Super Bowl LVI in Los Angeles is 110 days away and avocado marketing campaigns are already swinging into gear. Just last week, Avocados From Mexico teamed up with former New Orleans quarterback Drew Brees for its 2022 Super Bowl “Get in the Guac Zone” promotion.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

“I love avocados. They taste great, they’re good for you and they really do make just about anything better,” says Breese.

Mexico supplies around 83% of annual avocado production. It’s followed by California (9%) and Peru (3%).

The Mexican Association of Avocado Producers, Packers, and Exporters (APEAM) shipped 140,860 tons of avocados in the month before this year’s big game in Tampa, FL. This represents an 11% increase over 2020.

Even though avocados are produced year-round in Mexico, winter volumes will start to ramp up next month. According to USDA data, around 10% of annual production will be shipped in January alone. Truckload volumes across the southern border average around 1,300 loads per week. It’s expected to increase to around 1,600 truckloads per week in the leadup to the big game on February 6th 2022.

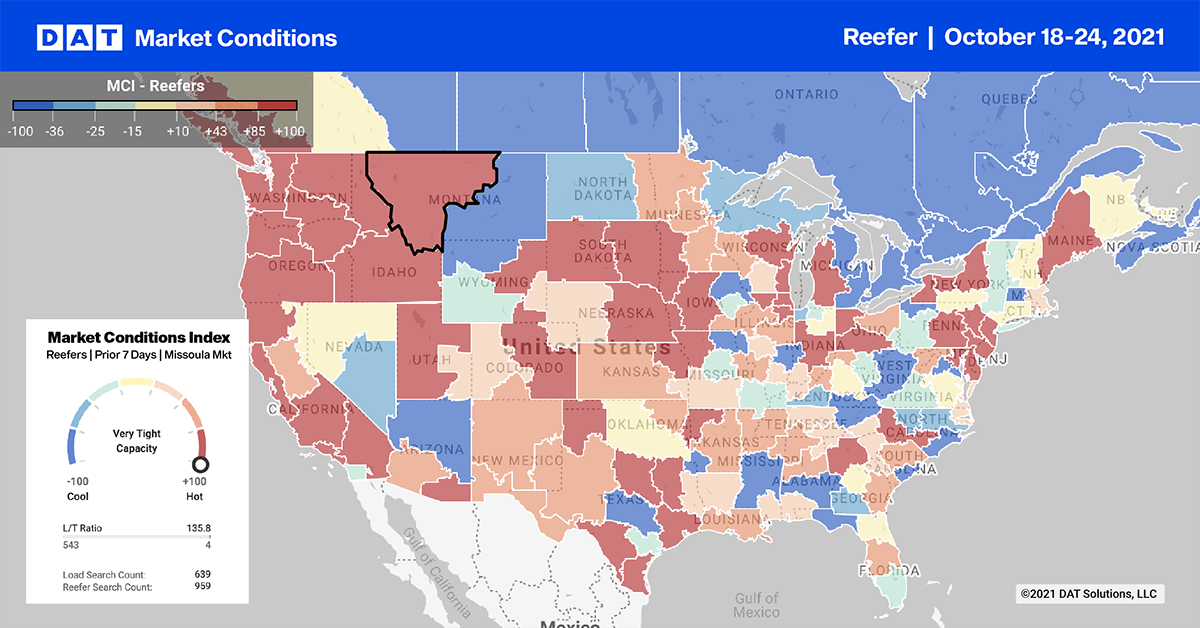

Apple and pear harvests spark truck shortage

Truckload capacity continues to tighten in the Pacific Northwest this week as the apple and pear harvest ramps up. Washington State and Oregon produce around 85% of annual domestic production. According to the USDA, shipping is set to begin this week with the annual peak occurring in January.

Between the two states, truckload carriers can expect to move around 3,100 loads per week in November peaking at almost 4,000 loads per week by the time January rolls around. DAT is already seeing spot rates and loadboard activity increase as the USDA reports a shortage of trucks to load both commodities last week.

Reefer spot rates in the Pendleton market were up $0.10/mile last week to an average of $2.98/mile as load post volumes continue to climb (up 24% since last month):

- Loads to Stockton hit a new 12-month high at $2.64/mile

- Loads to Los Angeles recorded an all-time high rate of $2.58/mile

Last week, the USDA reported a shortage of trucks in 10 of the 20 produce markets tracked weekly. The markets include:

- Carrots and grapes in Kern County, CA

- Lettuce in Salinas

- Apples in New York

- Winter vegetables in Florida

Spot rates

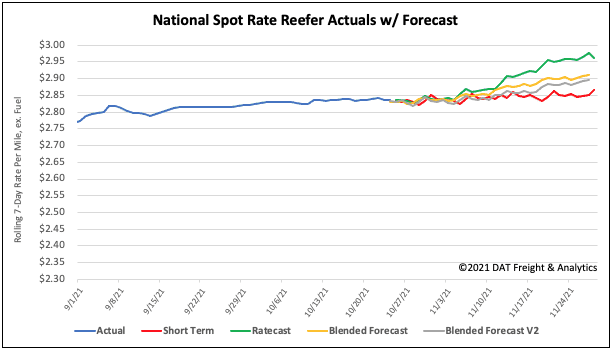

After increasing for the three week’s prior, last week’s spot rate decrease of $0.04/mile erased all the October gains to end the week at a national average of $2.84/mile. This is still 17% or $0.48/mile higher than this time last year.

Of our Top 70 lanes (for loads moved), spot rates:

- Increased on 22 lanes (compared to 27 the week prior)

- Remained neutral on 35 lanes (compared to 29)

- Decreased on 14 lanes (compared to 15)

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models