The 2023 produce season starts in the Southeast but is driven by California regarding the market-wide lift truckload volume and spot rates. The multi-year drought in California suppressed the 2022 produce season; this year, it’s impacted by extensive flooding in January and March. The area worst affected by the flooding was the Salinas Valley, where early planting and harvesting periods were delayed.

According to Grower-Shipper Association of Central California President Christopher Valadez, “The March storm flooded not only those same lands again (as the January storms) but also affected more and additional acreage. In March, many farmers had crops planted, unlike in January. Whether you had crops planted or didn’t have crops planted, you have either flooded again or flooded anew. It extended the clock and lengthened the delay to when you can get in that field again.”

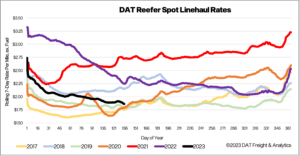

Early signs point to growers starting to ship meaningful volumes, and while they’re still a long way behind last year, there is an expectation volume will be just as good as last year by the time we get to Independence Day. Currently, truckload volumes out of California are down around 20% compared to 2022. Still, for the first time this year, the USDA reported a slight capacity shortage in the six produce-growing regions in the state. For truckload carriers hauling fruit and vegetables, national spot rates were currently averaging $3.54/mile for the week ending May 9th, up $0.06/mile w/w but $0.90/mile lower than in 2022, according to the USDA.

May is National Strawberry Month in California, where shipping is in its peak volume window, forecasted to last through mid-May. Giant Berry Farms noted that their Watsonville and Salinas growing areas are seeing exponential growth despite initial weather challenges, with estimates projecting substantial harvest volume increases in the next five weeks.

Find loads and trucks on DAT One, North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges unless otherwise noted.

Behind Atlanta, Florida reefer markets occupied two of the top three spots last week, boosted by solid volumes ahead of Mother’s Day and watermelon season. Outbound capacity tightened for the fourth week – rates jumped by $0.23/mile to $2.27/mile in Miami, while in nearby Lakeland, rates were up $0.10/mile to $2.11/mile. State-level rates in Florida at $2.28/mile are around $0.10/mile higher than in 2019.

On the West Coast, outbound reefer capacity continues to tighten in Fresno, where rates increased by $0.10/mile to $1.91/mile for outbound loads. Ontario outbound spot rates are averaging $2.09/mile, up $0.17/mile in the last month, with Los Angeles reefer rates following a similar trend at $2.06/mile. In San Francisco, which includes the Salinas Valley produce market, spot rates increased by $0.06/mile to $1.88/mile last week. California reefer rates are currently averaging $2.18/mile, identical to 2019.

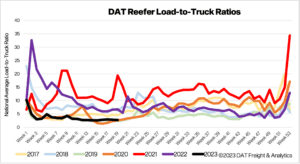

After being flat the previous week, reefer spot market volumes decreased following last week’s 5% decline. Volumes are just over half what they were a year ago and 19% below the Week 19 long-term average. Equipment posts were 3% lower last week, resulting in the reefer load-to-truck (LTR) decreasing from 2.81 to 2.73.

Following the prior week’s penny-per-mile increase, reefer spot rates increased slightly last week to just over $1.91/mile. Reefer spot rates are $0.07/mile higher than in 2019 and $0.48/mile lower than the previous year.