February’s damaging cold temperatures looks to be impacting the supply of cabbage for next week’s St Patrick’s Day celebrations.

Even though it’s not regarded as a traditional dish in Ireland, here in the United States, corned beef and cabbage is the dish of the day for Irish-Americans. According to the Texas International Produce Association, cabbage farmers are reporting a 20% crop loss across the Rio Grande Valley in southern Texas.

According to the USDA, 75% of U.S. cabbage production comes from just five states, with California the leader at 32% of the annual total. Florida is second at 24%, followed by Texas at 21% of total annual production. Texas typically ships around 20% of the annual total in February, and another 25% in March each year.

So far, February 2021 truckload volumes for cabbage are down 40% year over year due to the recent Polar Vortex event. That’s the equivalent of 240 fewer truckloads.

Find reefer loads and trucks on the largest load board in North America.

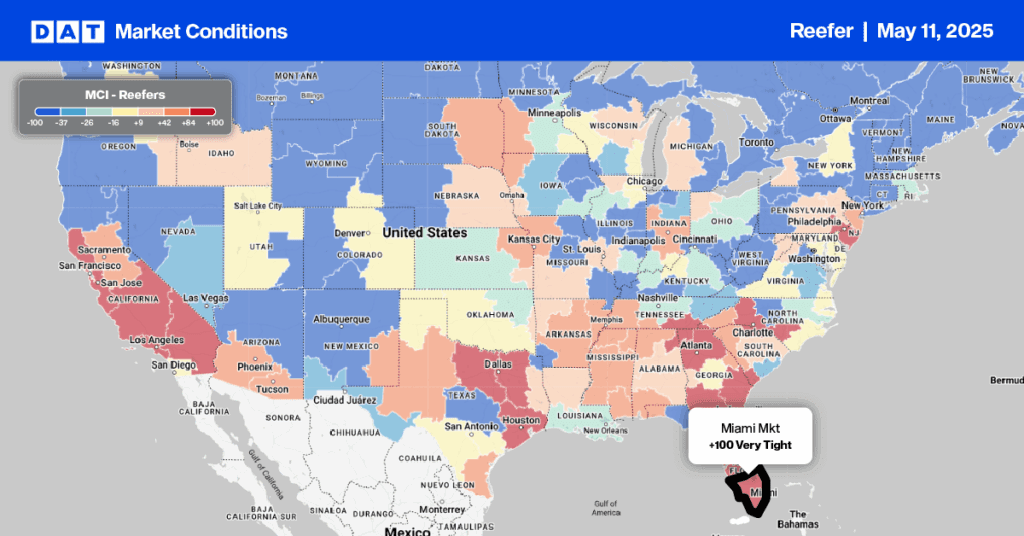

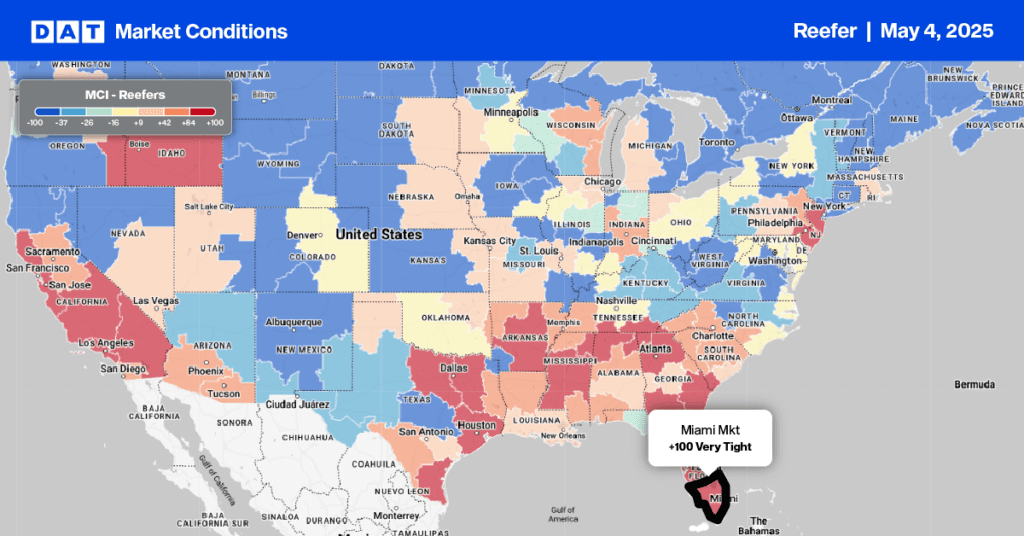

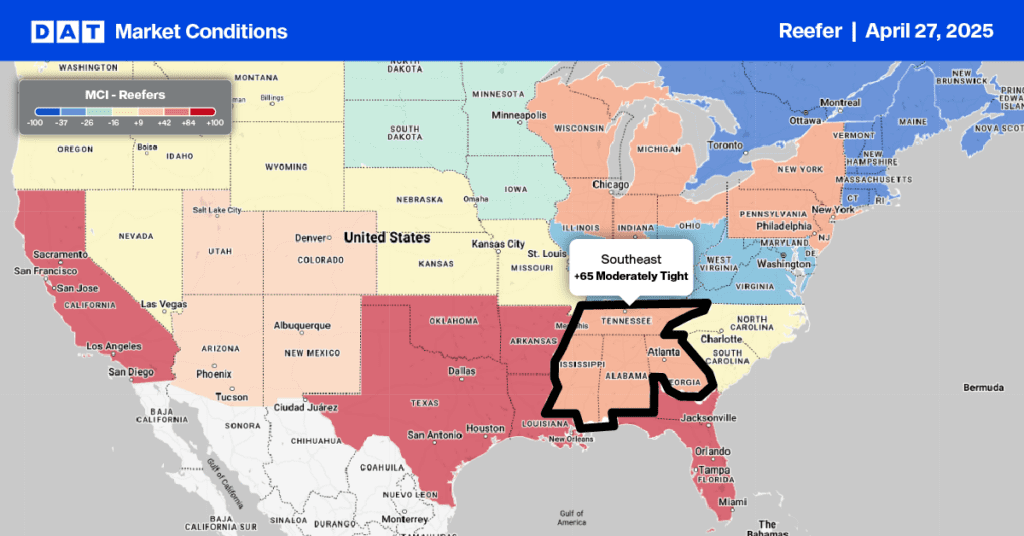

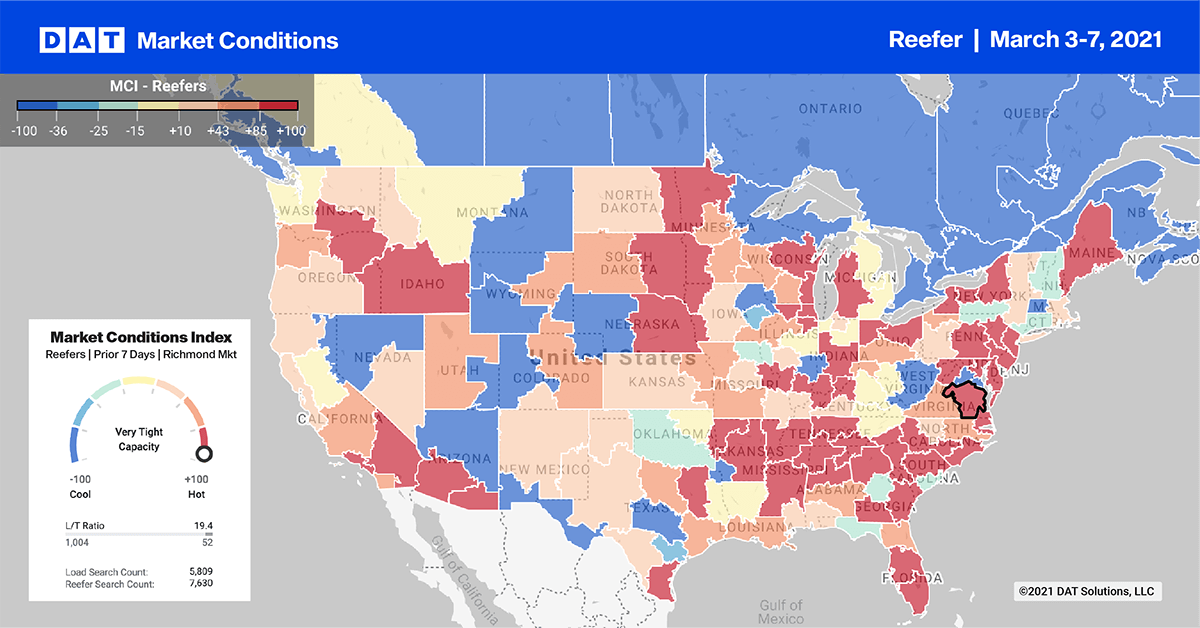

Reefer load post volumes dropped by 13% w/w in the top 10 spot markets last week, with Miami the only top 10 market to post positive volume gains.

The 2021 produce season starts around now in southern Florida, and Miami posted a 19% w/w increase in volume and a $0.19/mile increase in outbound rates to an average $1.95/mile. In nearby Lakeland, FL, where the Plant City Strawberry Festival is underway, rates were up $0.13/mile to $1.90/mile excluding fuel.

Reefer capacity was also tight in Atlanta last week. Even though load volumes dropped 9% w/w, outbound spot rates were up $0.20/mile to $2.67/mile.

After three weeks of increasing rates in Twin Falls, ID, capacity eased slightly, with rates dropping $0.02/mile to $2.75/mile.

In Seattle, volumes dropped 5% w/w after four weeks of gains, which is consistent with high demand for wild-caught Alaskan Pollock during Lent. Outbound rates from Seattle to Denver were up $0.40/mile last week to $2.89/mile, and loads to Chicago were up $0.30/mile to $2.24/mile, excluding fuel.

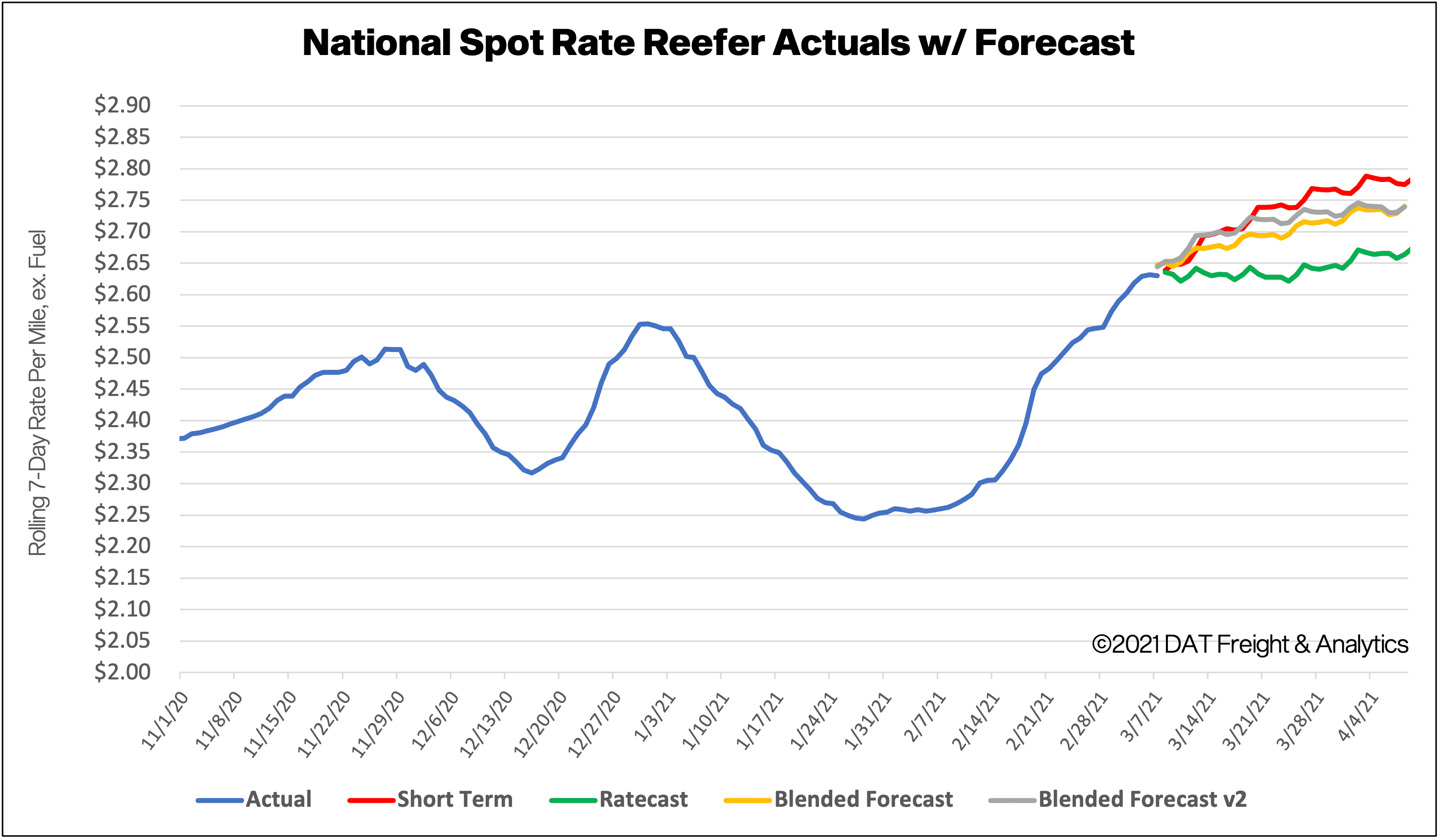

Spot rates forecast

Spot rates in the reefer sector reacted almost the same as the dry van sector last week, increasing by $0.09/mile to $2.67/mile, excluding fuel surcharges. Compared to the same week in 2020, reefer spot rates are now $0.85/mile higher.

How to interpret the rate forecast

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

- Blended Scenario: More heavily weighted towards the longer-term models.

- Blended Scenario v2: More heavily weighted towards the shorter-term models.