California and Texas remain in flux with overall volumes roughly the same the last several weeks. Reefer produce failed to climb at the end of July, due in part to a sharp decline in volumes from Fresno.

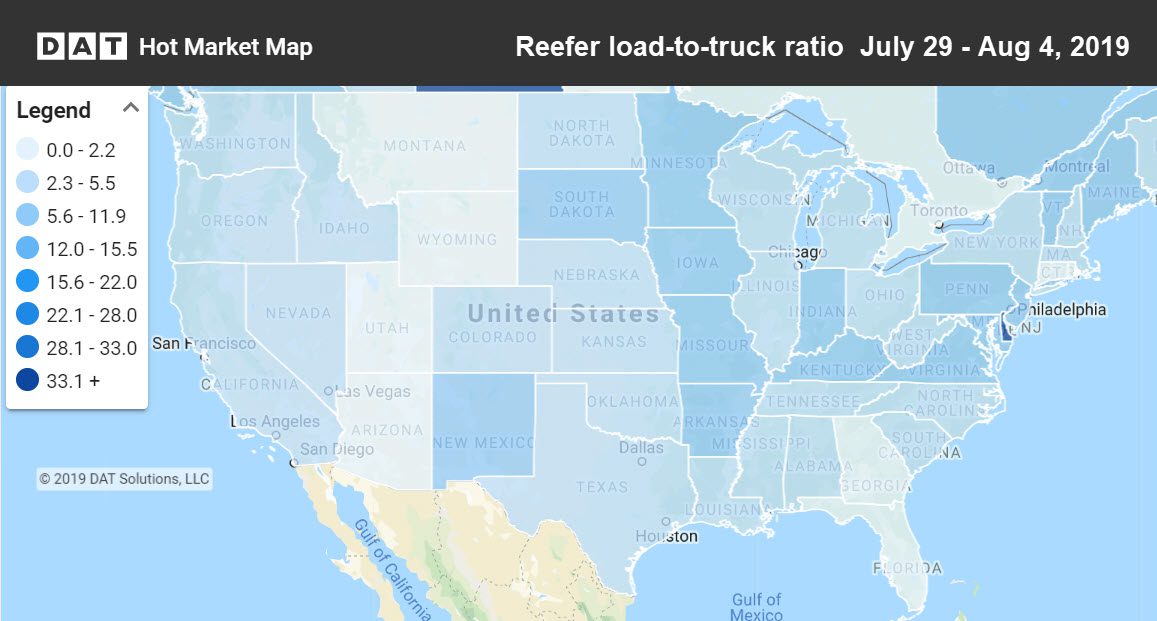

The national load-to-truck ratio for reefers was up 18% last week compared to the previous week, which meant it was easier for carriers to find loads. The national average reefer rate ended July at $2.19 per mile, which was 7¢ lower than the June average, but 4¢ higher than May.

Reefer demand was strongest in midwestern states that border the Mississippi River, but weak in Florida. Hot Market Maps are available in the DAT Power load board and DAT RateView.

RISING

Los Angeles area volumes were up more than 10%, which stopped the rate slide in that market. Elsewhere, Denver outbound rates were up a bit due to higher volumes.

- Green Bay to Des Moines jumped 58¢ to $2.68/mi (known to fluctuate)

- Philadelphia to Miami rose 23¢ to $2.06/mi

- Los Angeles to Phoenix increased 7¢ to $3.25/mi

FALLING

McAllen, TX had a 25% increase in volumes, but that wasn’t enough to raise rates in that market. In Dallas, both volumes and rates were down.

- Grand Rapids to Cleveland dipped 25¢ to $3.09/mi

- Miami to Baltimore declined 23¢ to $1.27/mi

- McAllen to Atlanta slipped 29¢ to $1.96 (but demand picked up at the end of the week)