Refrigerated freight was met with tight capacity last week, with the annual Roadcheck inspection blitz taking many trucks off the road. That, combined with higher demand out of California, led to some big spikes in reefer rates. The national load-to-truck ratio for the week was the highest it’s been in three years, and it may set another record before the end of this month.

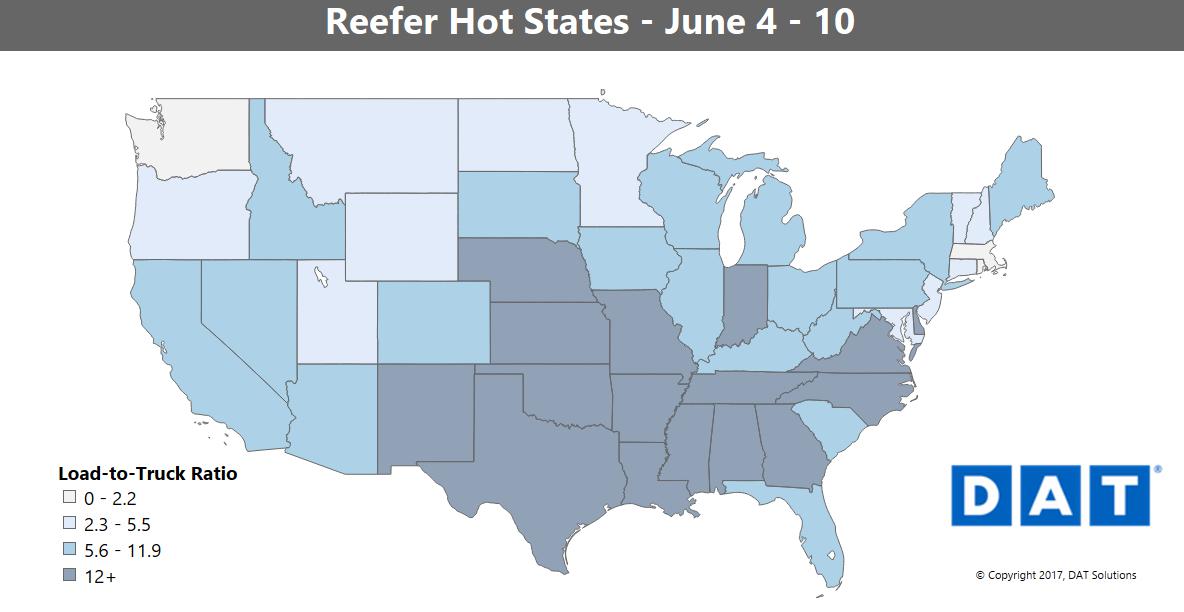

Load-to-truck ratios are highest for reefers in the darker blue areas on the Hot States Map above.

There was a big surge in reefer freight out of Elizabeth, NJ, though rates haven’t responded yet. We did get the expected bump in rates out of Fresno though, and California produce shipments are expected to remain strong at least until the 4th of July.

All rates below include fuel surcharges and are based on real transactions between carriers and brokers.

RISING

A few lanes out of California crossed the $3 mark:

- The biggest jump in price was on the lane from Fresno to Denver, which surged 61¢ to $3.14/mile

- L.A. to Portland, OR was up 45¢ to $3.33/mile

- Sacramento to Portland added 50¢ to 3.21/mile

- Sacramento to Salt Lake City rose 27¢ to an average of $3.00/mile

Rates out of Florida continued to slide, but on the flip side, reefer rates were up big from Atlanta heading into Florida. Dallas reefer rates continued to surge, with beef and other meat products on the move. Between Dallas and Atlanta, reefer rates were up 13¢ in both directions, averaging $2.00/mile both there and back.

One big outlier: Even though other outbound rates from Miami are sliding down into the off-season, the average reefer rate from Miami to Boston was up 20¢ to $2.10/mile.

FALLING

Other Florida reefer prices tumbled

- The biggest drop was on the lane from Lakeland to Charlotte, which plunged 84¢ to an average of $1.82/mile

- Miami to Baltimore was down 33¢ to $2.28/mile

Cross-border volumes continue to be soft down in Nogales, AZ, and the lane from there to Los Angeles lost 20¢ to $2.07/mile.

Find loads, trucks and lane-by-lane rate information in the DAT Power load board, including rates from DAT RateView.