According to the USDA (U.S. Department of Agriculture), contributing to lower reefer volumes of fresh and frozen beef is the shrinking inventory of cattle, down 2% year-over-year (y/y) and the lowest in 73 years. For reefer carriers, the truckload volume of beef has dropped by 14% since the 20-year record high in March 2022, or the equivalent of 7,400 fewer monthly truckloads. U.S. cattle continue to dwindle after a drought and high input costs pressuring ranchers to sell off their herds, shrinking the national headcount to 87.2 million as of Jan. 1, according to the USDA’s Cattle report.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

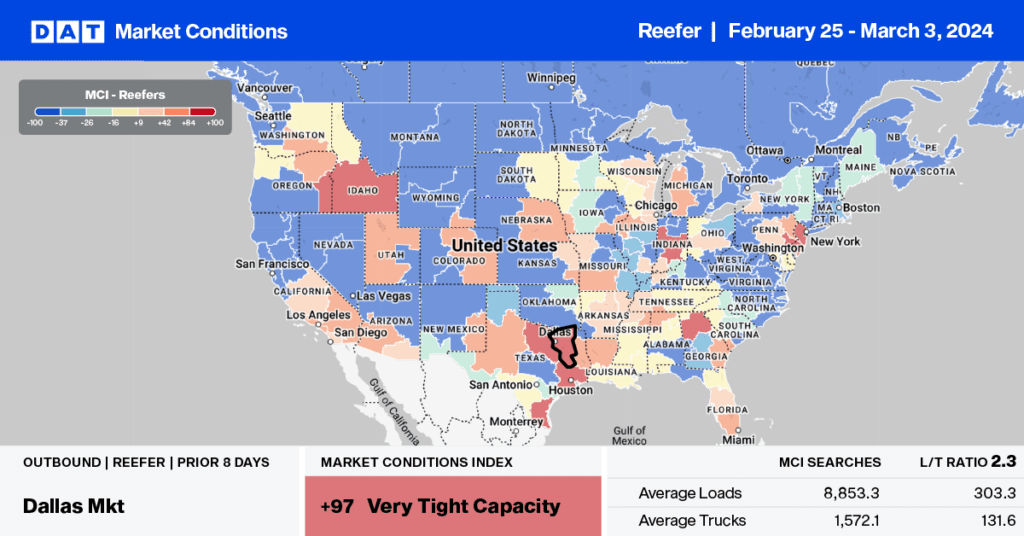

Domestic beef production is 3% lower than last January, while imports are almost 10% higher and at the highest level in 30 years, according to USDA data. Higher imports of beef change the origin of frozen and fresh beef truckloads for carriers from the “beef patch” in the American mid-west to cross-border markets and ports. Reefer loads moved in Texas, Missouri, Nebraska, and Kansas are 2.7% lower y/y following last week’s 2% decrease in volume. According to USDA data, 27% of U.S. beef imports came from Canada last year, while 18% came from Australia, with just over half arriving in the Port of Oakland.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

The Chicago reefer market held the top spot, accounting for almost 4% of loads moved following last week’s 1% increase in volume. As was the case in most larger markets, sufficient available capacity in the Windy City resulted in a $0.05/mile decrease for outbound loads to an average of $2.10/mile. At the state level, Illinois outbound rates at $2.40/mile are 11% lower than last year, following a 10% decrease in loads moved over the same timeframe.

The number one outbound lane between Chicago and Kansas City paid carriers $1.71/mile even though volumes were up 7% w/w. Chicago to Ft. Worth paid carriers an average of $1.80/mile, which was $0.07/mile lower than last year. In Florida, where produce season has started and the Plant City Strawberry Festival is underway, reefer linehaul rates continue to cool, averaging $1.19/mile, down $0.03/mile last week. According to the USDA, outbound produce volumes are 22% lower than last year in Florida and 12% lower nationally.

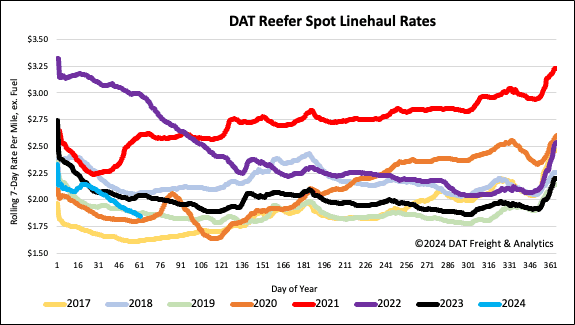

Spot rates

With produce volumes lagging, we’re seeing the national average reefer spot rate continue to cool, down $0.02/mile last week. At $1.87/mile, linehaul rates have dropped for six straight weeks, down $0.21/mile since the mid-January rate surge as cold temperatures gripped a large section of the country. Compared to last year, reefer linehaul rates are $0.19/mile lower and $0.04/mile higher than in 2020 as the freight market continued to soften before the pandemic.