U.S. imports of Mexican mangoes are starting the 2021 season with higher volumes predicted than in recent years. The National Mango Board of Orlando, FL is expecting significantly higher volumes until mid-June, compared to the previous year.

The board expects about 12% more of the tropical fruit than the previous season, with an estimated volume of about 42 million boxes or the equivalent of 31,500 truckloads. About 64% of mangoes come from Mexico, 15% from Peru and 9% from Ecuador, with most of the mango import volume focused around two commercial zone crossings on the U.S.-Mexico border – Pharr, TX, (65%) and Nogales, AZ, (34%).

Even though local growers in the Rio Grande Valley in the McAllen market have been hit hard by last week’s freezing cold air, damaging citrus and leafy green crops, carriers should keep an eye on mango imports. In 2020, serious volumes began shipping mid-April, concluding late-August; 82% of Mexico’s mango volume is shipped during this period or the equivalent of 16,200 truckloads.

Find reefer loads and trucks on North America’s largest on-demand freight marketplace.

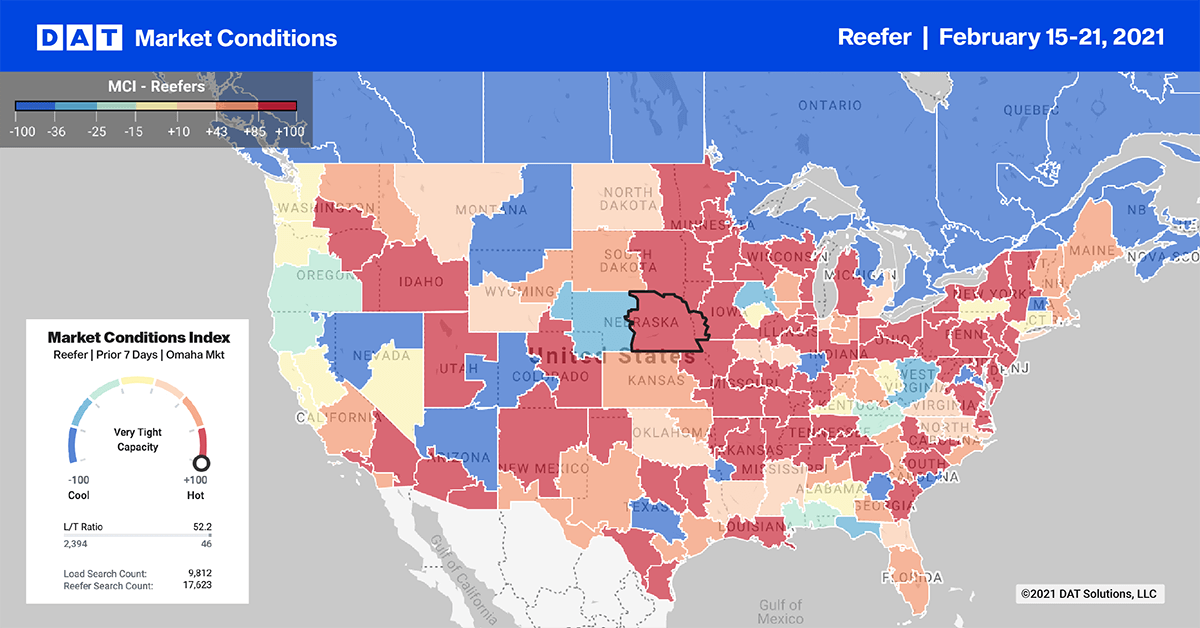

In the top 10 markets, reefer load posts on the DAT One load board network increased by 27% week over week. Capacity was very tight, pushing up rates by $0.20/mile on average. Elizabeth, NJ, held onto the number one spot following an 18% w/w increase in volume and $0.30/mile rate increase to an overall average of $2.48/mile, excluding fuel, for all outbound loads.

Volumes in Atlanta were up 20% w/w with rates increasing by $0.16/mile to $2.42/mile. Available capacity in Chicago and Joliet also tightened, as rates moved up $0.12/mile to $3.12/mile in Chicago and by $0.05/mile to $3.13/mile in Joliet.

Outbound reefer rates surged in McAllen, TX, as shippers moved as much volume as they could before the arctic air destroyed citrus and leafy green crops. Volumes were up 74% w/w, pushing rates up by $0.39/mile to $2.77/mile. In the hard-hit Dallas market, volumes were down 21% w/w but rates were up $0.14/mile to $2.29/mile. In nearby Fort Worth, load posts were down 29% w/w and rates were up $0.06/mile to $2.22/mile.

Spot rates in the reefer sector reacted much the same as the dry van sector, increasing by 9% w/w or $0.22/mile to $2.54/mile excluding fuel. Reefer spot rates are now 29% higher or $0.73/mile higher than the same week in 2020.