On the southern border, produce volumes last week were down slightly year-over-year, recording just 1% fewer loads compared to the same week in 2020, according to the USDA.

McAllen, TX, and Nogales, AZ, handled the majority of volume, followed by Laredo, TX. Sixty percent of the truckload produce volume that arrived from Mexico last week came from peppers (19%), cucumbers (13%), avocados (11%), limes (11%) and squash (7%).

In the McAllen market, the number one commodity last week with the most truckloads was limes (20%) followed by avocados (15%) and tomatoes (11%). In Nogales, the focus was more on meeting U.S. demand for winter vegetables, with bell peppers (17%) topping the list for most truckloads followed by cucumbers (16%) and tomatoes (16%).

Find reefer loads and trucks on the largest on-demand freight exchange in North America.

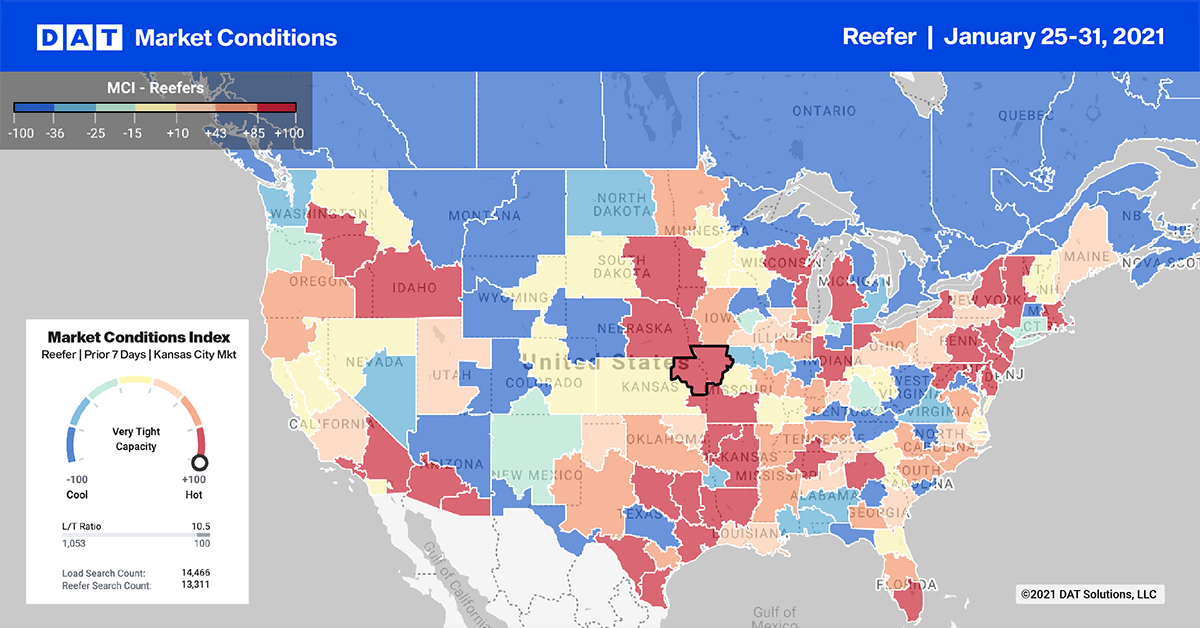

Last week’s invasion of freezing Arctic air delivered the first subzero temperatures to cities across the Plains and Midwest where, temperatures have consistently been well above average in recent months. The resulting impact on the reefer market has been higher demand for temperature-controlled trailers to keep freight from freezing – freight that would typically be hauled in a dry van in warmer temperatures.

Reefer load posts increased in all top 10 markets. Similar to dry van, reefer rates dropped $0.06/mile on average.

Elizabeth, NJ, retained the number one spot, with a 4% increase in volume, but like all top 10 markets, average spot rates dropped. In contrast, 3-day average rates on the 785-mile Elizabeth to Chicago lane are much higher at $2.55/mile and as high as $3.52/mile for some loads.

Reefer volumes were up 54% w/w in Los Angeles and Ontario, CA, but capacity continued to loosen, with spot rates also dropping by $0.07/mile.

Ahead of Super Bowl celebrations, outbound volumes in McAllen (#10) increased by 17% w/w and by 45% w/w in Tucson, AZ – capacity was loose in both markets with spot rates dropping by $0.10/mile and $0.13/mile respectively. In McAllen, outbound reefer rates averaged $2.35/mile to all markets but slightly higher at $2.28/mile to Chicago and $2.99/mile for loads to New York City.

Spot rates

Spot rates in the reefer sector plateaued, staying around $2.26/mile, which is still $0.44/mile higher than the same week in 2020. Colder arctic air will have been a factor in higher reefer volumes and a reason why the recent slide in reefer rates has been halted for the time being.

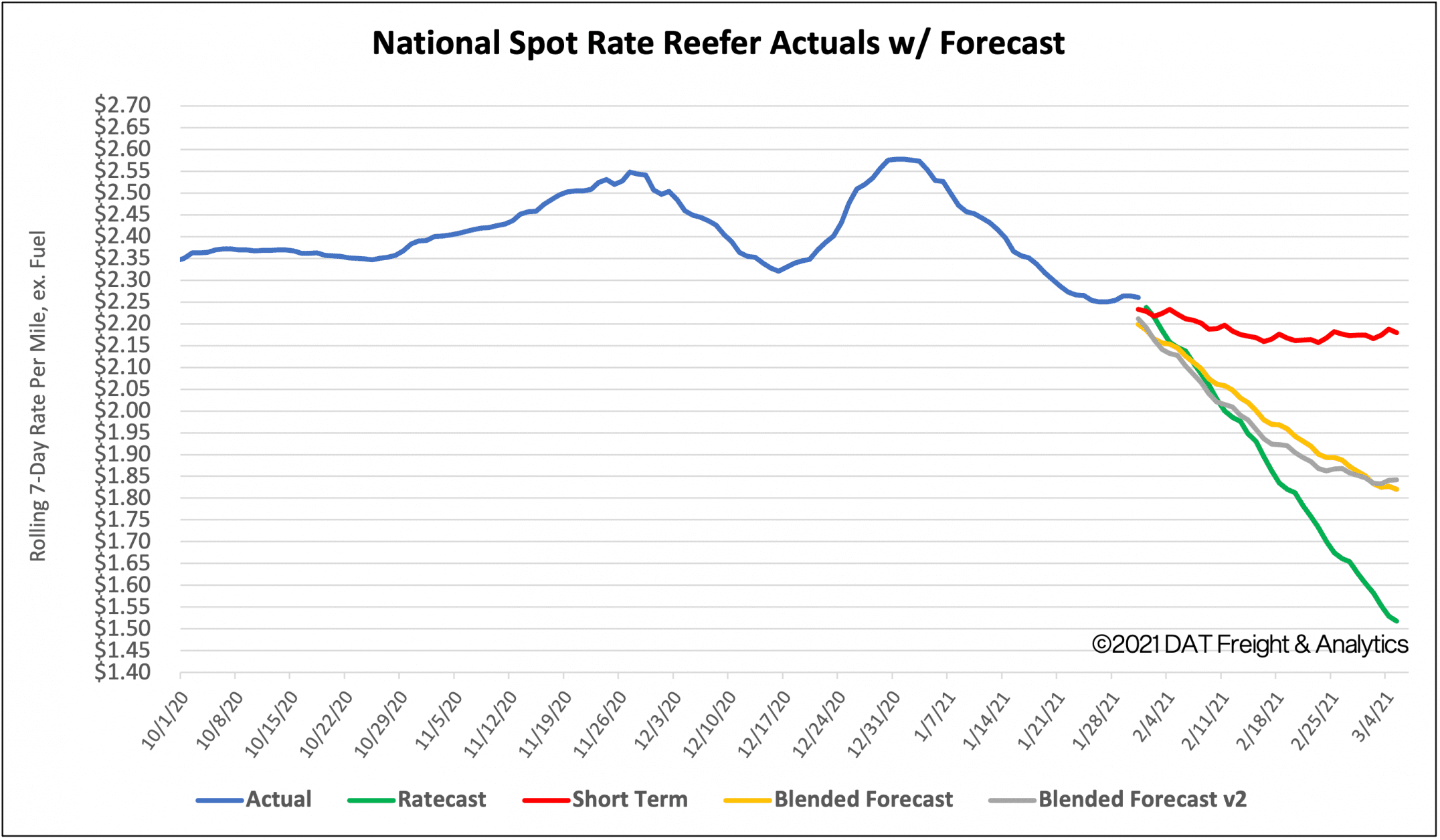

How to interpret the rate forecast

1. Ratecast Prediction: DAT’s core forecasting model estimate showing continued optimism and rate growth.

2. Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

3. Blended Scenario: More heavily weighted towards the longer-term models.

4. Blended Scenario v2: More heavily weighted towards the shorter-term models.

> Learn more about Ratecast predictions available in RateView.