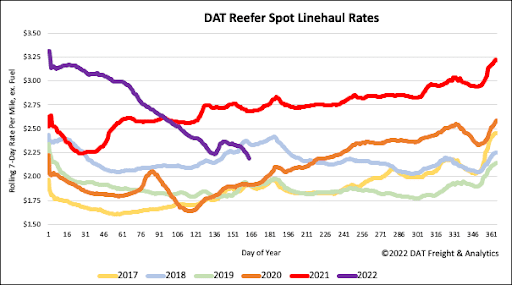

In the first two weeks of June, reefer spot rates typically increase by $0.07/mile on average as produce season approaches its typical peak, but that’s in pre-pandemic years. In the last two weeks, reefer spot rates have dropped by $0.10/mile. Reefer rates dropped the most last week, decreasing by $0.07/mile to a national average of $2.25/mile, which is $0.49/mile lower than the previous year and $0.16/mile lower than where reefer spot rates were in 2018.