July ended and August began, so you might have expected a quiet week. Nope. Load posts edged down on DAT load boards, but national average rates rose 3¢ per mile for vans and flatbeds, while reefers added 4¢.

Van Load Counts Stay Near All-Time High

There’s a lot of freight out there for vans right now, and August had a stronger start than any month in more than a year and a half. National average rates recovered 3¢ per mile last week, due to a boom in freight heading into population centers in the Northeast. Those lanes are associated with retail, and the cargo may include last-minute merchandise for the back-to-school season. That’s not just notebooks and pencils, but also clothing, shoes, non-perishable foods, and anything that will fit into a backpack or lunch bag when school starts up.

HOT MARKETS – Three markets had rate increases last week for outbound vans, and all three are known for retail distribution centers. Rates rose the most in Buffalo, driving the outbound average close to $2 bucks per mile ($1.98, to be precise.) Rates also got a boost on eastbound lanes out of Chicago and Columbus, both averaging above $2.10 per mile now, due to a richer mix of load and lane choices. For load volume, Los Angeles moved up to number 1, replacing Atlanta, which now occupies the number-2 slot, with Dallas hanging on in third position. You can find a van load pretty readily in all three markets, but average outbound rates there were mostly unchanged last week.

NOT SO HOT – The Denver market is always a tough place to find a load, and outbound rates dropped even further there last week. The Mile-High City may be the origin of this week’s Worst Lane in America: Denver to L.A., down 7¢ to 94¢ per mile. Ugh. If you really, really have to go to Denver, you’ll want to get top dollar on the way in.

Flatbed Rates and Volumes Surprise in the Southeast

Flatbed rates usually peak in the spring, but this year is different. Rates held steady in July and now they’re starting to rise again in August. Then 18% more flatbed loads moved last week than the week before, which is a surprise for this time of year. Another surprise was the relative strength of flatbed rates in the Southeast, this late in the summer. More freight was also moving out of the Midwest, and rates rose in a couple of Western regional hubs last week, as well.

HOT MARKETS – Atlanta and Memphis had a surprisingly good week, with outbound rates trending up in both markets. Rates out of the Midwest were expected to rise, and they did, in Cleveland and also in Rock Island, IL. Out West, rates and volumes moved up and out of Reno and Phoenix. Of course, the biggest flatbed market by far is Houston, which hit a plateau in July. There’s not much change now, but outbound volume and rates have held up well over the past six weeks.

NOT SO HOT – Freight volume was up, but rates were down, in three East Coast freight markets: Harrisburg, Tampa, and Roanoke.

TriHaul Takes Advantage of Rising Eastbound Rates

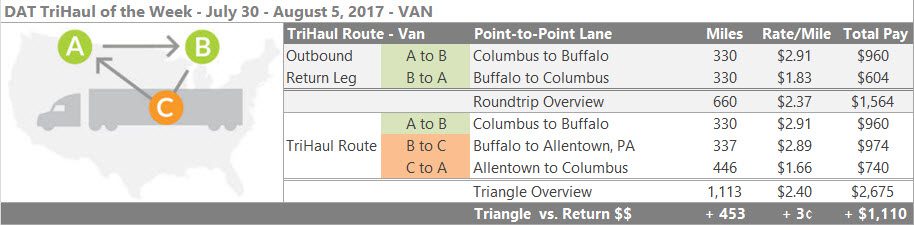

Rates are trending up on lanes that connect the Midwest to the Northeast, and this creates TriHaul opportunities when you take more than one load in that eastward direction. One example is the lane from Columbus to Buffalo. The average eastbound rate is up to $2.91 per mile – it even hit $3.00 for a few days there – and it’s been trending up for weeks. The rate for the return trip from Buffalo to Columbus is close to the national average, at $1.83 per mile.

Instead of taking a load directly back to Columbus, find a second load from Buffalo to Allentown, PA, which was paying $2.89 per mile last week. The rate is still not great on the return trip from Allentown to Columbus at only $1.66 per mile, but you’ll have another 453 loaded miles and over $1,000 in additional revenue, at an average rate of $2.40 per loaded mile for the whole trip. If it works with your schedule and Hours of Service, that could be a good way to round out your loaded miles for the week.

Find loads, trucks and lane-by-lane rate information on DAT load boards, including rates from DAT RateView.