According to Chris Visser, J.D. Power Valuation Services commercial vehicles senior analyst and product manager: “Most segments of the used truck market are performing extremely well, with price appreciation widespread. Fundamentals support continued strength in the short term and possibly longer. We are now more than a full year into the freight market recovery, with no letup in pressure on the horizon.”

Used truck prices have often been regarded as reliable indicators of:

- Overall market health

- Purchase cycle and resale values

- Truckload capacity

The current freight market is being driven by tight supply on the driver and equipment side. But unlike other more recent freight cycles, it’s also being driven by high levels of freight demand.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Used truck volumes at auction have dropped 82% in the last year

The J.D. Power June 2021 report indicated that the volume of used trucks in the three to seven year-old sleeper cab category sold at auction has dropped 82% year-over-year.

Right after the pandemic hit and demand crashed in March and April last year, carrier exits from the industry hit record levels. Just two months later, we saw the highest number of trucks hitting the auction block in the last decade.

In June 2020, the number of trucks at the two largest auction houses nationwide hit 1,054. This surpassed the previous high set in December 2019 by 36%. One year later that number is down to just 192 trucks.

“At this point, auction pricing for late-model sleepers is higher than any time in the six years we’ve been tracking our benchmark group,” says Visser. “And retail pricing is at or above any period in the 12 years following the Great Recession.”

Three-year-old Class 8 trucks went under the hammer for $90,548 at auction. This represents a 95% annual increase, while four year-old trucks went for $71,263 on average — up 121%. The most gains were recorded in the five-year-old category where prices were up 128% to an average of $62,296 in June compared to the same time last year.

“June’s auction results were a study in contrasts, with lower-mileage trucks bringing stratospheric money and higher-mileage, rougher-condition trucks unimpressive due to unfavorable mileage and condition,” says Visser.

What about used truck retail prices?

Ongoing truck production constraints due to labor and part shortages have resulted in many buyers looking to the used truck market to add capacity to their fleets. This is especially true for low-mileage trucks with some engine and powertrain warranty still in place.

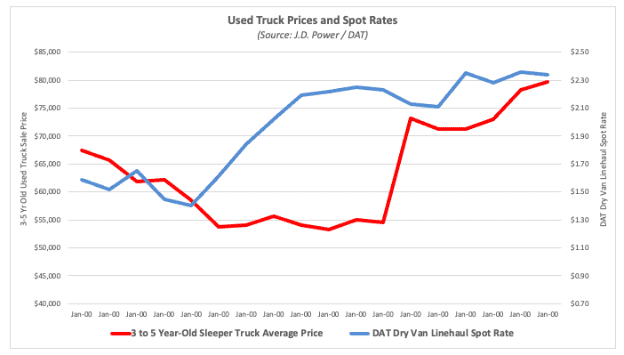

After a full year of recovery in the freight markets, late-model sleeper tractors remain in tight supply and pricing continues to impress. The J.D. Power June 2021 Commercial Truck Guidelines industry report states that late-model truck values were up by 1.9% in June compared to May. And in the first six months of 2021, late-model trucks were 20.9% ahead of the same period of 2020, and 2.6% ahead of the same period of 2019. The average selling price of every sleeper truck sold is the highest since at least 2007, according to the report.

Where did all the trucks come from?

In the last 12-months the industry has added just over 200,000 new trucks to the market since the pandemic took hold at the start of April last year, according to June’s Federal Motor Carrier Safety Administration (FMCSA) Census File.

That represents a 4.4% year-over-year growth in truck capacity with 25% of that growth from owner-operators alone. In fact, fleets ranging in size from one to forty trucks that have a higher exposure to the spot market than most other categories, accounted for 78% of trucks added in the last 12-months. But these numbers may be slightly misleading.

A lot of leased owner-operators switched to the independent category under their own authority. So while the FMCSA has seen more trucks added, it includes both new entrants and owner-operators shifting from lease to independent.

Record-high spot rates have played a huge role in escalating truck prices as new carriers enter the market to take advantage of high profit margins.

In the last year, we saw the addition of new capacity while spot rates continued to hold steady at current levels. There also hasn’t been any sign of the traditional post-July 4 fall in rates.

It’s reasonably safe to assume the industry will continue to add independent contractor capacity and keep used truck prices high and auction inventory levels low while new trucks are delayed at the factory level.