According to USDA data, potatoes are the number one specialty crop by volume for refrigerated shipping. In addition, potatoes have the unique ability to be shipped year-round even though the harvest season has ended. When appropriately stored, potatoes can remain in storage until the next harvest, and this is the driving factor behind the recent shortage. Potatoes ship from every region in the U.S. and the Pacific Northwest is the highest producer accounting for nearly 50% of the supply.

The current shortage primarily stems from Idaho due to a poor 2021 harvest. “The Idaho potato industry as a whole is facing extremely short supplies from August to September,” says Donald Russo, senior category manager for the Bronx, N.Y.-based Baldor Specialty Foods. Very hot, dry and smoky conditions during the 2021 growing season cut down 25%-30% of yields across Idaho. “Poor weather during the growing season really decreased volume, and the quality of open storage-shed potatoes didn’t hold up,” said Russo.

“It’s not unusual for there to be a shortage of Idaho potatoes in August,” said Idaho Potato Commission President and CEO Jamey Higham. “We plant only one potato crop a year, which is harvested in September, and our goal every year is to sell all the potatoes before the new crop is harvested. This year, the shortage happened a little earlier than in previous years. Harvest is getting underway this week, and production will ramp up over the next several weeks,” Higham said. “Potato supplies will be back in full swing soon.”

All rates cited below exclude fuel surcharges unless otherwise noted.

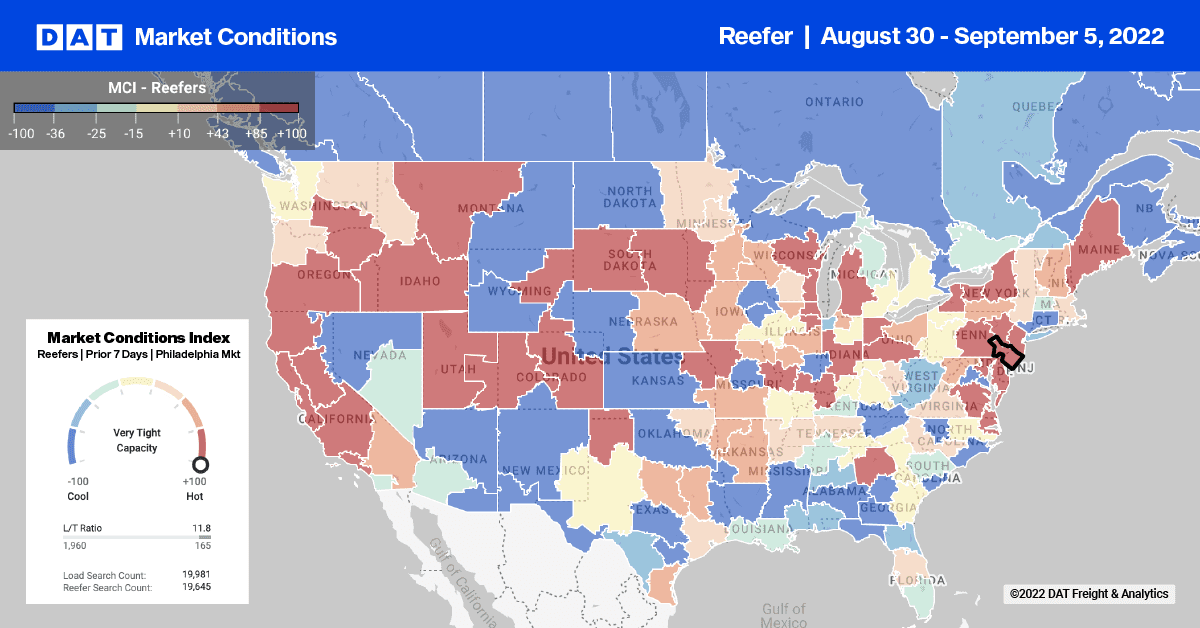

The Michigan produce season continues to grow higher weekly volumes tightening reefer capacity following last week’s 30% w/w jump in load posts. In the Saginaw market, reefer linehaul rates increased by $0.17/mile to an outbound average of $2.79/mile last week. On the high-volume reefer lane from Saginaw to Tallahassee, spot rates have increased by over $1.00/mile since June to an average of $3.07/mile last week.

In South Texas in the McAllen market, the USDA reported a surplus of trucks last week, with spot rates dropping for the fourth week to an average of $2.02/mile. Loads 1,500 miles east to Miami were paying slightly higher at $2.05/mile, around $0.50/mile lower than the previous year, while the McAllen to Lakeland lane was much higher at $2.35/mile. Loads northeast to Hunts Point, NY, continue to slide and, at $1.87/mile last week, are now just over $2.00/mile lower than the 12-month high of $3.91/mile at the start of the year.

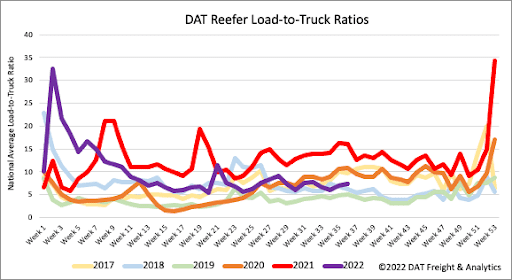

As shippers continued to position last-minute temperature-controlled freight ahead of last weekend’s Labor Day celebration, reefer load posts increased by 4% last week. Compared to the previous year, volumes are around half what they were at the end of August and around 23% lower than this time in 2020 during the early stages of the pandemic economic recovery. There was very little change in equipment post volumes last week, leaving the reefer load-to-truck (LTR) ratio primarily unchanged at 7.36.

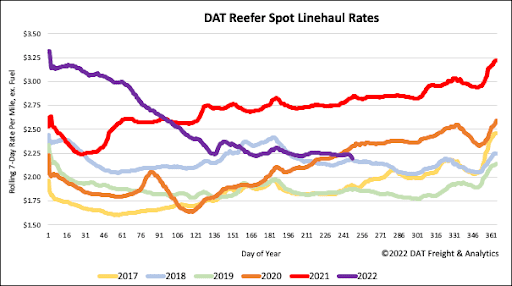

Like the flatbed sector, reefer linehaul rates are now within $0.02/mile of 2018 spot rates following last week’s $0.02/mile decrease to a national average of $2.24/mile. Reefer spot rates are $0.63/mile lower than the previous year after dropping by almost $1.00/mile since the start of the year. Last week’s average spot rate is still $0.28/mile higher than the pre-pandemic August average.