Early in produce season, we’re seeing reports of truck shortages from the USDA.

Last week there were shortages reported for loads of potatoes from the Red River Valley in Minnesota, San Luis Valley in Colorado, Upper Valley and Twin Falls-Burley District in Idaho, and potatoes and onions from the Columbia Basin in Washington. In Michigan, trucks were in high demand for loads of apples while a shortage of trucks was reported for sweet potatoes in Eastern North Carolina.

Total truckload volumes for domestic produce were down 38% year over year as of last week, while imported produce volumes continue to climb — now up 12% y/y. Truckload volumes are still down by just over 13,000 loads according to the USDA, although expectations are for a much strong second half in 2021.

According to Part 1 of the Foodservice Recovery produced by the Produce Marketing Association, “It will start to shift faster forward when the lights go green. It’s not a question of if, it’s when … and looking at where. It also depends on what food looks like. For instance, meal kits in more channels can have a huge boom. We are looking at catering, conventions and how food is served. Restaurateurs (not convention and events) and schools that have been closed for long periods of time will overreact with demand to fill pipelines to get back in business.”

Find loads and trucks on the largest load board network in North America.

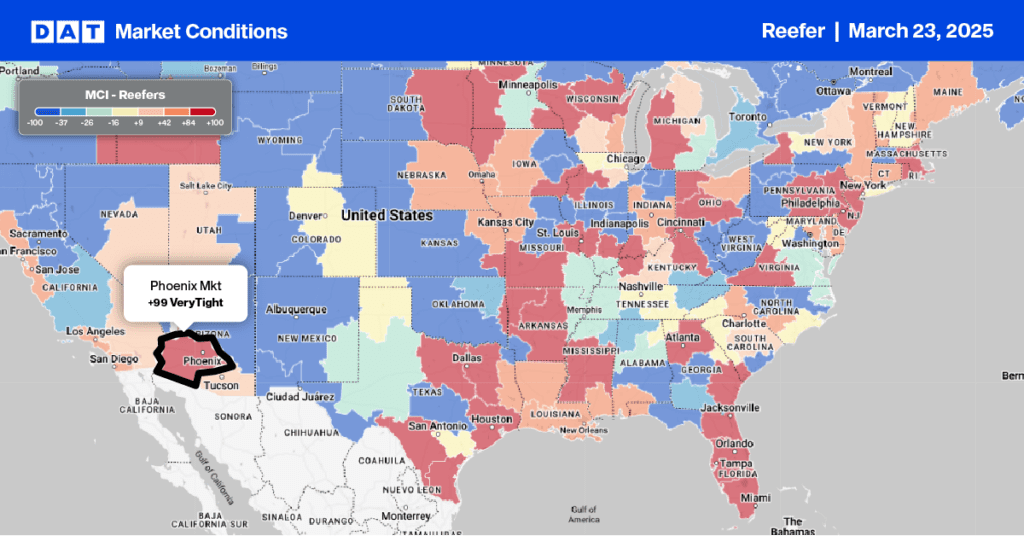

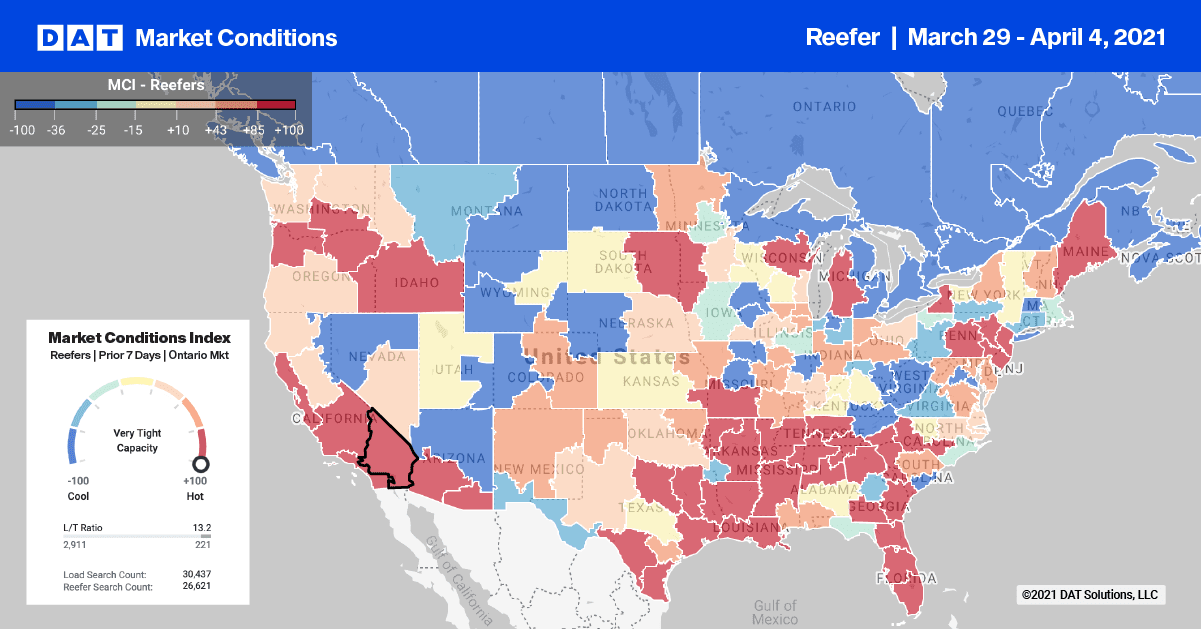

Load posts in the top 10 reefer markets stayed flat last week. As reported in recent weeks, reefer capacity is beginning to tighten in produce markets as it usually does from now through Independence Day.

Markets including Miami; McAllen, TX; Ontario, CA; Philadelphia and Houston, all reported higher spot rates last week. Capacity was particularly tight in southern Florida in both the Miami and Lakeland markets.

In Miami, loads to New York City jumped by $0.46/mile from the March average to $2.72/mile, excluding fuel surcharges. Loads to Baltimore hit $2.85/mile after climbing $0.47/mile since March. Farther north in Lakeland, loads to Charlotte are up $0.59/mile from the March average to an average of $2.76/mile.

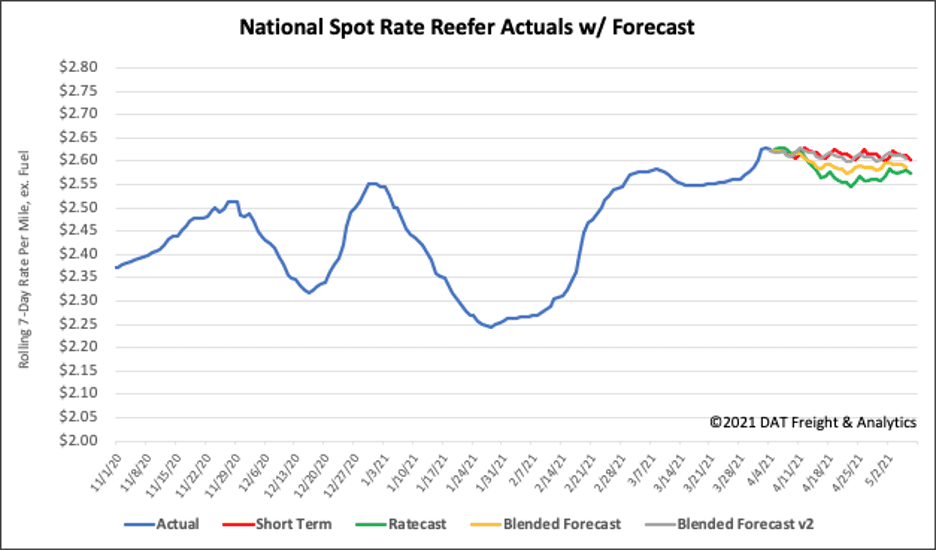

Spot rates forecasts

Capacity remains tight in the temperature-controlled sector as spot rates increased again last week, moving up $0.03/mile to $2.66/mile, excluding fuel. Compared to the same week in 2020, reefer spot rates are now $0.76/mile higher and remain at record high levels.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.