Last week there was a rebound in van freight volumes—up about 8%—as stores move back-to-school merchandise and stock up for the Labor Day holiday weekend. Van rates have been dropping at a steady pace all month, but last week the decline slowed, moving just 1¢ lower, to a national average of $2.15/mile. We’ve now moved from a slight slump to seasonal norms.

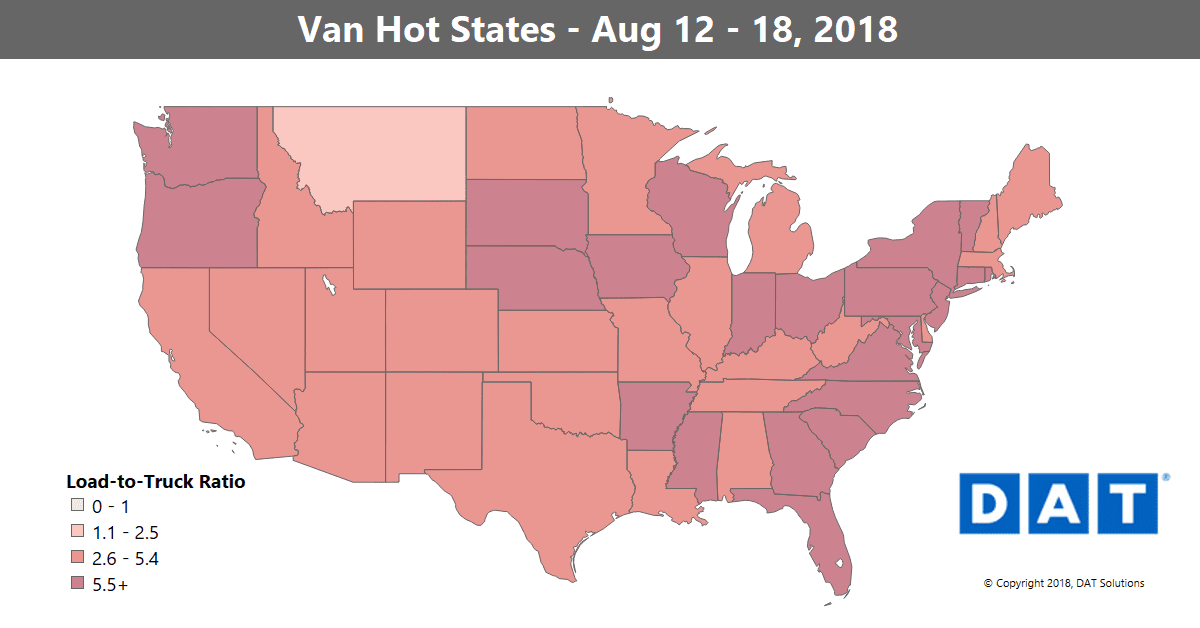

Rates continue to build strength in the Midwest and West, while Texas and the Southeast region have been slipping. On the top 100 van lanes last week, 45 lanes were up, 46 declined, and 9 were neutral.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

RISING RATES

Denver had the largest jump last week, followed by Columbus, Ohio. In the past month, Buffalo and Seattle have been gaining strength. Lanes where rates increased included:

- Columbus to Buffalo jumped 23¢ to $3.86/mile

- Chicago to Allentown, PA rose 15¢ to $3.04/mile

- Denver to Phoenix increased 18¢ to $1.29/mile

- Seattle to Spokane bumped up 15¢ to $3.67/mile

FALLING RATES

On other lanes, rates are high but are easing off a bit. Rates fell on these lanes:

- Seattle to Eugene pulled back 14¢, dropping to $2.96/mile

- Philadelphia to Boston also fell 14¢, to a solid $4.00/mile

- Buffalo to Allentown was down 13¢ to $3.40/mile

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.