After a slow start, reefer freight is finally hitting its stride. We’ve seen a uptick in both rates and freight volumes the past two weeks. The Midwest is leading the way, as summer produce is finally moving. Also, the run-up to the 4th of July holiday brought increased demand for refrigerated truckload shipments. The national average reefer rate for the first week of July was $2.30 per mile. That’s 5¢ higher than the June average and 15¢ higher than the average in May and April.

Just as we saw with van freight, demand peaked on Monday and then declined as the July 4 holiday approached. Freight volumes were down compared to the previous week, but that’s to be expected with a shorter work week. Because the holiday fell on a Thursday, many people also took Friday off.

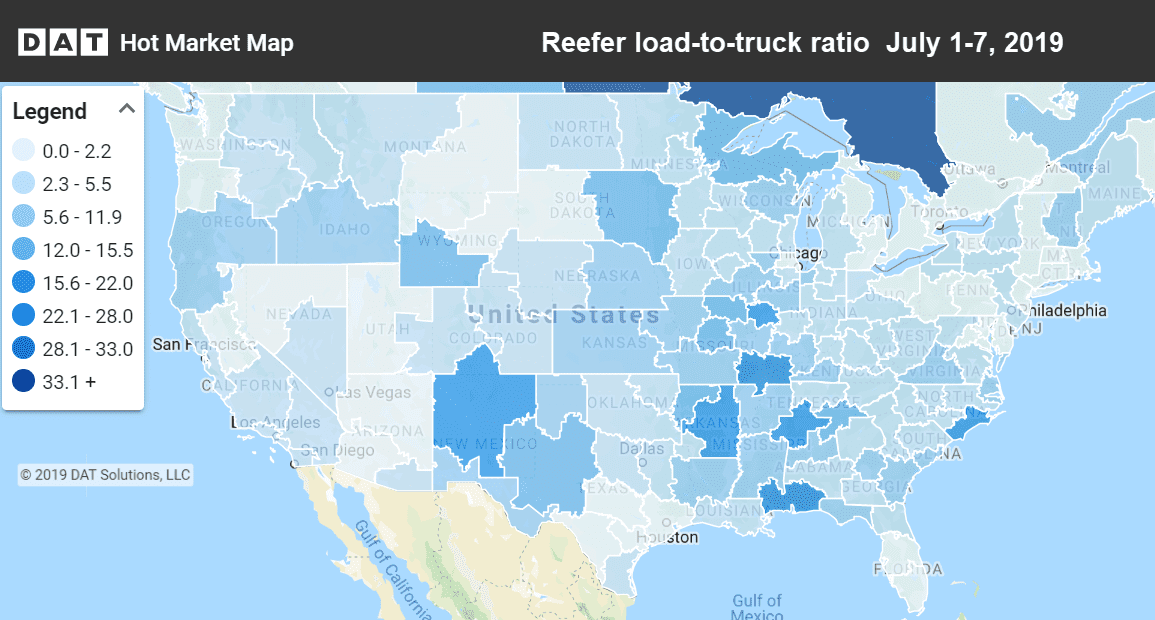

Shown above are the freight markets where trucks were hardest to find last week. Darker shades indicate that there were more load posts compared to truck posts. Hot Market Maps are available in DAT Power and DAT RateView.

In the same pattern we saw with van loads, reefer load posts and truck posts were strong at the beginning of the week, but trailed off as the 4th of July holiday approached.

Rising rates

The big winners last week were California and the Midwest. Prices were up in three of the top California markets, including Stockton/Sacramento, Ontario and Los Angeles. Over the past month, the strongest gaining market has been Grand Rapids, MI. It’s too early for apples, but they could be harvesting asparagus, blackberries, peaches, potatoes, and strawberries.

- Grand Rapids to Cleveland surged 44¢ to $3.87/mi.

- Green Bay to Minneapolis also increased 44¢ to $2.83/mi.

- Grand Rapids to Atlanta gained 32¢ to $2.23/mi.

- Green Bay to Joliet, IL added 28¢ to $3.80/mi.

- Lakeland, FL to Chicago was up 17¢ to $1.65/mi. They’re likely shipping sweet corn and melons.

Falling rates

Rates are falling in some of the southernmost markets, including Nogales, AZ, McAllen, TX, and Lakeland and Miami, FL.

- Lakeland to Baltimore was down 20¢ to $2.00/mi.

- Nogales to Brooklyn fell 19¢ to $2.49/mi.

- McAllen, TX to Dallas declined 12¢ to $2.51/mi.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.