Typically, the Mexican produce season will peak over the next two weeks before cooling off until the cycle starts again in September. As of the middle of April, imported truckloads of produce were 1% lower than last year. However, there are signs the season may have peaked early due to weaker consumer demand in the U.S. Tomato shipments (16% of volume) were up 9% y/y, followed by avocados (14%) up 14% y/y and cucumbers (10%) up 10% y/y.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

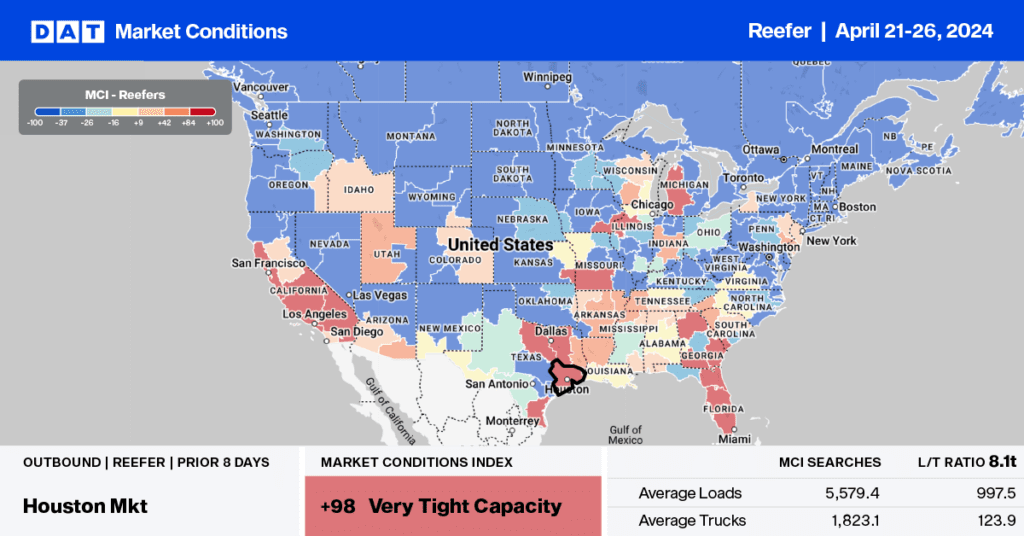

McAllen, TX, and Nogales, AZ, are the two major ports of entry for produce, accounting for 30% of total imports this year. In the McAllen market, the volume of truckloads moved is up 18% year over year (y/y), but like most markets, an excess of available capacity has kept prices around 5% lower than last year. In addition to the volume of imported produce from Mexico, McAllen is also located in the Rio Grande Valley, famous for leafy greens, cabbages, herbs, and citrus. According to the USDA, due to water shortages, the Lower Rio Grande Valley produce season is almost 50% lower than last year at the mid-point of April. Peak shipping season in the valley typically occurs in the first two weeks of June, so there’s still plenty of time to catch up.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

According to the USDA, the slight shortage of trucks in Nogales for imported produce continued for the second week. Outbound volumes were up 2% week-over-week (w/w), although linehaul rates remained primarily flat at around $2.06/mile. On the number lane to Los Angeles, loads moved surged last week, increasing by 33% w/w while spot rates increased slightly to $2.00/mile.

Available capacity tightened in Florida last week ahead of the 26th Annual 75 Chrome Shop truck show in Wildwood. Like the Mid-America Truck Show, this show attracts many reefer carriers who take the week off. In the Lakeland market, linehaul rates increased by $0.20/mile to $1.45/mile on a 16% higher volume of loads moved. Further south in Miami, Mother’s Day imported flowers are starting to arrive; linehaul rates increased by $0.19/mile to $1.63/mile on a 7% higher volume of loads moved.

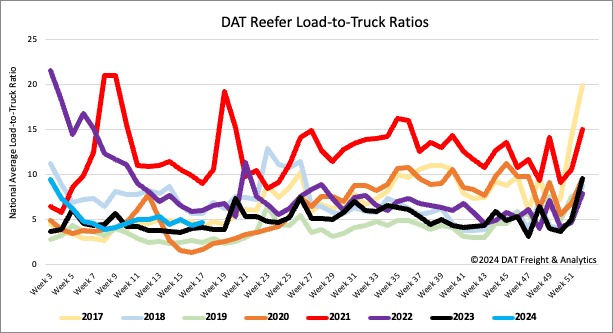

Load-to-Truck Ratio

Renewed strength in the produce market boosted truckload spot market volumes following last week’s 5% increase in load post volume. Equipment posts reversed course, decreasing by 3% w/w, resulting in the reefer load-to-truck ratio increasing by 8% w/w to 4.69.

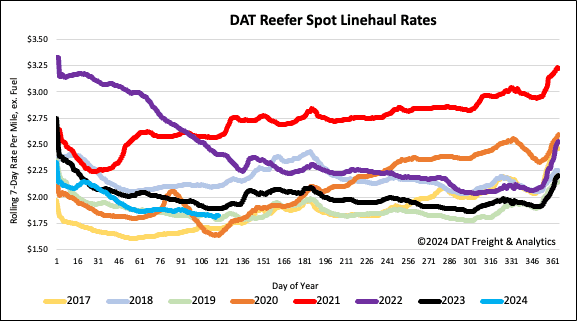

Spot rates

Reefer spot rates were flat last week at a national average of $1.85/mile as we head into the two-week shipping peak ahead of Mother’s Day. Reefer linehaul rates are $0.07/mile lower on a 10% higher volume of loads moved than last year.