Update (Feb. 24) — As the coronavirus spreads to countries outside China, supply chain managers in the U.S. expect ripple effects to reach our shores in the coming weeks and months.

Coronavirus is in the news, and there have been a lot of dire predictions about a worldwide pandemic. The new variant of this virus spread rapidly in China, and it must be pretty scary for people in and near the affected regions. On the business side, supply chain pros worry because China’s economy is intertwined with ours and with the rest of the world, and the impact could cause gaps in worldwide availability of many raw materials, intermediate goods, and finished products.

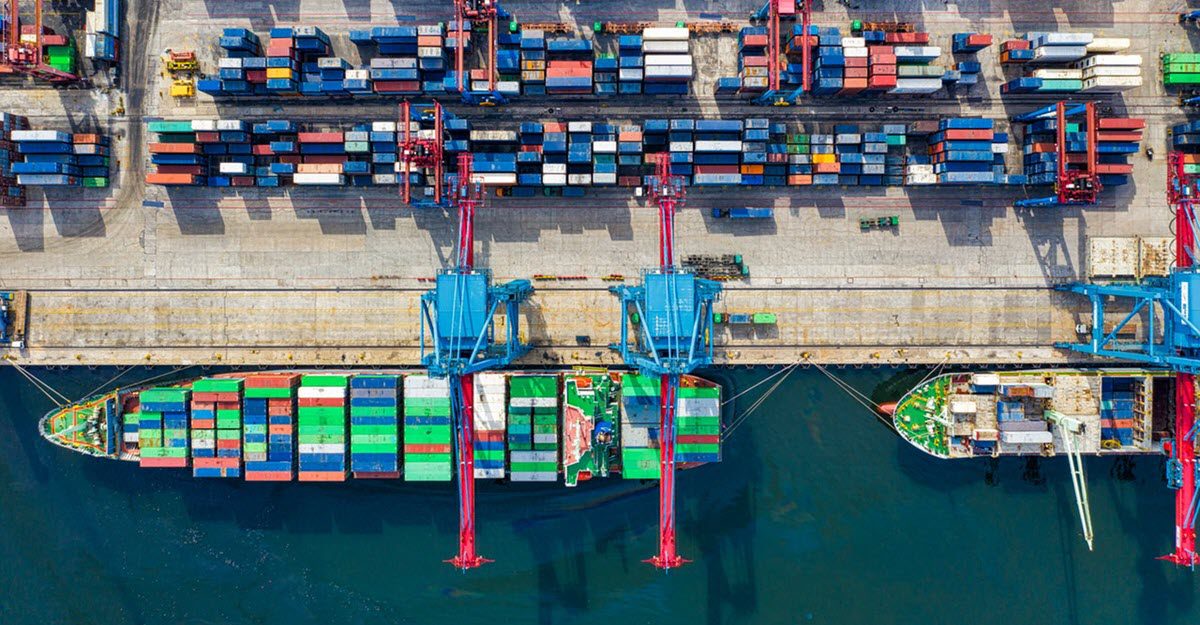

So far, there has not been much of a direct impact on domestic freight volumes in the U.S., but it could just be too soon to tell. It’s the slow season over here, and we would not ordinarily be getting much in the way of imports from China anyway. For one thing, most Chinese factories and ports were closed for the Chinese New Year at the end of January, and after they re-open it typically takes a couple of weeks for ships to reach our shores.

New Year closures have been extended in some cases, though, in an attempt to contain the spread of the virus. If the closures persist into March, that could lead to significant declines in U.S. import traffic and port activity generally, especially on our West Coast.

The virus originated in Wuhan, an important Yangtze River port that manufactures goods and also transfers them from the interior of the country to major seaports including Shanghai. Wuhan, the surrounding Hubei Province, and other large cities are under full or partial quarantine, in an effort to contain the virus.

Trucking won’t be affected right away

While sea freight and air freight may already be feeling the impact of coronavirus-related work stoppages and quarantines, domestic trucking transportation in the U.S. will be the last to succumb. Plus, imports comprise only a small percentage of trucking freight in the U.S., but a high percentage of the cargo that travels by sea and air.

Going forward, there are likely to be more ripple effects in the supply chain due to changes in the prices and availability of oil, copper, and other commodities, as well as manufactured goods and components that China will not be able to provide in the expected quantities. Some manufacturing sectors will suffer if key Chinese factories and ports remain closed for many more weeks.

To borrow from medical terminology, there are still a few vectors the virus can take that would make a big difference in U.S. freight volumes and rates over the next few months. If you or your customers are moving freight in certain industries, you’ll feel the impact even sooner.

U.S. supply chains depend on Chinese imports

Manufacturing is an international business these days, and Chinese factories make or assemble component parts and finished goods for export.

Technology products are especially dependent on Chinese manufacturing, but the volume of tech gadgets won’t make a big difference in trucking for a while. You might have to wait longer for your new cell phone, but that won’t cause too much disruption in freight. The stock market could take a hit, but that impact has been muted so far.

Auto parts from China are vital to the U.S. motor vehicle supply chain, and if those parts and sub-assemblies become unavailable that would threaten freight volumes here. The same goes for clothing and other retail merchandise. When tariffs came into effect last year, many U.S. manufacturers and distributors sought other suppliers outside China, but many more paid the tariffs and/or re-negotiated pricing with their Chinese trade partners to mitigate the financial damage.

Medicines and medical equipment are increasingly made in China, including everything from disposable face masks, gloves, and syringes, to complex hospital equipment, to chemotherapy drugs and other medications. When these items are less readily available in the U.S. it doesn’t affect trucking freight directly, but it can be harder for doctors and hospitals to treat patients and prevent infections.

Global oil market has indirect impact on U.S. freight

Oil and gas exploration could be affected by coronavirus, but more indirectly. China is the world’s biggest oil importer by far, and investors feared that coronoavirus would stall the Chinese economy and cause a sharp decline in their oil and gas imports. Not coincidentally, oil prices fell from above $63 (WTI) at the beginning of January to just under $50 last week, but prices may already be starting to recover. As a net energy exporter, the U.S. is shielded to some extent from oil price wars, but even American oil companies tend to reduce production when prices go below a certain threshold.

When oil prices dropped below $30 in 2015, it wasn’t worth the cost to drill in some locations. That led to a slowdown in oil and gas production in the U.S., which hurt domestic freight volumes and rates. The same scenario seems unlikely to recur in the U.S. in 2020, for a number of reasons.

- It’s temporary. Energy companies and investors appear to believe that the coronavirus outbreak is a temporary setback, as seen by the stock market’s quick recovery. (However, stock prices may be more volatile for companies whose fortunes are tied closely to Chinese industrial output.)

- Drilling costs dropped. The marginal cost of drilling is much lower now than it was just a few years ago.

- Pipeline construction will start soon. There are a number of pipeline projects that are all funded and ready to break ground this spring, and those will generate new demand for rail, rail intermodal, and flatbed services.