California avocado production is, so far this season, the best since the start of the Pandemic in 2020. According to the USDA, shipment volumes are up 41% year-over-year (y/y), with approximately 60% of the crop already harvested and about 40% of the California avocado crop still maturing and sizing on the trees. Based on findings from its midseason grower and packer crop survey, the California Avocado Commission (CAC) is eyeing a robust crop this year, with an estimated volume to exceed 250 million pounds or the equivalent of almost 6,000 truckloads. The CAC is forecasting the 2024 crop is about 20% higher than the pre-season estimate.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Around 70% of avocado shipments come into the U.S. from Mexico, where volumes are 30% lower yearly. 87% cross in Texas via the Laredo (36%) and McAllen (51%) freight markets. Earlier this month, the USDA paused safety inspections for avocados and mangos from the Mexican state of Michoacán due to a security incident involving USDA staff.

Mexican avocado production is primarily concentrated in Michoacán, where rich volcanic soils and natural irrigation facilitate year-round harvesting. The efficiency of the supply chain is also noteworthy, with avocados being harvested, packed, and shipped and reaching consumer tables within a week, as reported by the Association of Avocado Exporting Producers and Packers of Mexico (APEAM).

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This time last year, the USDA reported a slight shortage of reefer trucks for loads of vegetables, particularly lettuce from the Salinas-Watsonville growing regions. This year, there are sufficient trucks to meet demand, which is 9% lower than last year despite 29% higher y/y volumes of lettuce last week. Offsetting strong lettuce volumes was the number two commodity, strawberries, which are 25% lower than last year.

Like the week before July 4, reefer linehaul rates are increasing on major lanes even though the regional volumes are lower than last year. On the Salinas to Los Angeles lane, carriers were paid an average of $2.53/mile last week, which is $0.16/mile higher than last year. Carriers were paid $2.55/mile on the Ontario lane, $0.20/mile higher than last year. Carriers hauling from Salinas to Phoenix were paid $2.57/mile, $0.26/mile higher year-over-year. For long haul loads to Hunts Point, NY, carriers were paid an average of $2.13/mile, $0.14/mile lower than last year.

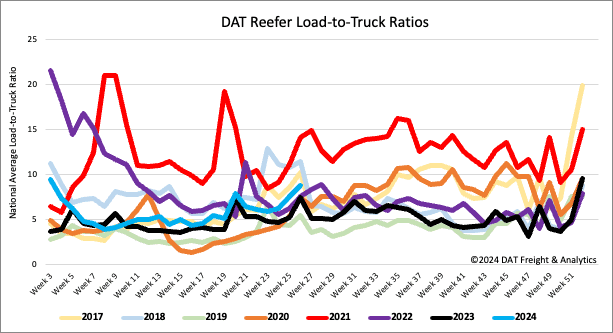

Load-to-Truck Ratio

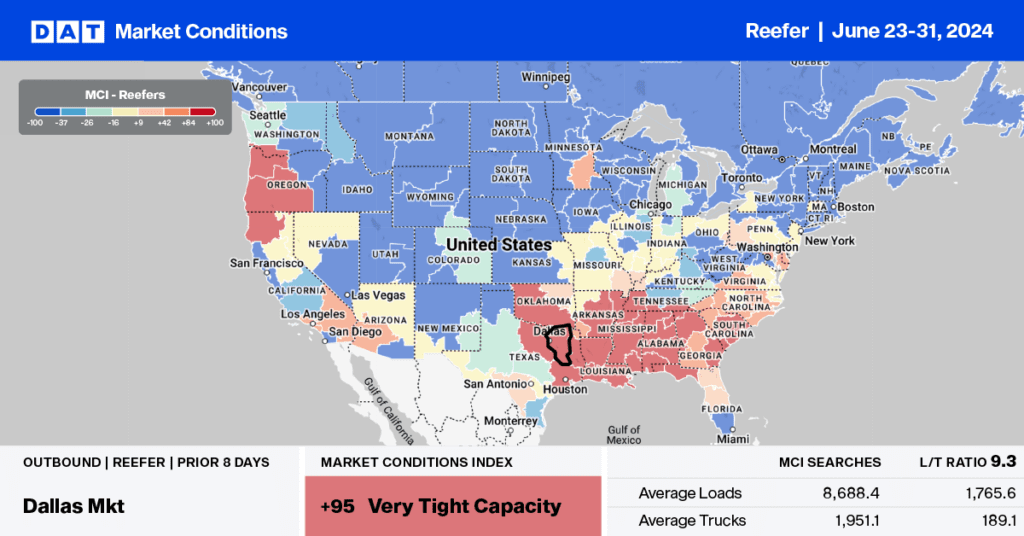

Even though reefer load post volumes increased by 7% last week, they’re still 7% lower than last year due to much softer produce volumes. At a time when truckload produce volumes typically increase by 8-10% w/w in the lead-up to July 4, last week’s volumes were down 4%. The Georgia season is coming online and up 1% y/y, but 6% lower volumes out of California, which produces around a third of truckload volumes, is dragging down the national market. Mexico import volumes are 28% lower y/y, adding to lower truckload volumes. Carrier equipment posts were 7% lower last week, increasing the reefer load-to-truck ratio (LTR) by 15% w/w to 8.74.

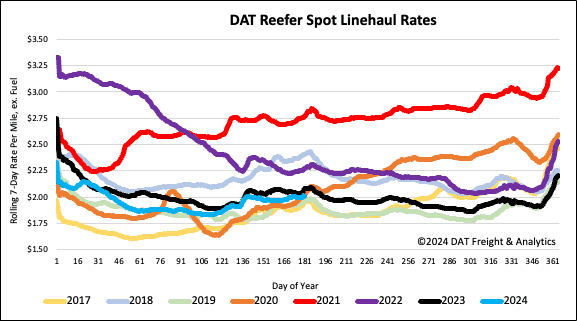

Spot rates

The national average reefer linehaul rate remained flat last week at $2.03/mile, underlining the softness the USDA reports in the produce market. At this level, reefer linehaul rates are almost identical to last year’s, with a 3% higher volume and $0.05/mile higher than in 2019.