Rates rose for all three equipment types in major markets last week. Most of the pressure is normal for the season, and it was intensified by the ongoing movement of fresh produce, retail food and other consumer products to shelves for Memorial Day.

VAN

California rates lagged for a long time, until truckers felt like guests at the mystical hotel in the Eagles song: “You can check out any time you like but you can never leave.” But outbound rates from the Golden State have been trending up in May, and the past week they increased even farther. Inbound rates to Philadelphia yielded some brotherly love for the trucker, while Philly outbound rates seemed to rebound this week after a long, cool month.

What’s hot

– Rates from Stockton rose 3.6% in the past week, and Los Angeles rates are up 3.3%, to $2.18, including fuel. The L.A.market is on an upward trend, with a 6.8% cumulative increase in May to-date.

– Other markets with rising rates: Columbus, up 3.6% and Charlotte, up 3.2%.

– Inbound lanes to Philadelphia are hot. From Charlotte to Philly, up $0.44 (18%) to $2.92/mile, Columbus to Philly up $0.25 (9.7%) to $2.87, and the lane rate from Chicago rose $0.19 (8.2%) to $2.51.

– Oddly, outbound rates from Philly recovered 2.0% last week, due partly to a $0.23 (7.5%) increase on the route from Philly to Boston, the week’s highest-priced major lane at $3.28.

What’s not

– Memphis rates slipped 1.1% after a long hot streak. Philadelphia was down 2.8% for the month, despite last week’s surge, and Chicago rates are down 0.6% since May 1.

– In the West, the lane from Denver to Dallas slid $0.35 (23%) to $1.20 per mile, and Salt Lake City to Stockton dropped $0.16 (11%) to $1.26.

– Worst lanes were Seattle to L.A., at $1.01 per mile and Philly to Chicago, the perennial (least) favorite, at the same low rate.

REEFER

Reefer rates have been rising since early April. The most recent week posted a 3.3% gain in major markets, the biggest so far. Rate pressure is most intense in the Southeast and Southwest, where produce harvests are driving volume and price above last year’s same-month average. Memorial Day also boosted refrigerated freight volume, as stores stocked up on fresh food for seasonal barbecues and picnics.

What’s hot

– Florida markets are hot, with a 1.6% surge out of Miami to $2.92. Lakeland rates rose 5.9% to $2.50, including fuel. The lane from Lakeland to Atlanta rose $0.54 (28%) to $2.49.

– Out West, Phoenix saw a 14% rate increase, to $2.53. Rates from Phoenix to Elizabeth NJ soared $0.46 (20%) to $2.71, and the lane to Salt Lake City was up $0.29 (11%) to $2.99.

– Fresno had the biggest volume increase, with rates to Seattle up $0.30 (11%) to $3.01, and the lane from nearby Sacramento to Portland OR gained $0.43 (15%) to $3.26, among the highest in the country.

What’s not

– Reefer rates cooled from Atlanta, down 3.4% and Salt Lake City, down 3.3%. Philadelphia, not a major reefer market, lost the most with a 9.3% decline.

– Atlanta to Miami lost $0.22 (9.1%) to $2.21 per mile, balancing strong rates and volume from South Florida. Atlanta to L.A. is one of the lowest-paying lanes. Atlanta to Dallas/Ft Worth and reloading to AZ/CA might make more sense.

– McAllen in South Texas was up slightly, but key individual lane rates sagged. Rates to Dallas slipped $0.29 (11%) to $2.44, and the lane to Columbus dropped $0.22 (10%) to $1.95.

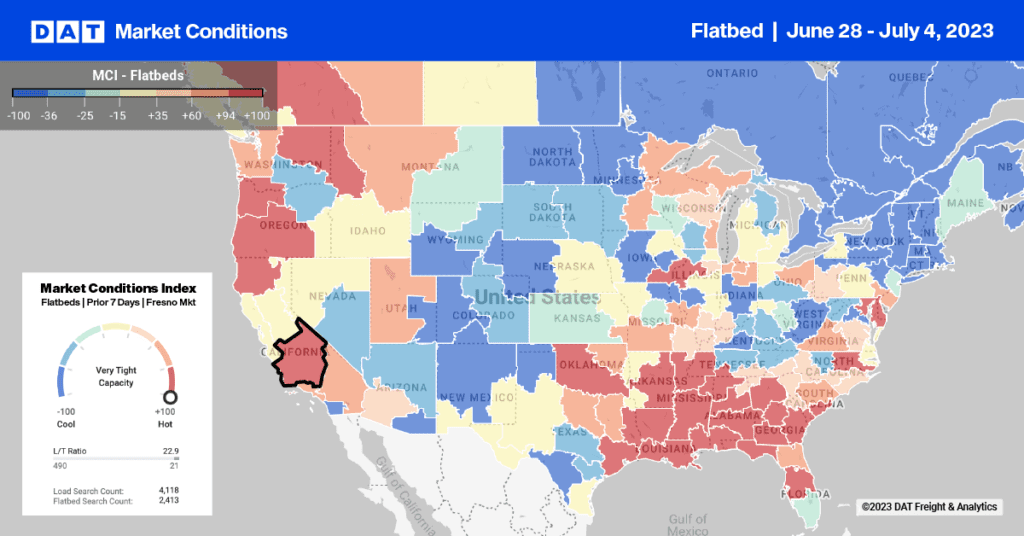

FLATBED

Flatbed rates surged 1.4% for the week, with scarce capacity in the Southeast, including Florida. California also includes several challenging markets.

What’s hot

– Memphis still leads in the Southeast, at an average rate of $2.89, although rates dipped recently. Not far behind: Savannah, with a 6.6% gain this month to $2.60; Atlanta at $2.55; Raleigh at $2.49.

– Tampa is the most improved flatbed market with a 17.5% increase in the past month, to $1.98, Los Angeles rates are up 16.4% to an average of $2.55.

– Rates from L.A. to El Paso surged 24% to $2.55, edging out Cleveland to Grand Rapids.

What’s not

– Reno is the weakest flatbed market, at $1.79 per mile.

– The lane from Ft. Worth to Mobile, at $1.58 per mile, had a dubious distinction as the lowest flatbed rate between two major markets.