Within the next three months, we’ll see the seasonal transition where our fruit and vegetables are grown and hauled. The overarching trend is from traditional domestic produce growing regions as the domestic seasons wind down to imports from South and Central America at port markets such as Los Angeles or Philadelphia. Chile and Peru start shipping grapes, and Peru floods the market with blueberries yearly.

A DAT Freight & Analytics load data study shows that the highest number of refrigerated moves since 2020 in the Philadelphia market typically occurs in July, October, and January. Before the pandemic, the load moves usually peaked in March and December. Illinois, North Carolina, and Ohio are the top three destinations for reefer loads out of Philadelphia. The number of moves has also increased; before the pandemic, the number of loads moved ranged from 4,000 to 6,000 per month; since 2020, the monthly range of reefer moves is about 6,000 to 8,000.

The average length of haul also follows the same trend, with longer distances found in January, February, July, and October (873 miles), which are just under 6% higher than the average length of haul in other months (825 miles). Since the pandemic, the average length of haul (816 miles) has increased by 16% compared to the pre-pandemic average of 703 miles.

Not only is the Port of Philadelphia significant for reefer carriers, but there is also considerable demand for flatbed carriers. The Packer Avenue Marine Terminal offers steel (plate, wire, coils, pipe, and tubing), and project cargo shippers a safe and efficient gateway for importing and exporting cargo.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $1.88/mile for outbound loads, capacity has been mostly flat in Philadelphia for the last three weeks but tightening on the popular 1,000-mile haul to Lakeland, FL. At $2.20/mile, Lakeland loads have been paying carriers almost $0.70/mile more than in May and are identical to last year. Although 300 miles shorter, Atlanta loads followed a similar trend at $1.94/mile last week, the same as in 2022.

The yellow potato harvest is underway in the Madison, Wisconsin market, with the first potato loads being washed, graded, and packed for fresh market delivery to distribution centers and retail grocers last week. Outbound loads in Madison jumped $0.16/mile the previous week to an outbound average of $2.53/mile, while loads to Atlanta and Lakeland paid carriers $2.65/mile.

In California, reefer capacity was flat in Fresno last week as rates leveled off at $2.21/mile, while in nearby San Francisco, rates increased $0.02/mile to $2.20/mile. Stockton outbound linehaul rates at $2.47/mile were $0.06/mile higher than the previous week.

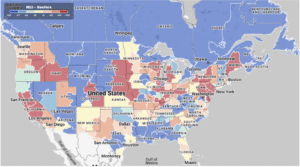

Load to Truck Ratio (LTR)

Boosted by higher produce volumes in the Mid-Atlantic and West Coast regions, reefer spot market volumes improved again following last week’s 13% surge in load posts. However, volumes are around 37% lower than in 2022, but 22% higher than in 2019. Carrier equipment posts dropped for the third week, resulting in last week’s reefer load-to-truck ratio (LTR) jumping from 4.10 to 5.18, only the fourth time this year the LTR has been above 5.0.

Spot Rates

Boosted by higher volumes, reefer linehaul rates were flat again last week, with the national average remaining around $1.97/mile for the second week. Reefer spot rates are $0.32/mile lower than in 2022 and $0.10/mile higher than in 2019 – the gap is widening.