June freight volumes have been rising the past two weeks, ever since International Roadcheck took some capacity off the road during the first week of June. In fact, June freight volumes in the Top 100 van lanes are up 22% compared to June 2018. So why are rates 41¢ per mile lower this year?

There are a number of contributing factors. For one, a record number of truck purchases last year has led to increased capacity. That means that shippers, freight brokers, and 3PLs have an easier time covering these volumes. In addition, the difference between truckload contract rates and spot rates is near a historic high. It’s likely that freight is switching from contract carriers and intermodal back into the spot marketplace.

Another factor is that produce harvests have been muted this year, which has slowed demand for reefer trucks. When reefer freight is soft, that capacity moves to the van market.

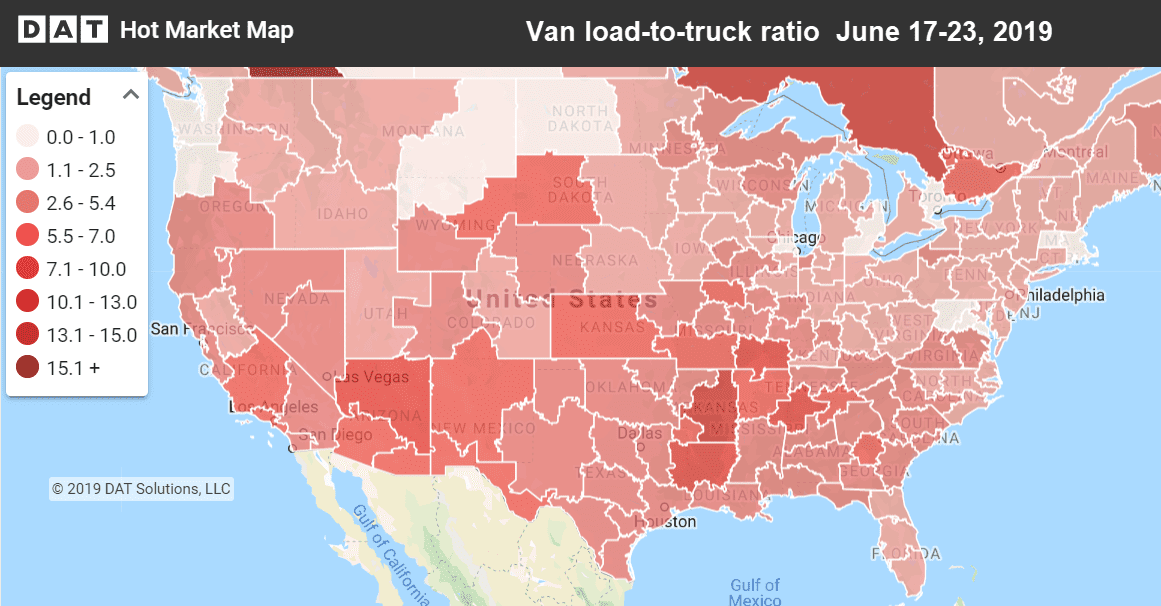

Hot Market Maps in DAT Power and RateView show where trucks are hardest to find. The darker the color, the less competition there is for truckload freight.

Rising Rates

Rates were up out of both Los Angeles and Stockton, CA, last week. It could be that we’re seeing the last gasp of freight movement related to beating higher tariffs, including the scare of tariffs on freight from Mexico.

- Stockton to Seattle increased 16¢ to $2.79/mi.

- Los Angeles to Phoenix added 11¢ to $2.80/mi.

- In the East, Columbus, OH, to Atlanta gained 10¢ to $1.95/mi.

- Atlanta to Miami bumped up 12¢ to $2.65/mi.

Falling Rates

Seattle volumes bounced back but still could not counter the number of inbound trucks. Rates were also lower coming out of Houston, which has seen strong volumes. Weaker rates from Houston to Laredo and Los Angeles are the primary cause.

- Seattle to Salt Lake City dropped 23¢ to $1.60/mi.

- Chicago to Buffalo gave back 34¢ to $2.25/mi. after rising 41¢ the previous week

- Chicago to Allentown, PA, gave back 10¢ to $2.45/mi. after jumping 31¢ the previous week

- Atlanta to Charlotte was down 10¢ to $2.59/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.