The COVID-19 crisis has created an extremely difficult business environment for trucking companies this spring. Not only has it created working conditions that are potentially dangerous for a driver’s health, truckload volumes plunged while stay-at-home orders persisted. That dragged rates down as well.

But after weeks and weeks of declines, freight markets finally appear to have turned a corner.

For the first time since late March, pricing on the top 100 van lanes included more increases than decreases. National load-to-truck ratios for all equipment types are also trending upward, signaling that demand for truckload shipments is returning, as produce season picks up and some states begin to reopen businesses.

Find freight with DAT One, with access to the largest on-demand network for truckload freight.

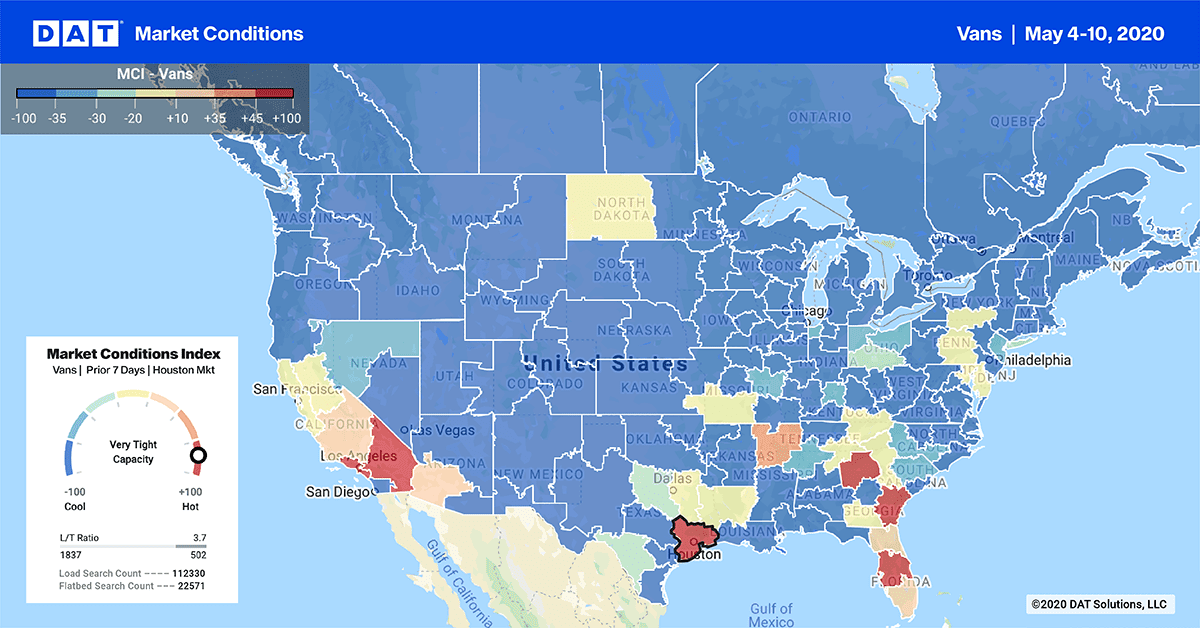

The Market Conditions map in DAT Power and DAT RateView shows key markets finally coming to life, with the Market Conditions Index indicating high demand in the produce regions of California, Texas and the Southeast. Not only does that benefit reefer carriers, but it also lifts van markets since reefer trucks will look for van freight when demand for refrigerated freight lags. With less competition for freight, rates rise.

While the Market Conditions Index shows improvements for carriers in produce regions, it also shows that port markets are gaining traction, even in the Northeast where the map has been a deep blue, signaling low demand for truckload freight.

Obviously, we still have a long way to go, but it’s a step in the right direction toward providing some much-needed relief for carriers.

Notable increases for van rates

Outbound rates improved out of Memphis, which is often a signal of improving retail demand. A couple of examples:

- Memphis to Indianapolis climbed 17 cents to $1.84 per mile

- Memphis to Columbus improved 10 cents to $1.63 while the return trip held steady. Still well below normal levels, but moving upward.

The biggest increase was on the lane from Charlotte to Buffalo, NY, which jumped up to $2.04 per mile, about where it was a month ago.

Los Angeles to Seattle increased 18 cents to an average of $2.18 per mile.

Largest declines for van rates

Chicago to Los Angeles is a lane that competes heavily with railroad, and it lost 13 cents last week at just $1.13 mile.

It was a similar story for Houston to Los Angeles, plus inbound prices are adjusting to the higher outbound demand in L.A. This lane fell 10 cents to $1.21, well below where it was a month ago.