The beer industry produced over 180 million barrels of beer in 2021, according to data by Statista; this translates to over 1 million trucks moving this liquid gold from the production facilities to the beer distributors who deliver it to the final consumer. The beer industry has been in an overall decline since the nineties, but 2021 offered a glimmer of hope as y/y production increased by nearly a million barrels.

Inflation has thrown a wrench in predicting the latest consumer spending habits, and typically, when consumers have less money, history shows a shift to buying budget brands. As a result, some major beer companies are starting to see sales soften as buying habits shift to the economic beer brands. Molson Coors Beverage Company said its U.S. economy beer portfolio, which includes Miller High Life and Keystone Light, had its best quarterly performance versus the industry in three years. At the same time, the above premium brands, such as its hard seltzers, still showed strong sales.

“We do continue to see trade-up in our portfolio and in the industry across our major markets,” Gavin Hattersley told Wall Street this week. “But it’s also true and notable that the economy segment is strengthening in the U.S., and three of our four key economy brands grew segment share in the second quarter.” AB InBev’s Budweiser’s CEO Michel Doukeris told analysts that in the U.S., premiumization is “not slowing down.” However, sales of economy brands like Busch Light continue to accelerate.

However, not all U.S. beer companies have the same experience; recent quarterly performances show continued growth in premium brands. Heineken’s Dolf van den Brink said, “interesting to see the continued trends on premium beer, which is accelerating rather than slowing down,” the beer executive noted. “We’re seeing resiliency in the beer category at large. At the same time, we’re not naive, and we are deliberately cautious and vigilant for the short and midterm.”

Constellation Brands, the company behind premium brands such as Modelo Especial and Corona Extra, has grown over the last decade and isn’t experiencing a sales decline. CEO Bill Newlands said, “While consumers report increasing concerns about the economy, these concerns have not yet translated into significant behavior change for beverage alcohol shoppers, particularly for our major brands. Overall, total beverage alcohol servings per capita in the U.S. are expected to remain stable, with growth of 1% to 2%,” he said. As with many industries, it appears that an economic downturn for alcoholic beverages is possible, but the results are still conflicting when those fears may come to fruition.

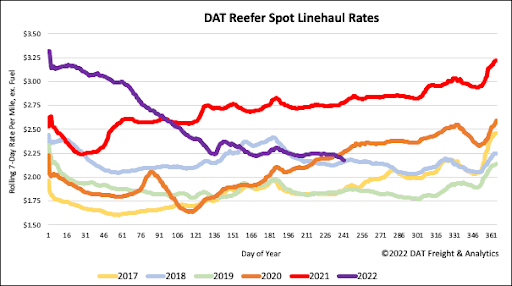

All rates cited below exclude fuel surcharges unless otherwise noted.

Like the dry van spot market in Florida last week, reefer load posts surged, increasing by 19% w/w, with average outbound spot rates rising by just $0.01/mile to $1.31/mile. The Lakeland freight market’s capacity was tighter, with spot rates increasing by $0.04/mile to $1.27/mile. Further north in Savannah, where load posts increased 3% w/w, linehaul rates increased by $0.08/mile to an average of $1.64/mile, while on the high-volume Savannah to Atlanta short-haul lane, rates dropped to the lowest in 12 months at $789/load. That’s just over $350/load less than the previous year.

In the Pacific Northwest (PNW), reefer capacity was tighter last week, with regional reefer linehaul rates increasing by $0.06/mile to an outbound average of $1.95/mile. In Pendleton, OR, reefer load posts have been climbing for the last six weeks following last week’s 18% w/w increase. Capacity continues to tighten as produce season ramps up – spot rates increased by $0.05/mile to $2.01/mile last week. PNW reefer lane level rates typically start climbing from now through year-end, and they did just that last week for loads from Pendleton to Stockton. After dropping all year, rates turned the corner last week, increasing by $0.21/mile over the July average to $1.97/mile. Ratecast is forecasting a peak of $3.00/mile on this lane, which is more than double last week’s rate but $1.00/mile lower than last season’s January high of $4.05/mile.

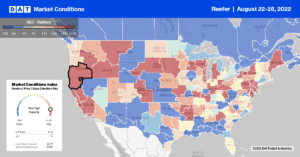

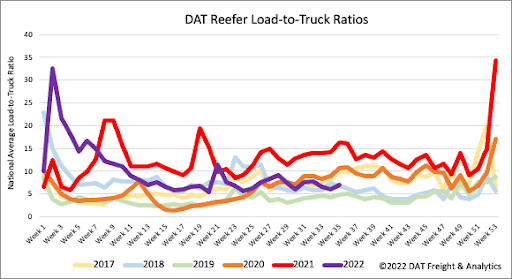

As shippers positioned temperature-controlled freight ahead of this weekend’s Labor Day celebration, reefer load posts surged last week, increasing by 13% w/w. While not as high as 2020 and 2021 August volumes, the previous week’s spot market activity was 25% higher than in pre-pandemic years. Reefer carriers typically take more time off during inspection weeks than their flatbed and dry van counterparts following last week’s 4% w/w decrease in equipment posts. More load posts and fewer equipment posts pushed the reefer load-to-truck (LTR) ratio up by 17% w/w to 7.04.

Surging spot market volumes weren’t enough to stop the reefer linehaul spot rate from dropping last week following another $0.02/mile decrease. The national average reefer rate ended the week at $2.22/mile, $0.60/mile lower than the previous year but just over $0.01/mile higher than 2018. For context, even though reefer linehaul rates have dropped by $0.94/mile year-to-date, they are still $0.28/mile higher than the pre-pandemic August average.