Thanksgiving week was short but intense. Thanksgiving occurred later in November this year, so the holiday weekend coincided with end-of-month pressures. Not surprisingly, rates rose sharply on loads that were picked up during the week, to entice carriers and drivers who may have had to spend Thanksgiving on the road. Somewhat surprisingly, the lanes with the biggest rate increases actually gained in both directions. (See details below.)

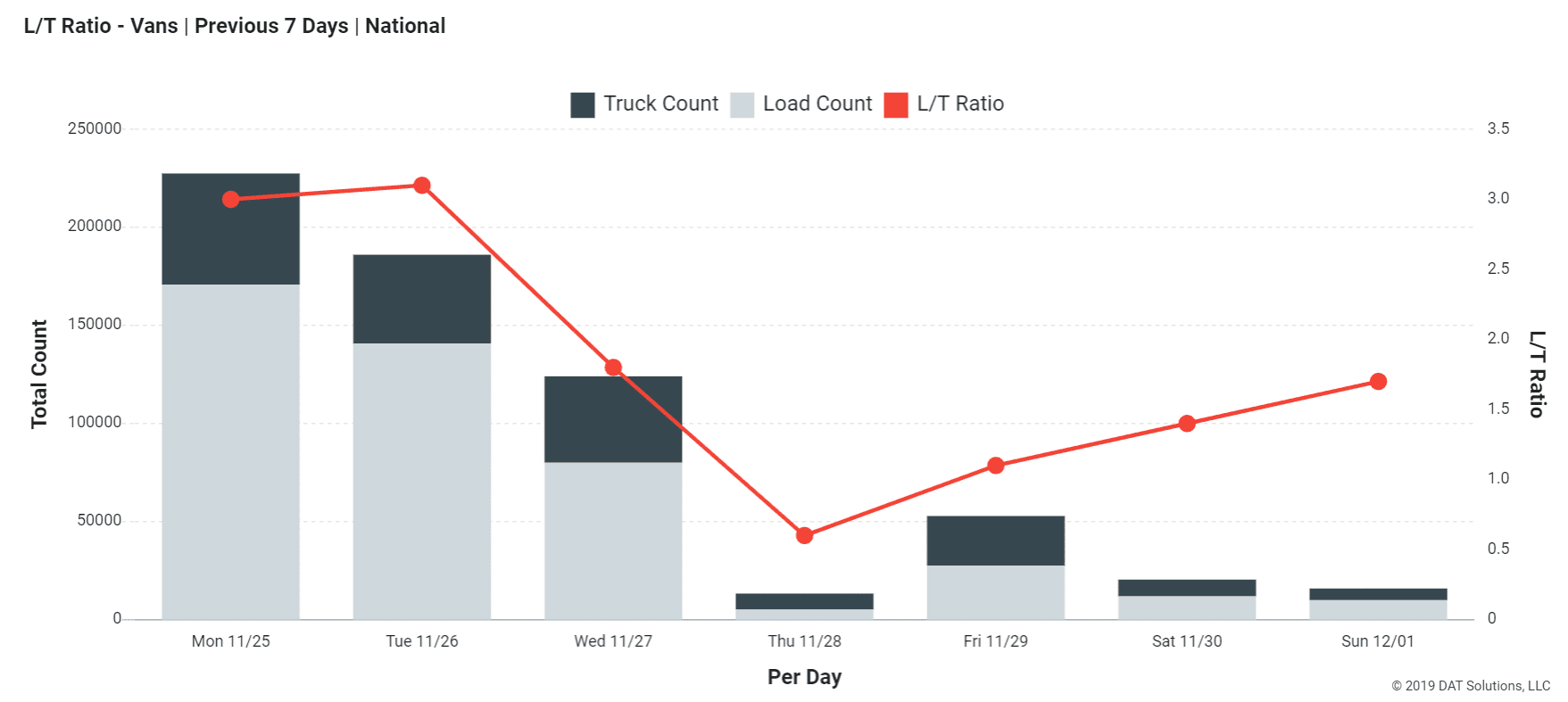

The short work week curtailed the number of loads moved, as load board activity slowed and load-to-truck ratios fell for all equipment types. That’s because plenty of brokers (as well as shippers and receivers) took a four-day weekend, while some carriers posted their trucks, a signal that they were ready to get back to work on Friday. The national average van rate ended November at $1.83 per mile, which was 3¢ higher than October’s average.

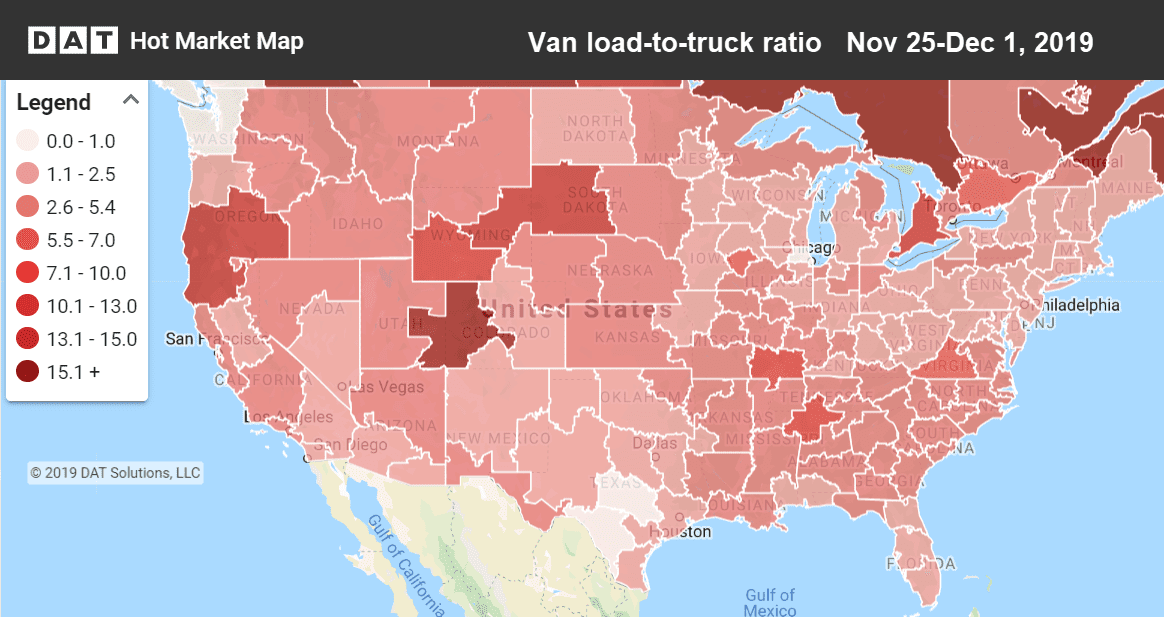

Hot Market Maps show the number of available trucks vs. available loads and are available in the DAT Power load board and DAT RateView.

Load and truck posts were strong to start the week, but dropped off as the Thanksgiving holiday approached. (Graph available in the DAT Power load board and DAT RateView.)

Rising markets and lanes

On the top 100 van lanes, rates increased on 79 lanes last week. Sixteen held steady, while only 5 lanes posted lower prices.

- Portland, OR to Stockton, CA jumped up 30¢ to $1.91/mile (could be Christmas trees) while Stockton to Portland gained 6¢ to $2.53/mi. with decent volumes.

- Denver to Albuquerque, NM was up 16¢ to $2.11/mile. The return trip declined 4¢ to $2.08/mi., with not many loads moved.

- Philadelphia to Columbus, OH added 11¢ to $1.56, and the headhaul from Columbus to Philly rose 9¢ to $2.95. This lane is associated with retail freight moving to warehouses.

- Buffalo to Allentown, PA was up 26¢ to $3.27/mile. This was likely Canadian imports. Even though Canada didn’t have a holiday last week, there was pent-up demand due to resumption of rail service after the previous week. The return trip from Allentown to Buffalo dropped 5¢ to $2.32/mile.

- Charlotte to Memphis gained 11¢ to $1.59, and the return trip added 13¢ to $2.17/mile. This could be retail freight, as Memphis is home to many distribution centers for truckload freight as well as parcel.