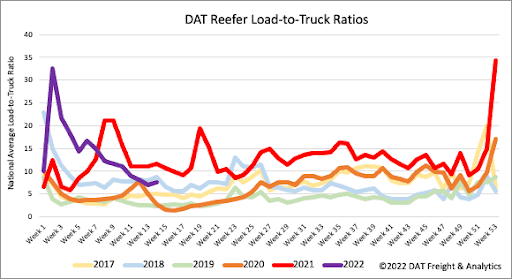

Last year, the USDA was reporting a shortage of trucks in 9/22 produce growing regions and a slight shortage in 10/22 regions – reefer capacity was very tight. This week it’s almost the opposite, with just one region reporting a shortage of trucks in Eastern North Carolina for sweet potatoes and a slight shortage in just two regions (potatoes in Colorado and apples in Michigan). The 2022 produce season is shaping up very differently as demand eases and capacity loosens rapidly.

For the week ending March 26, domestic truckloads of produce are down 32% y/y (equivalent to almost 10,000 fewer weekly truckloads of produce), with imported volumes flat over the last month. Digging a little deeper into the sweet potato truck shortage, reefer spot rates have been flat at $2.47/mile excl. FSC in the last few weeks, but we’re not yet at the peak in outbound load volumes – that occurred in April and May last year. Spot rates are much higher on individual lanes, including Raleigh, NC, to Hunts Point, NY, where reefer rates averaged $4.37/mile excl. FSC last week – that’s around $0.40/mile higher y/y.

As the Florida produce season begins to cool and spot rates dropping for the three prior weeks, outbound spot rates in Lakeland increased by $0.04/mile to $1.74/mile last week. Loads north to Hunts Point, NY, were paying much higher at $2.38/mile excl. FSC while loads to Atlanta dropped to $1.74/mile is $0.42/mile lower y/y. Further north in Jacksonville, short-haul capacity tightened last week with spot rates jumping on average by $0.28/mile to an outbound average of $2.78/mile excl. FSC. Load post volumes increased by 24% w/w as well.

Load post volumes continue to climb in Fresno now up 45% m/m but with plenty of West Coast reefer capacity available, spot rates decreased by $0.03/mile to an average outbound rate of $2.79/mile excl. FSC last week. Loads north to Seattle were flat at $3.34/mile excl. FSC (down $0.05/mile y/y) while loads east to Phoenix were up $0.21/mile to an average of $2.91/mile excl. FSC last week.

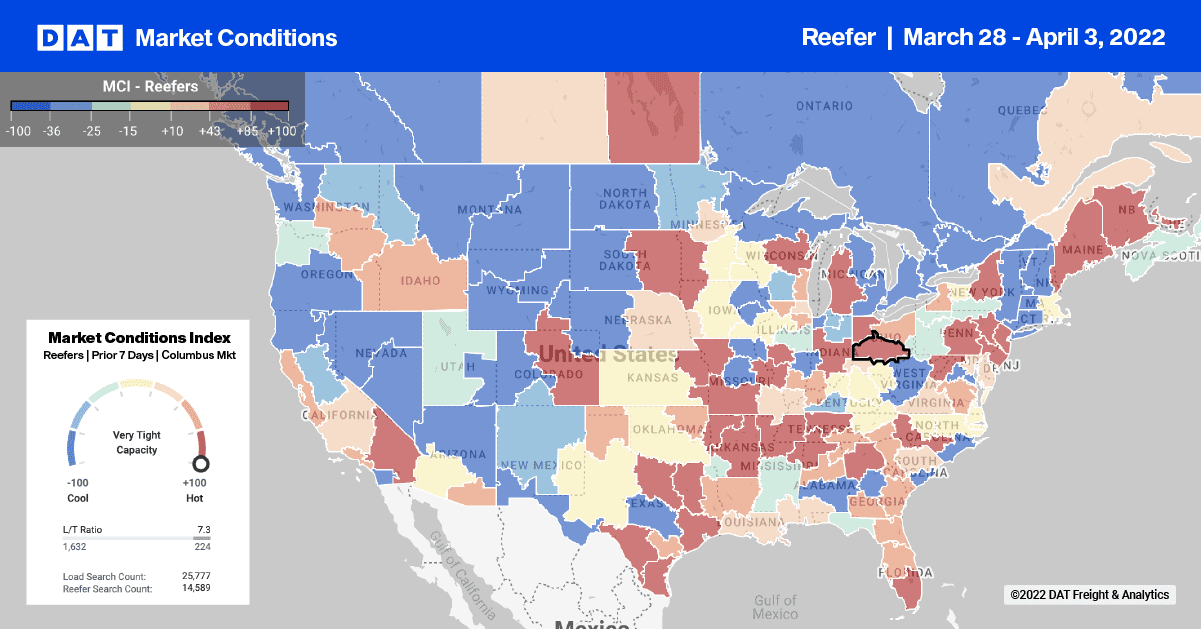

Last week, there was a slight bump in reefer load post volumes, increasing by 5%, although volumes remain down by 28% m/m and 26% y/y as the reefer market cools rapidly ahead of produce season. Fewer carrier equipment posts resulted in the reefer load-to-truck ratio increasing by 10% w/w from 6.93 to 7.63.

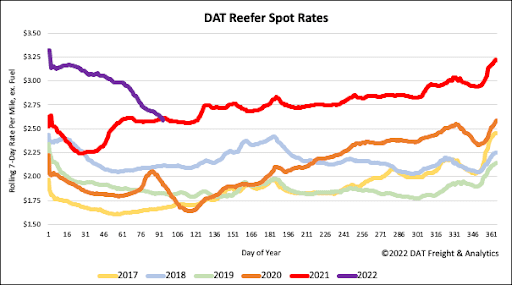

After dropping $0.06/mile the week prior, reefer spot rates dropped by another $0.06/mile last week and are now $0.01/mile lower than the same week in 2021. Reefer spot rates have dropped by $0.53/mile since the start of the year to end last week at a national average of $2.63/mile excl. FSC. Spot rates decreasing in the first quarter are not unusual. In the previous five years, reefer rates dropped by $0.22/mile on average in the first quarter, except for last year when they increased by $0.09 due to the Polar Vortex market disruption. This year’s year-to-date decrease is more than double the average of prior years.