As winter sets in, shippers will increasingly add freeze protection or protect-from-freeze (PFF) to bills of lading to keep traditional dry freight from freezing. PFF is quite common in the less-than-truckload sector from November 1 through May 31, so freight that can be maintained at the shipper’s desired temperature sheltering using heated trailers, heat shelters, pallet covers, and blankets to ensure the freight does not freeze in transit. Styrofoam coolers are also an option for smaller consignments, but in the case of a full truckload, the refrigeration motor on the front of the trailer is ideal for maintaining a constant temperature.

While the start of the cold season varies across the country, it typically runs from October to March, with some of the coldest temperatures occurring in the northeast, upper Midwest, Pacific Northwest, and Canada, where reefer spot rates are rising. The list of commodities susceptible to freezing in winter includes certain dried goods like coffee and flour, chemicals, paints, glues, liquids, wine, alcohol, perishable food, and batteries – all must maintain an above-freezing temperature throughout transit to maintain quality.

For shippers, carriers, and brokers, the cost difference between a dry van and a reefer moving freight at a different temperature to ambient can be substantial. Not all carriers have suitable cargo liability coverage, so our best advice is to communicate the requirements for the freight and make sure those requirements are listed on the bill of lading.

All rates cited below exclude fuel surcharges unless otherwise noted.

Mexican tomatoes and avocados dominate cross-border produce volumes ahead of this year’s Super Bowl event in Las Vegas. We’re still a few weeks away from peak shipping volumes, and as of last week, USDA volumes were around 6% lower than last year. In the Sonora, MX market, adjacent to the Tucson reefer market, produce volumes trail 2023 by 6% but are only just at the start of the shipping season, which typically peaks in May.

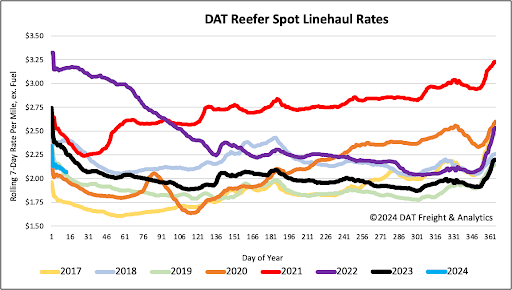

Nogales to San Francisco loads paid carriers $2.44/mile last week, the highest in 12 months but around $0.10/mile lower than last year. Reefer loads from Los Angeles to Las Vegas averaged $4.55/mile last week after being relatively flat for most of the last year. This starkly contrasts the December 2021 record-high of $7.00/mile on this regional haul lane during the peak of supply chain disruptions, particularly on the West Coast.

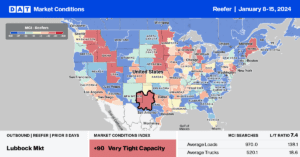

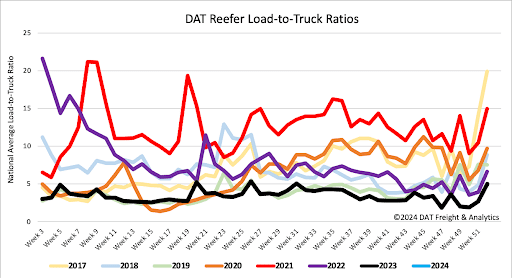

Reefer load post (LP) volumes are just under 50% lower than last year, following last week’s 8% w/w decrease. Carrier equipment post volume (EP) jumped by 33% w/w as carriers returned to work but remained 30% lower than last year, resulting in last week’s reefer load-to-truck ratio (LTR) ending the week at 3.59.

Reefer capacity returning to the market and 20% year-over-year (y/y) lower produce volumes contributed to lower linehaul spot rates last week. Reefer rates have dropped by $0.10/mile in the first two weeks of the year following last week’s $0.03/mile decrease. At $2.08/mile, spot rates are $0.20/mile lower than last year, and compared to the start of 2020, when the market was oversupplied, linehaul rates were $0.08/mile higher last week.